- United States

- /

- Machinery

- /

- NYSE:PRLB

Proto Labs (PRLB): Assessing Valuation After Q3 Earnings and Updated Guidance

Reviewed by Simply Wall St

Proto Labs (PRLB) just released its third-quarter results, showing higher sales and steady net income compared to last year. In addition, the company issued new revenue and earnings guidance for the upcoming quarter.

See our latest analysis for Proto Labs.

Proto Labs has had an eventful year, with its latest revenue jump and earnings guidance energizing investors and contributing to a year-to-date share price return of 26.43%. The stock’s momentum is trending up in the short term, and the one-year total shareholder return of 23.06% shows that long-term holders continue to see solid gains, despite some volatility along the way.

If you’re eager to keep exploring market opportunities, this is a great time to broaden your perspective and discover fast growing stocks with high insider ownership.

Yet with shares rising once again on solid results, investors are left wondering if Proto Labs is undervalued at current levels or if the market is already factoring in all of the company’s expected future growth.

Most Popular Narrative: 8% Undervalued

Proto Labs closed at $48.99, while the most widely followed narrative calculates a fair value of $53.33. With this gap, many are scrutinizing the assumptions that drive this target and what it says about the company’s future course.

Digital infrastructure, resilient supply chains, and strong financial health enable investments in automation and global expansion. These factors support margin improvement and long-term earnings growth. Reliance on key accounts, regional weaknesses, and margin pressures from competition and tariffs threaten profitability, especially with the ongoing need for costly operational and technological investments.

What is the main lever behind this valuation? Consider surging margins, bold automation strategies, and future earnings projections pursued by only a few competitors. The foundation of this fair value rests on ambitious growth assumptions and an earnings trajectory that could set a new standard in the sector. Interested in which numbers are most significant? The narrative has the full story.

Result: Fair Value of $53.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges in European manufacturing and a reliance on large accounts could still disrupt Proto Labs’ growth and put pressure on future returns.

Find out about the key risks to this Proto Labs narrative.

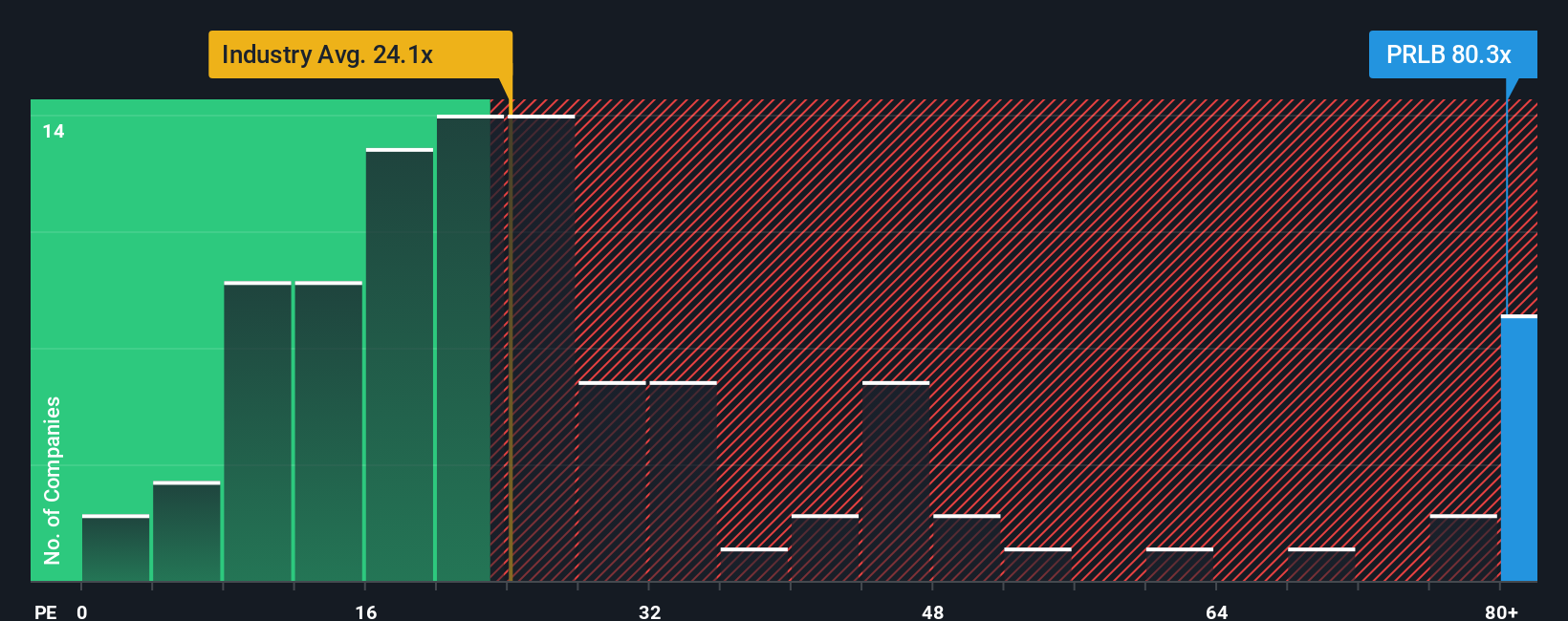

Another View: Market Relative Valuation

Looking at Proto Labs through the lens of earnings multiples paints a different picture. The company trades on a price-to-earnings ratio of 78.2x, which is well above both the US Machinery industry average of 24.1x and its peers at 33x. The fair ratio for this stock, based on market trends, is 32.8x. This sizable gap could leave the stock exposed to valuation risk if future growth does not keep up. Does the premium really reflect Proto Labs' future, or could a reset be around the corner?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Proto Labs Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own perspective on Proto Labs’ valuation in just a few minutes. Do it your way.

A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Potential doesn’t wait, and neither should you. Turn insights into action by targeting stocks with winning trends using these top opportunities on Simply Wall Street:

- Unlock growth potential by evaluating these 881 undervalued stocks based on cash flows that are poised for a re-rating as market conditions shift in their favor.

- Capture the edge in healthcare technology by reviewing these 32 healthcare AI stocks which are already making waves in patient outcomes and digital diagnostics.

- Supercharge your income strategy by targeting consistent payers within these 16 dividend stocks with yields > 3%. See how reliable returns can strengthen your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives