- United States

- /

- Construction

- /

- NYSE:PRIM

Why Primoris Services (PRIM) Jumped After Raising 2025 Guidance on Strong Q3 Results and Dividend

Reviewed by Sasha Jovanovic

- On November 3, 2025, Primoris Services Corporation announced raised full-year earnings guidance after reporting third quarter sales of US$2.18 billion and net income of US$94.62 million, alongside a US$0.08 per share dividend declaration.

- The company’s updated net income outlook of US$260.5 million to US$271.5 million reflects momentum from strong revenue and earnings growth, particularly in the quarter ended September 30, 2025.

- Given the substantial guidance increase, we'll assess how this strengthens the investment case around Primoris’s expanding margins and project pipeline.

Find companies with promising cash flow potential yet trading below their fair value.

Primoris Services Investment Narrative Recap

To hold Primoris Services stock, you need to believe in its ability to secure profitable data center and utility-scale renewable projects, while navigating intense competition and project execution challenges. The sharp rise in full-year earnings guidance strengthens the near-term outlook, making momentum in winning new contracts the key catalyst, but margin pressure from renewables remains the biggest risk, this news does not eliminate that concern. Primoris’s raised 2025 net income outlook, now US$260.5 million to US$271.5 million, directly reflects improved execution and strong third quarter results, confirming that recent revenue gains are translating into higher profits, a positive sign for those watching margin expansion from renewables and utilities projects. On the other hand, investors should be aware that persistent margin headwinds in the Renewables segment still pose...

Read the full narrative on Primoris Services (it's free!)

Primoris Services' outlook anticipates $8.7 billion in revenue and $358.2 million in earnings by 2028. This projection depends on 7.7% annual revenue growth and a $117.2 million earnings increase from the current $241.0 million.

Uncover how Primoris Services' forecasts yield a $147.30 fair value, a 17% upside to its current price.

Exploring Other Perspectives

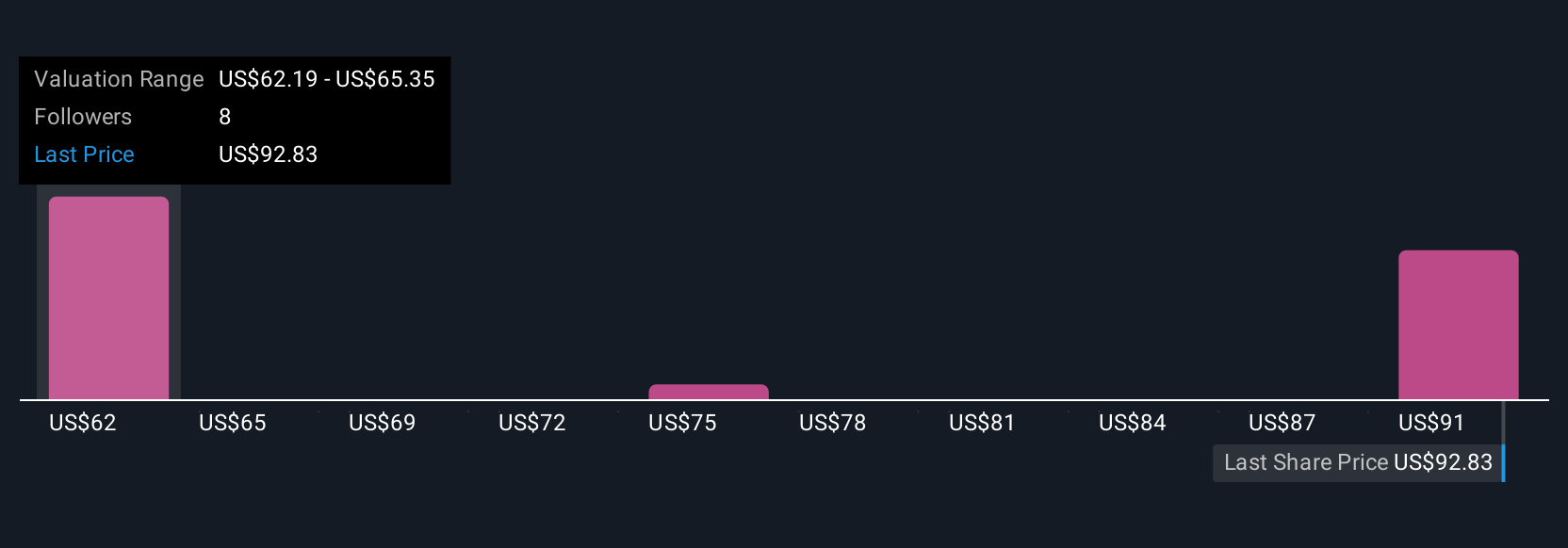

Four fair value estimates from the Simply Wall St Community span US$77.76 to US$147.30, highlighting a wide range of market opinions. Amid this, contract pipeline momentum remains crucial for future revenue and profit gains, so consider several viewpoints before deciding.

Explore 4 other fair value estimates on Primoris Services - why the stock might be worth 38% less than the current price!

Build Your Own Primoris Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primoris Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Primoris Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primoris Services' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives