- United States

- /

- Electrical

- /

- NYSE:NVT

How Investors May Respond To nVent Electric (NVT) Surpassing $1 Billion in Quarterly Sales on AI Data Center Demand

Reviewed by Sasha Jovanovic

- nVent Electric plc reported record third-quarter results in the past week, achieving its first-ever billion-dollar sales quarter and raising its 2025 outlook due to strong momentum in AI data centers and infrastructure growth.

- This performance highlights the company’s expanding liquid cooling portfolio for AI applications and underscores its increasing role as a key supplier for the global electrification and digitalization surge.

- We'll examine how nVent's rapid sales growth from AI data center demand may influence its outlook and investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

nVent Electric Investment Narrative Recap

To be a shareholder in nVent Electric today, you need to have confidence in the long-term growth of AI data center infrastructure and the company's ability to maintain leadership in liquid cooling and electrification solutions. The recent record-breaking quarter underscores this momentum as a critical catalyst, but it does not materially address the company's heightened exposure to the cyclicality of AI-related capital spending, which stands as the most important short-term risk.

Among the numerous announcements, the third-quarter earnings release stands out for its relevance: nVent reported US$1,054 million in sales, a sharp increase from the previous year's US$782 million, and raised its 2025 outlook based on ongoing strength in AI data center and infrastructure demand. This surge highlights how rapid revenue and order backlog growth, fueled by AI and electrification projects, continues to drive near-term expectations yet leaves the business vulnerable if customer investments slow unexpectedly.

On the other hand, investors should be aware that high concentration in data center buildouts means any pullback in AI capital spending could...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's narrative projects $4.5 billion revenue and $651.5 million earnings by 2028. This requires 10.4% yearly revenue growth and a $395.4 million earnings increase from $256.1 million today.

Uncover how nVent Electric's forecasts yield a $105.84 fair value, a 5% downside to its current price.

Exploring Other Perspectives

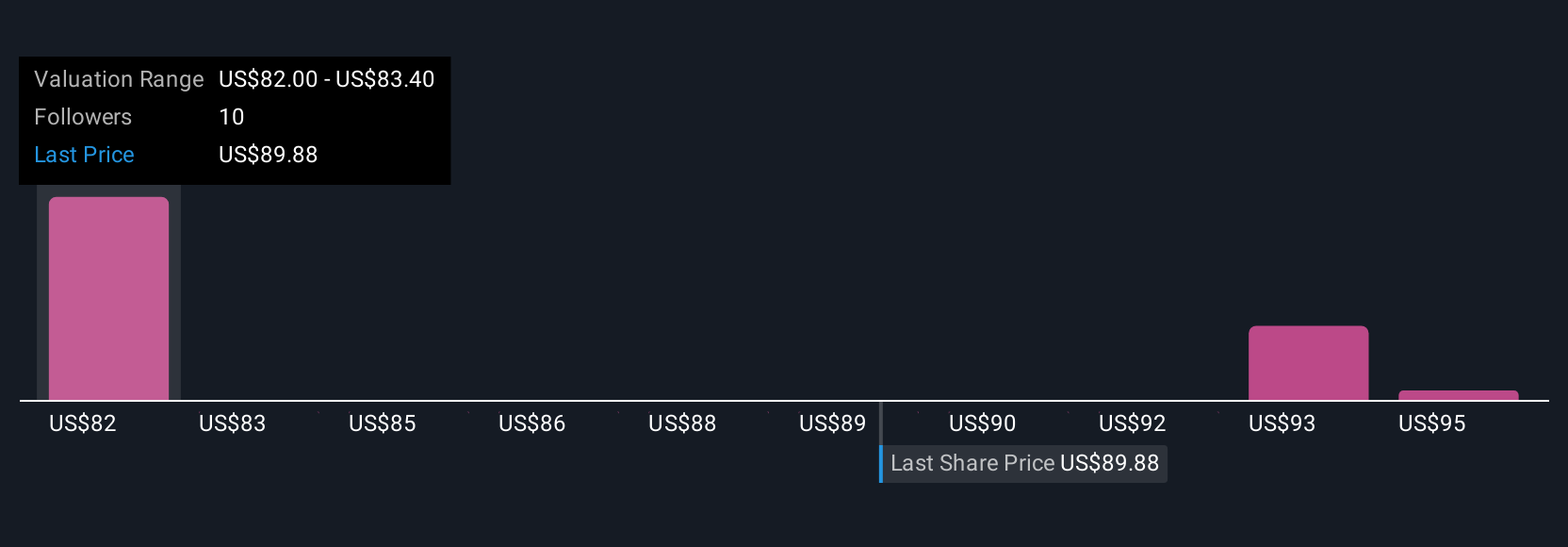

The Simply Wall St Community supplied five fair value estimates for nVent ranging widely from US$73.37 to US$121.09 per share. The company’s sharp recent revenue growth tied to AI infrastructure has fueled optimism but also heightens sensitivity to sector investment cycles, see what other investors are forecasting and how their outlooks compare.

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth 34% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives