- United States

- /

- Construction

- /

- NYSE:MTZ

The MasTec (NYSE:MTZ) Share Price Is Down 42% So Some Shareholders Are Getting Worried

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in MasTec, Inc. (NYSE:MTZ) have tasted that bitter downside in the last year, as the share price dropped 42%. That's disappointing when you consider the market returned -17%. At least the damage isn't so bad if you look at the last three years, since the stock is down 30% in that time. The share price has dropped 58% in three months. But this could be related to the weak market, which is down 29% in the same period.

Check out our latest analysis for MasTec

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the MasTec share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

MasTec managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

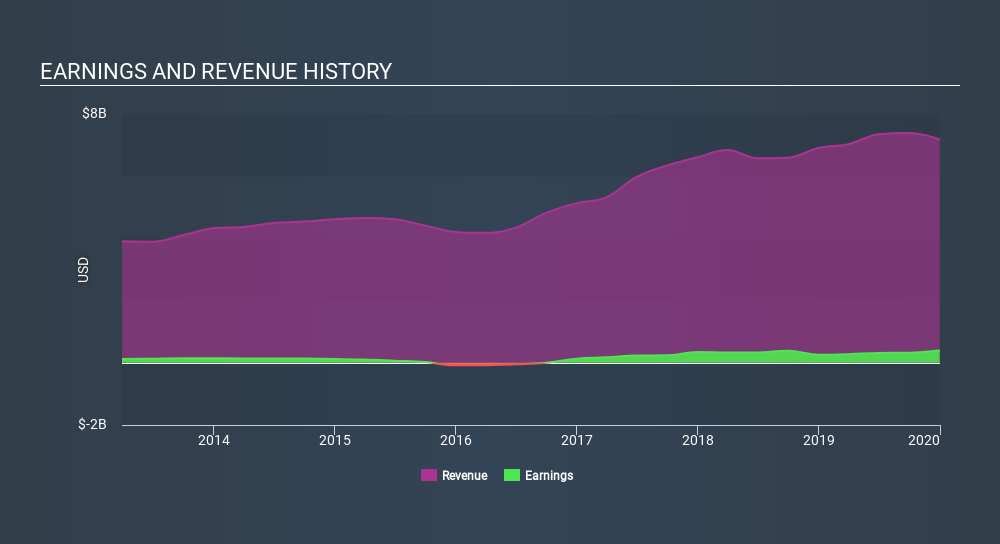

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how MasTec has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that MasTec shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 5.7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand MasTec better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for MasTec you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Fair value with moderate growth potential.