- United States

- /

- Industrials

- /

- NYSE:MMM

Does 3M's (MMM) Stable Dividend Reveal Its Evolving Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On November 4, 2025, the 3M Company Board of Directors declared a quarterly dividend of US$0.73 per share for the fourth quarter, payable December 12, 2025, to shareholders of record on November 14, 2025.

- This dividend continuation highlights 3M’s ongoing commitment to shareholder returns even after major legal settlements and the spin-off of its healthcare business.

- We'll now explore how 3M's continued dividend commitment despite recent transformation informs the company's investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

3M Investment Narrative Recap

To be a 3M shareholder today, you need to believe that the company can sustain innovation-led growth, execute on portfolio streamlining, and weather legacy legal headwinds while delivering steady cash returns. The recent dividend affirmation, while underscoring a strong track record of distributions, does not materially affect the most immediate catalysts, such as organic sales acceleration through new product launches, nor does it significantly reduce exposure to ongoing PFAS legal liabilities, which remain the most significant risk.

The company’s reiterated quarterly dividend of US$0.73 per share, announced on November 4, 2025, is a continuation of its historical pattern and highlights resilience in capital allocation. This move aligns with strong third-quarter earnings guidance and cash flow, but does not directly mitigate the overhang of pending PFAS litigation, which continues to demand investor attention in the near term.

In contrast, investors should be aware that major unresolved PFAS lawsuits could still create sudden financial pressures...

Read the full narrative on 3M (it's free!)

3M's outlook anticipates $26.1 billion in revenue and $4.7 billion in earnings by 2028. This projection is based on 2.0% annual revenue growth and a $0.8 billion increase in earnings from the current $3.9 billion level.

Uncover how 3M's forecasts yield a $174.31 fair value, a 6% upside to its current price.

Exploring Other Perspectives

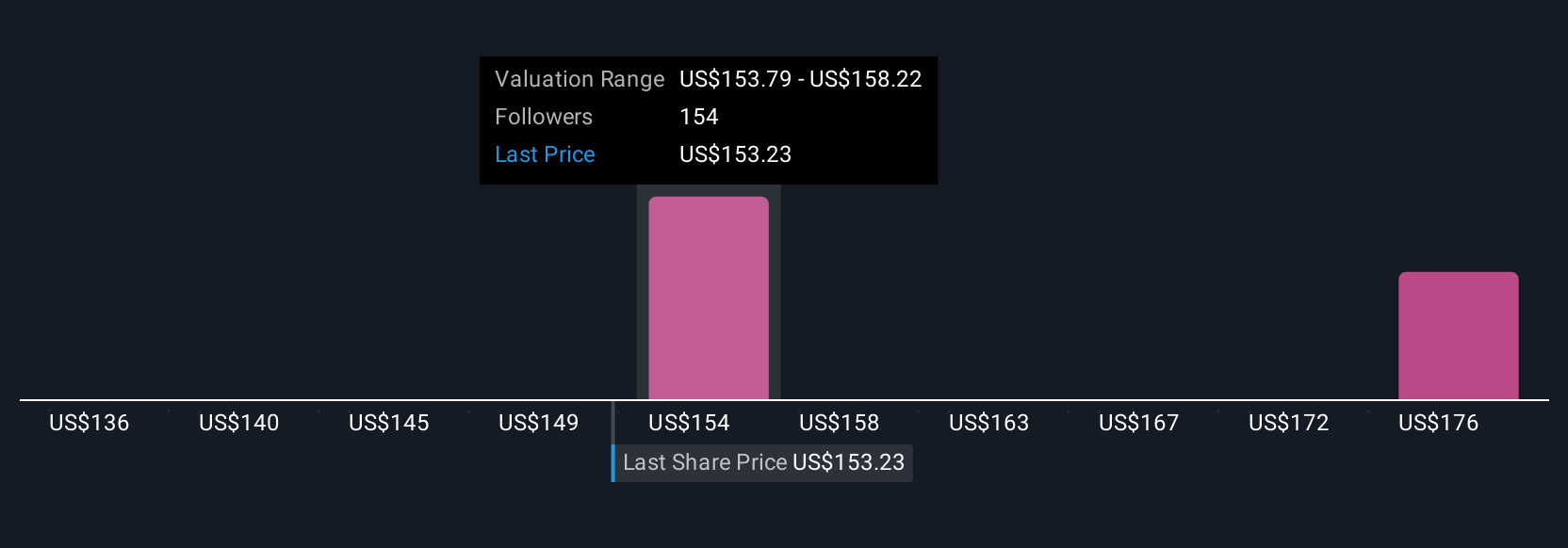

Six fair value opinions from the Simply Wall St Community span from US$142.36 to US$197.76 per share. While your peers weigh the company's price, management’s focus on new product innovation could play a key role in driving future performance, consider the full breadth of perspectives available.

Explore 6 other fair value estimates on 3M - why the stock might be worth as much as 20% more than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives