- United States

- /

- Building

- /

- NYSE:MBC

MasterBrand (MBC): Evaluating Valuation After Q3 Earnings Decline and Updated Guidance on Tariff Headwinds

Reviewed by Simply Wall St

MasterBrand’s third-quarter earnings report just dropped, underscoring a dip in sales and profit compared to last year. Investors are also digesting new guidance for the year that reflects tariff challenges and the company’s response.

See our latest analysis for MasterBrand.

Shares of MasterBrand have come under pressure this year, with the latest earnings and tariff updates weighing on sentiment. The stock has delivered a -24.7% year-to-date share price return and a -35.5% total shareholder return over the past year. This signals that momentum is currently fading as management takes proactive steps to offset fresh headwinds.

If you’re looking for your next idea beyond MasterBrand, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With recent declines and new tariff pressures, is MasterBrand's current valuation a hidden bargain for patient investors? Or has the market already factored in every challenge and possible rebound?

Price-to-Earnings of 16.8x: Is it justified?

MasterBrand is currently trading at a price-to-earnings (P/E) ratio of 16.8x, which sits higher than the peer average of 14.9x. Based on recent earnings, this implies investors are paying a premium for each dollar of profit compared to similar companies.

The P/E ratio indicates what the market is willing to pay for MasterBrand’s current and future earnings. A higher P/E can reflect expectations for growth, strong profit stability, or market confidence in the business model. In contrast, a lower P/E suggests the market sees greater risk or limited upside.

Despite trading at a premium to its peers, MasterBrand’s profit margins have slipped year on year and profits have actually declined, raising questions about whether such optimism is warranted. Compared to the US Building industry average P/E of 19.9x, MasterBrand looks cheaper within the sector. However, the discount could be justified by ongoing pressures on growth and profitability.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.8x (OVERVALUED)

However, softer revenue growth and persistent tariff challenges could undermine any optimism. This may leave the share price vulnerable if conditions do not improve soon.

Find out about the key risks to this MasterBrand narrative.

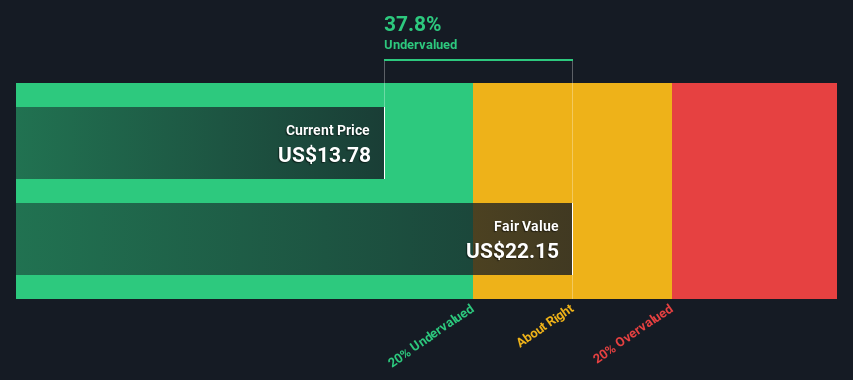

Another View: Discounted Cash Flow Says Undervalued

While MasterBrand’s share price looks expensive when compared to peers, our DCF model paints a different picture. The SWS DCF model estimates a fair value of $12.72. This suggests that the current price of $10.99 is about 13.6% below its intrinsic worth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MasterBrand for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MasterBrand Narrative

If you’d like a fresh perspective or want to dig into the numbers yourself, you can quickly build your own insight and narrative in just a few minutes. Do it your way

A great starting point for your MasterBrand research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the strongest returns often come from thinking beyond the obvious. Let me help you uncover standout opportunities that could transform your portfolio this year.

- Supercharge your watchlist by targeting reliable income streams with these 16 dividend stocks with yields > 3%, which consistently deliver generous yields above 3%.

- Capitalize on the AI boom by tapping into these 25 AI penny stocks, which are redefining industries and pushing the boundaries of innovation.

- Get ahead of the curve by accessing these 3588 penny stocks with strong financials, positioned for explosive growth and big upside potential before the crowd notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MBC

MasterBrand

Engages in the manufacture and sale of residential cabinets in the United States and Canada.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives