- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

Karman Holdings (KRMN): Evaluating Valuation After Record Revenue, Raised Guidance, and Strategic Expansion

Reviewed by Simply Wall St

Karman Holdings (KRMN) is in focus after reporting record quarterly revenue and gross profit. Management raised its outlook for full-year 2025 revenue. The company also issued preliminary 2026 guidance projecting strong double-digit growth.

See our latest analysis for Karman Holdings.

Despite the sharp pullback in the last week, with a 7-day share price return of -16.1 percent and a recent single-day drop, momentum for Karman Holdings is still very much alive. Its year-to-date share price return stands at a striking 135.2 percent. The recent secondary equity offering and acquisition put a spotlight on its growth trajectory, while upbeat guidance signals that long-term optimism remains intact.

If Karman’s rapid moves have you watching for the next potential breakout, now’s the perfect moment to expand your radar and discover fast growing stocks with high insider ownership

With shares up sharply this year and trading near their analyst price target, the key question is whether Karman Holdings is undervalued given its growth outlook or if the market has already priced in the good news. Is there still a buying opportunity, or has future upside already been captured in the stock’s valuation?

Price-to-Sales of 21.8x: Is it justified?

Karman Holdings is currently trading at a price-to-sales ratio of 21.8x, which is notably higher than both the US Aerospace & Defense industry average and its closest peers. Given the latest close of $70.68, investors are paying a substantial premium for each dollar of the company’s revenue compared to sector norms.

The price-to-sales (P/S) ratio measures what investors are willing to pay for a dollar of the company’s sales. For high-growth or innovative businesses, a premium P/S may reflect expectations for future expansion and market share gains.

While some companies command hefty multiples due to exceptional growth rates, Karman's current P/S of 21.8x is almost seven times the industry average of 3x. The peer average stands even lower at 2x, which places Karman in the uppermost valuation tier. In addition, the fair price-to-sales estimate is 5.5x, so the current multiple far exceeds what fundamentals might suggest as a reasonable level for the stock.

Explore the SWS fair ratio for Karman Holdings

Result: Price-to-Sales of 21.8x (OVERVALUED)

However, revenue growth could slow, or a broader market downturn may quickly reverse the current premium. This could make Karman’s valuation vulnerable to an abrupt correction.

Find out about the key risks to this Karman Holdings narrative.

Another View: Discounted Cash Flow Model

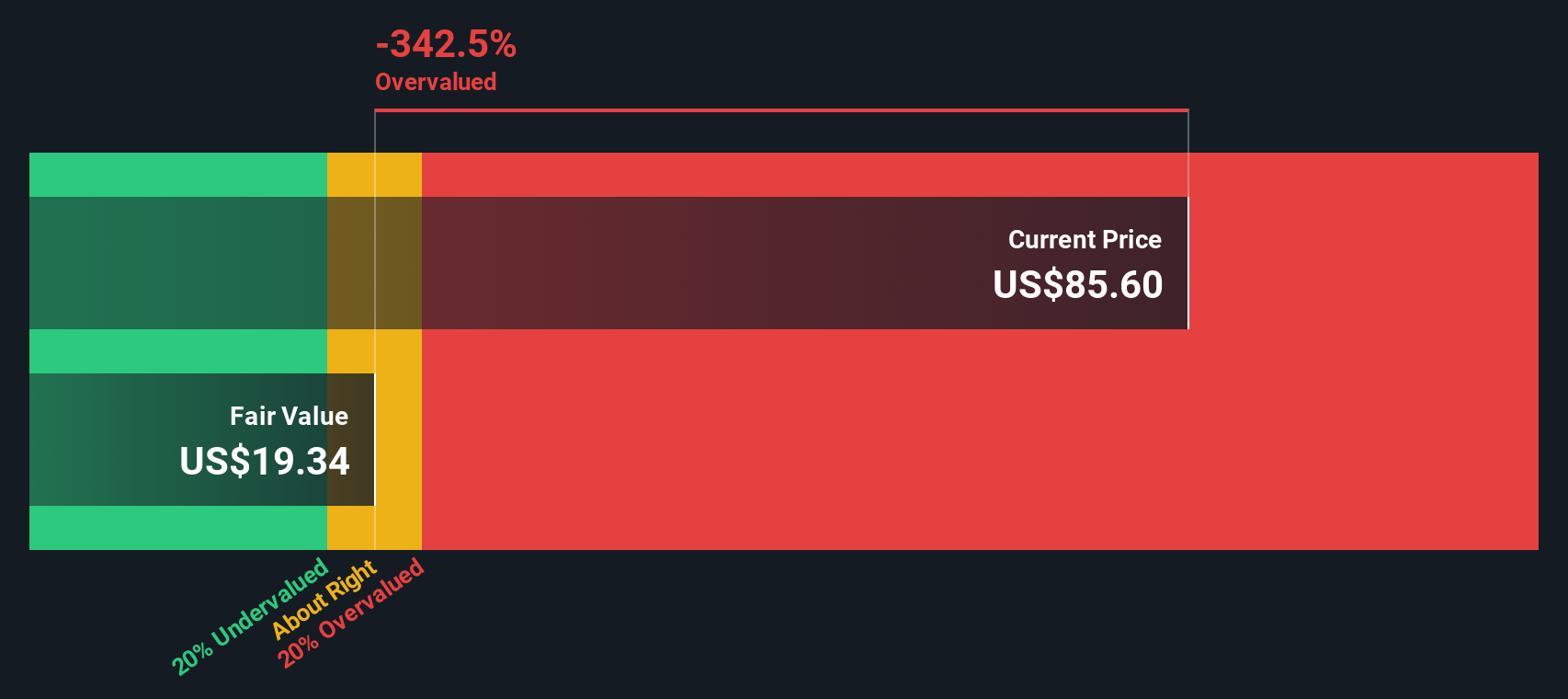

Taking a different approach, the SWS DCF model estimates Karman Holdings' fair value at $22.13 per share, significantly below the current price of $70.68. This points to even higher potential overvaluation than what multiples suggest. Could the market be too optimistic, or is the growth story simply that strong?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Karman Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Karman Holdings Narrative

If you have your own perspective or want to dive deeper into Karman Holdings’ data, you can quickly build your own narrative and analysis, often in just a few minutes. Do it your way

A great starting point for your Karman Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your watchlist and catch trends before they go mainstream by leveraging investment opportunities tailored to your interests. Why miss the next rising star?

- Catch high yields and strengthen your income strategy in one move with these 16 dividend stocks with yields > 3% for stocks boasting impressive dividend payouts.

- Spot breakthrough opportunities in healthcare innovation by tapping into these 32 healthcare AI stocks, where artificial intelligence meets medical advancement.

- Jump ahead of the curve and track technology front-runners harnessing the power of quantum computing with these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

High growth potential with very low risk.

Market Insights

Community Narratives