- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

Can Karman Holdings (KRMN) Balance Aggressive Expansion With Long-Term Profitability?

Reviewed by Sasha Jovanovic

- Karman Holdings Inc. recently announced its third-quarter 2025 earnings, reporting US$121.79 million in sales and US$7.64 million in net income, both up from the previous year, and raised its full-year 2025 revenue guidance.

- This performance comes alongside expansions through acquisition and a significant term loan, positioning the company for increased capability in the commercial space industry.

- We'll explore how Karman Holdings' raised revenue outlook and business expansion initiatives influence its current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Karman Holdings' Investment Narrative?

To be a shareholder in Karman Holdings right now is to bet on management’s ability to turn robust top-line momentum into durable profits, while navigating elevated risks tied to acquisition-fueled expansion and fresh debt. The latest earnings revealed record quarterly sales and a revised, higher full-year revenue outlook, affirming strong end-market demand. This serves as a potential short-term catalyst, even with concerns around low profit margins and heavy use of financing, especially the new US$130 million term loan. The acquisition of 5 Axis Industries broadens Karman’s capabilities in the commercial space sector, which may enhance its growth runway but also increases near-term execution risk as the company integrates new assets and ramps operational complexity. The raised guidance tips optimism, yet it also raises expectations at a time when board experience remains limited and profit margins lag history. Recent price weakness could reflect the market weighing these exact short-term risks and opportunities following the news, making the impact quite material for the stock’s narrative going forward.

However, limited board experience continues to be a concern for those watching closely.

Exploring Other Perspectives

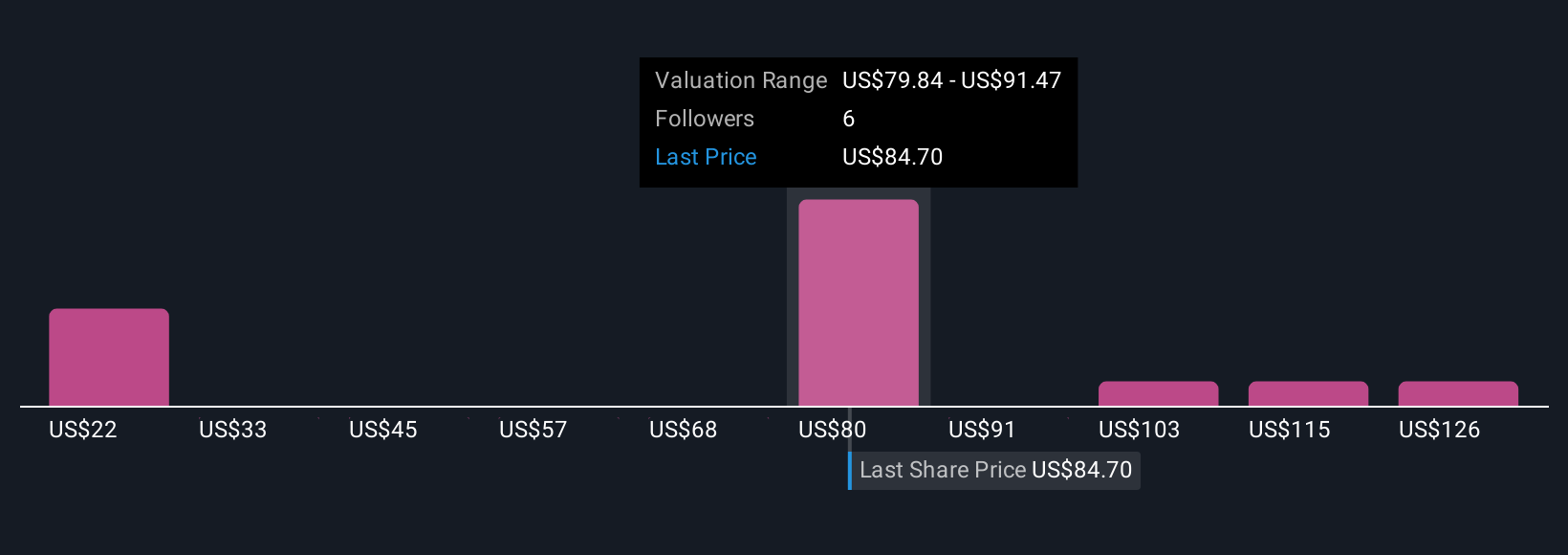

Explore 6 other fair value estimates on Karman Holdings - why the stock might be worth as much as 95% more than the current price!

Build Your Own Karman Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Karman Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Karman Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Karman Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

High growth potential with very low risk.

Market Insights

Community Narratives