- United States

- /

- Machinery

- /

- NYSE:KMT

Kennametal (KMT): Assessing Valuation After First Organic Sales Growth and Upbeat 2026 Guidance

Reviewed by Simply Wall St

Kennametal (KMT) just delivered its first quarter of organic sales growth in two years, supported by stronger demand and strategic wins in aerospace and infrastructure. Revenue and earnings exceeded forecasts, prompting management to raise their guidance for fiscal 2026.

See our latest analysis for Kennametal.

Momentum has returned in a big way for Kennametal, with a 22% share price return over the past month and a 29% gain in the last 90 days. This is clear evidence that investors are responding to the company’s improving results, robust guidance, and accelerating buyback activity. Despite the recent rally, one-year total shareholder return remains negative, which hints at room for further recovery if trends continue working in the company’s favor.

If Kennametal’s turnaround has you rethinking your strategy, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

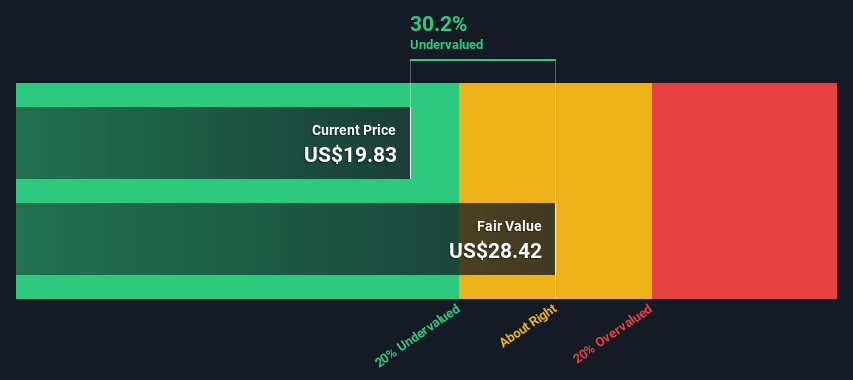

With shares rebounding sharply and a strong earnings beat now in the rearview mirror, the question for investors is whether Kennametal remains undervalued or if the market has already priced in the next phase of growth and recovery.

Most Popular Narrative: 23.7% Overvalued

With the current share price of $26.06 sitting well above the most popular narrative’s fair value of $21.06, the gap reveals that consensus sees the stock as notably overpriced. This perspective is driven by expectations for only moderate revenue and margin expansion over the coming years, set against a backdrop of industry change.

Portfolio optimization actions, including the divestiture of non-core assets and focus on higher-growth sectors like Aerospace & Defense, are expected to enhance the company's competitive positioning and earnings resilience. These actions support future margin expansion and earnings growth.

Will Kennametal achieve enough growth to turn the narrative upside down? Some analysts are betting on a big shift in sector mix and rising margins, but one quantitative assumption here is especially bold. Curious what’s driving such a bold call? Click to uncover the underlying drivers of this striking fair value assessment.

Result: Fair Value of $21.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a prolonged downturn in core end-markets or a failure to convert cost savings into higher margins could quickly undermine the current optimism.

Find out about the key risks to this Kennametal narrative.

Another View: Our DCF Model Says Undervalued

While consensus and multiples suggest Kennametal is overvalued, the SWS DCF model arrives at a very different conclusion. Based on long-term cash flows, Kennametal’s intrinsic value is estimated to be $76.74, well above the current share price. This dramatic valuation divide poses the classic investor question: could the market be missing something, or are the assumptions behind the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kennametal Narrative

If you want to look at the numbers for yourself and shape your own take, you can build a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kennametal.

Looking for more investment ideas?

Why stop with Kennametal when you can target tomorrow's biggest winners? Act now before others catch on and start using the Simply Wall Street Screener to unlock real opportunities.

- Tap into future megatrends by analyzing these 25 AI penny stocks, which are pioneering breakthroughs in machine learning and automation.

- Maximize your income potential and stability by hunting for these 17 dividend stocks with yields > 3% that meet high yield and consistency criteria.

- Catch early-stage momentum and outsized growth with these 3586 penny stocks with strong financials, which are rising fast on strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives