- United States

- /

- Building

- /

- NYSE:JELD

JELD-WEN (JELD) Is Down 41.0% After Job Cuts, Losses, and European Business Review—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- JELD-WEN Holding, Inc. recently reported third-quarter 2025 results revealing a drop in sales to US$809.5 million and a net loss of US$367.6 million, alongside plans to cut approximately 850 jobs, goodwill impairment charges of US$196.9 million, and a lowered full-year revenue outlook.

- The company also announced a review of strategic alternatives for its European business, which accounted for roughly US$1.1 billion in 2024 revenue, highlighting a significant reevaluation of its global operations.

- We’ll explore how the workforce reduction and strategic portfolio review influence JELD-WEN’s investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

JELD-WEN Holding Investment Narrative Recap

To be a JELD-WEN shareholder at this stage, you need to believe the company can execute on transformation initiatives to restore profitability and withstand ongoing headwinds in housing and construction markets. The recent Q3 results, deeper net loss, and lowered revenue outlook reinforce short-term risks, especially around declining demand and cost pressures, though they do not materially change the most immediate catalyst, the company’s ability to deliver on cost reduction and transformation targets, or the largest risk of ongoing volume declines in core markets.

Among the latest announcements, the decision to initiate a comprehensive review of strategic alternatives for the European business stands out. With Europe accounting for around US$1.1 billion in revenue last year, any portfolio actions could meaningfully shift JELD-WEN’s operational focus and future earnings mix, directly tying into current catalysts around cost optimization and long-term margin improvement.

However, it is just as important for investors to note the challenge that comes if demand continues to fall and cost savings are not enough to offset further volume declines...

Read the full narrative on JELD-WEN Holding (it's free!)

JELD-WEN Holding is expected to reach $3.4 billion in revenue and $91.6 million in earnings by 2028. This forecast implies a -0.6% annual decline in revenue and an earnings increase of $445.4 million from current earnings of -$353.8 million.

Uncover how JELD-WEN Holding's forecasts yield a $3.59 fair value, a 38% upside to its current price.

Exploring Other Perspectives

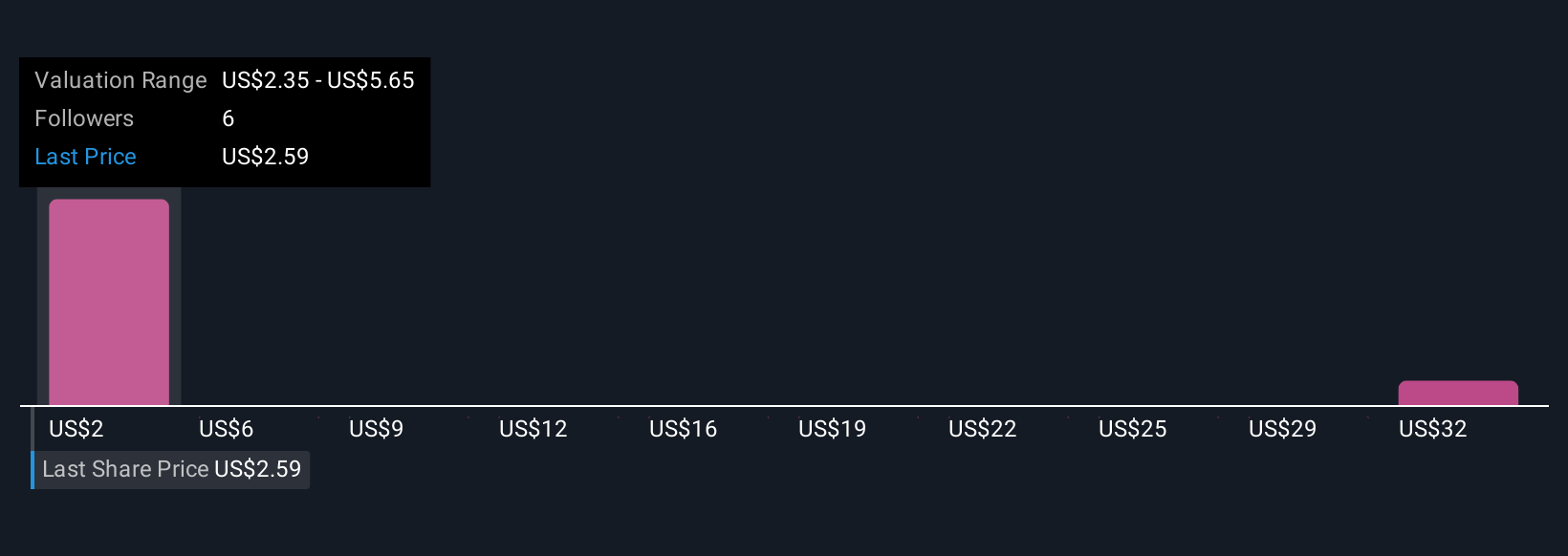

Four individual fair value estimates from the Simply Wall St Community cover a wide spectrum, from US$2.35 to US$35.39 per share. With these differing perspectives, keep in mind that forecasts of persistent demand challenges may influence whether the current price truly reflects the company’s outlook.

Explore 4 other fair value estimates on JELD-WEN Holding - why the stock might be worth 9% less than the current price!

Build Your Own JELD-WEN Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JELD-WEN Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JELD-WEN Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JELD-WEN Holding's overall financial health at a glance.

No Opportunity In JELD-WEN Holding?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JELD

JELD-WEN Holding

Designs, manufactures, and sells wood, metal, and composite materials doors, windows, and related building products in North America and Europe.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives