- United States

- /

- Building

- /

- NYSE:JCI

Johnson Controls (JCI) Gains After Strong 2025 Earnings and Upbeat 2026 Growth Outlook—What's Next?

Reviewed by Sasha Jovanovic

- Johnson Controls International reported its fourth quarter and full-year 2025 earnings, highlighting revenue of US$6.44 billion and net income of US$1.69 billion for the quarter, as well as increased annual earnings and revenue compared to the previous year.

- The company also issued guidance for 2026, indicating expectations for continued organic sales growth in the mid-single digits, which provides insight into its outlook on future market demand and operational stability.

- We will explore what Johnson Controls International’s improved full-year financial performance and 2026 sales growth outlook mean for its investment thesis.

Find companies with promising cash flow potential yet trading below their fair value.

Johnson Controls International Investment Narrative Recap

Owning Johnson Controls International shares means believing in the company’s potential to drive consistent growth through operational improvements, leadership changes, and innovation, all while managing the complexities of its transformation. The recent earnings highlight solid growth in both revenue and net income, and the company’s 2026 guidance of mid-single digit organic sales growth may support short-term optimism. However, these developments do not materially change the immediate risk of potential disruptions related to recent restructuring into new reporting segments.

The company’s guidance update, which signals expectations of steady organic sales growth into 2026, is especially relevant for investors watching near-term catalysts. This sales outlook aligns with the ongoing push to strengthen customer focus and improve operational execution, two factors at the heart of Johnson Controls’ investment case. Yet, despite these advances, investors should keep an eye on...

Read the full narrative on Johnson Controls International (it's free!)

Johnson Controls International is projected to reach $27.0 billion in revenue and $3.3 billion in earnings by 2028. This outlook assumes a 4.9% annual revenue growth rate and a $1.3 billion increase in earnings from the current $2.0 billion.

Uncover how Johnson Controls International's forecasts yield a $124.00 fair value, in line with its current price.

Exploring Other Perspectives

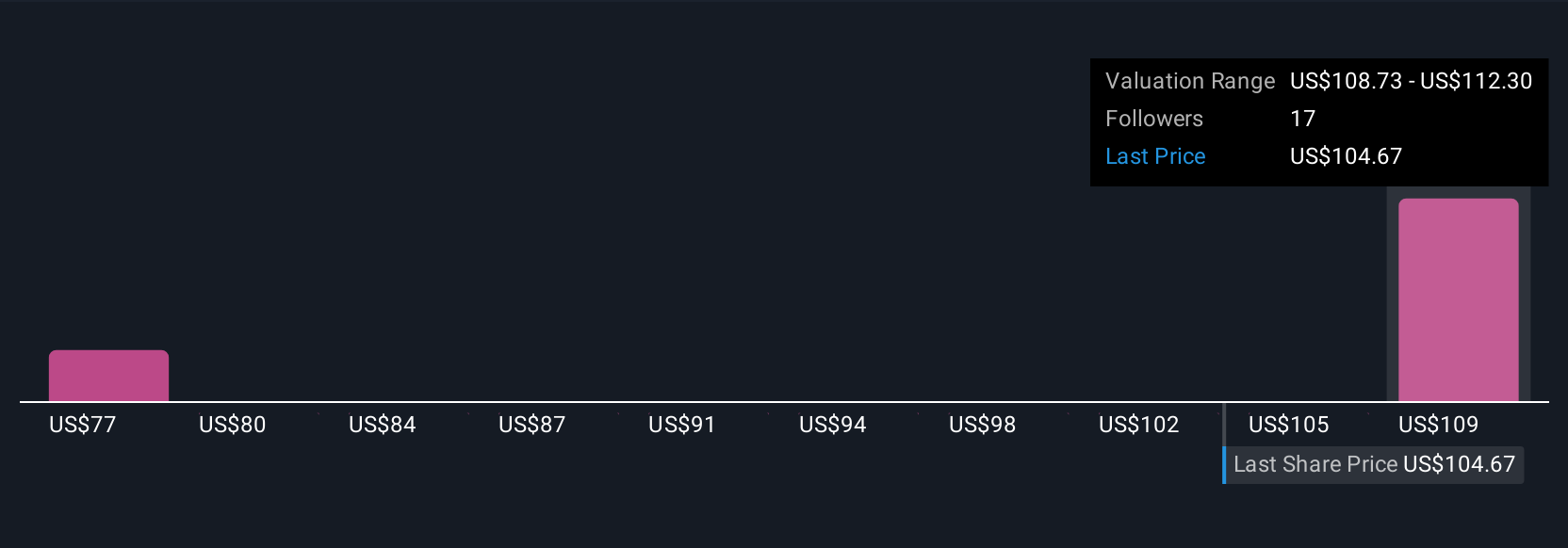

Three Simply Wall St Community members have independently valued Johnson Controls International stock between US$88.69 and US$130. While some expect strong execution from the company’s new organizational structure, others caution against potential transitional risks that could affect near-term performance. Check out a range of investor perspectives shared by our community.

Explore 3 other fair value estimates on Johnson Controls International - why the stock might be worth 27% less than the current price!

Build Your Own Johnson Controls International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Johnson Controls International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson Controls International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives