- United States

- /

- Building

- /

- NYSE:JCI

Johnson Controls (JCI): Assessing Valuation After Strong Earnings, Record Backlog, and Upbeat 2026 Growth Outlook

Reviewed by Simply Wall St

Johnson Controls International (JCI) just posted its latest quarterly and annual results, showing revenue and net income rising compared to last year. In addition to these results, management issued a positive outlook for organic sales growth in 2026.

See our latest analysis for Johnson Controls International.

Momentum is clearly building for Johnson Controls International after these upbeat results. The share price has surged 15.8% over the past month, adding to a standout 54.8% year-to-date price return. The company’s strong fiscal performance, a record $15 billion backlog, and continued decarbonization initiatives have all contributed to renewed investor enthusiasm and a robust 1-year total shareholder return of 43.5%.

If you’re inspired by JCI’s recent moves and want to spot other opportunities, why not broaden your search and discover fast growing stocks with high insider ownership

With shares running higher after strong results and analyst optimism, investors are now asking if Johnson Controls International is still undervalued, or if the market has already priced in all that future growth.

Most Popular Narrative: 1.4% Undervalued

With Johnson Controls International's most popular narrative fair value estimate of $124 just above the last close price of $122.25, the gap is minimal and suggests close alignment between current valuation and the narrative's outlook.

The company has significant opportunities for cost reductions and process improvements through the implementation of Lean practices. These initiatives are likely to positively impact net margins and overall earnings. Johnson Controls’ strong record backlog and sustained demand in key areas, such as its York HVAC and Metasys building automation platforms, provide a solid foundation for future revenue growth.

Want to know the growth blueprint behind this valuation? The narrative is fueled by bold assumptions about boosted profitability, robust expansion, and a bottom line leap that could reset expectations. Do the numbers stack up to these heightened ambitions? Dive deeper to decode what really drives the fair value for this market heavyweight.

Result: Fair Value of $124 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, results could disappoint if operational complexity slows improvements or if execution missteps limit benefits from new cost-saving initiatives.

Find out about the key risks to this Johnson Controls International narrative.

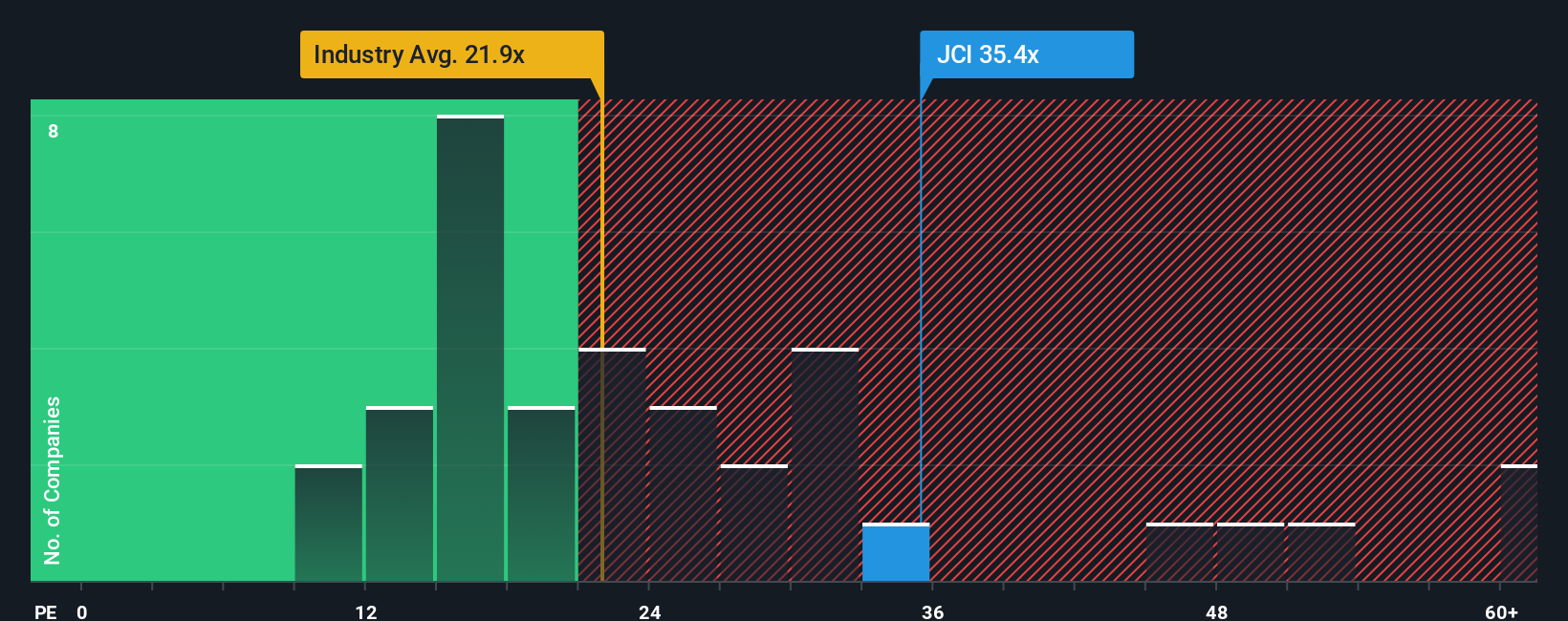

Another View: Multiples Suggest Caution

While the most popular narrative pegs Johnson Controls International as undervalued, a closer look at its price-to-earnings ratio tells a different story. The company trades at 46.5 times earnings, well above both the US Building industry average of 19.9x and its peer group at 26.4x. Even the fair ratio for JCI is estimated at 39.1x, which means the current price points to a premium. With such a sizable gap, does the market see something others have yet to price in, or is there risk of a pullback if expectations aren’t met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson Controls International Narrative

If you see things differently or want to dive into the details yourself, you can build your own narrative in just minutes. Do it your way

A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Turn your curiosity into action and take the lead with powerful screeners that make it easy to spot your next investment win.

- Unlock tomorrow’s potential by jumping into these 25 AI penny stocks, transforming industries with cutting-edge artificial intelligence.

- Start building steady portfolio gains by tapping into these 16 dividend stocks with yields > 3%, offering attractive yields above 3% for consistent income seekers.

- Get ahead of the curve and ride early momentum with these 3589 penny stocks with strong financials, which back solid financials and big growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives