- United States

- /

- Machinery

- /

- NYSE:JBTM

JBT Marel (JBTM) Is Up 14.1% After Raising Full-Year Earnings Guidance on Strong Q3 Results – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- JBT Marel Corporation recently reported third-quarter results showing sales of US$1.00 billion and net income of US$66 million, both significantly higher than the previous year.

- The company also raised its full-year earnings outlook, pointing to strong operational momentum and management confidence following a period of business integration.

- We’ll assess how this upgraded earnings guidance, driven by better-than-expected quarterly performance, reinforces JBT Marel’s investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

JBT Marel Investment Narrative Recap

For investors considering JBT Marel, the key proposition lies in confidence that the merged company’s scale, automation focus, and robust demand for protein processing solutions will outpace industry headwinds. The upbeat third-quarter results and raised full-year guidance underscore strong operational momentum, but don’t eliminate ongoing risks. The most important short-term catalyst remains driving synergies from the JBT-Marel merger, while concerns about integration efficiency and lingering restructuring costs are still top of mind. The recent earnings beat reinforces management’s credibility, though elevated costs from integration and potential order volatility remain critical watchpoints.

Of the latest announcements, the raised full-year earnings guidance stands out as most relevant: JBT Marel now expects revenue between US$3,760 million and US$3,790 million, with GAAP loss per share narrowing to a range of US$1.05 to US$0.75. This signals confidence that the improved quarterly performance is not a one-off, but a reflection of synergy capture from the merger, directly supporting the company’s transformation catalyst. Investors eyeing this stock will view such upward revisions as a key validation of management’s synergy targets in the near term.

Yet, in contrast to the upbeat outlook, continued integration challenges and merger-related risks present unresolved issues investors should be aware of...

Read the full narrative on JBT Marel (it's free!)

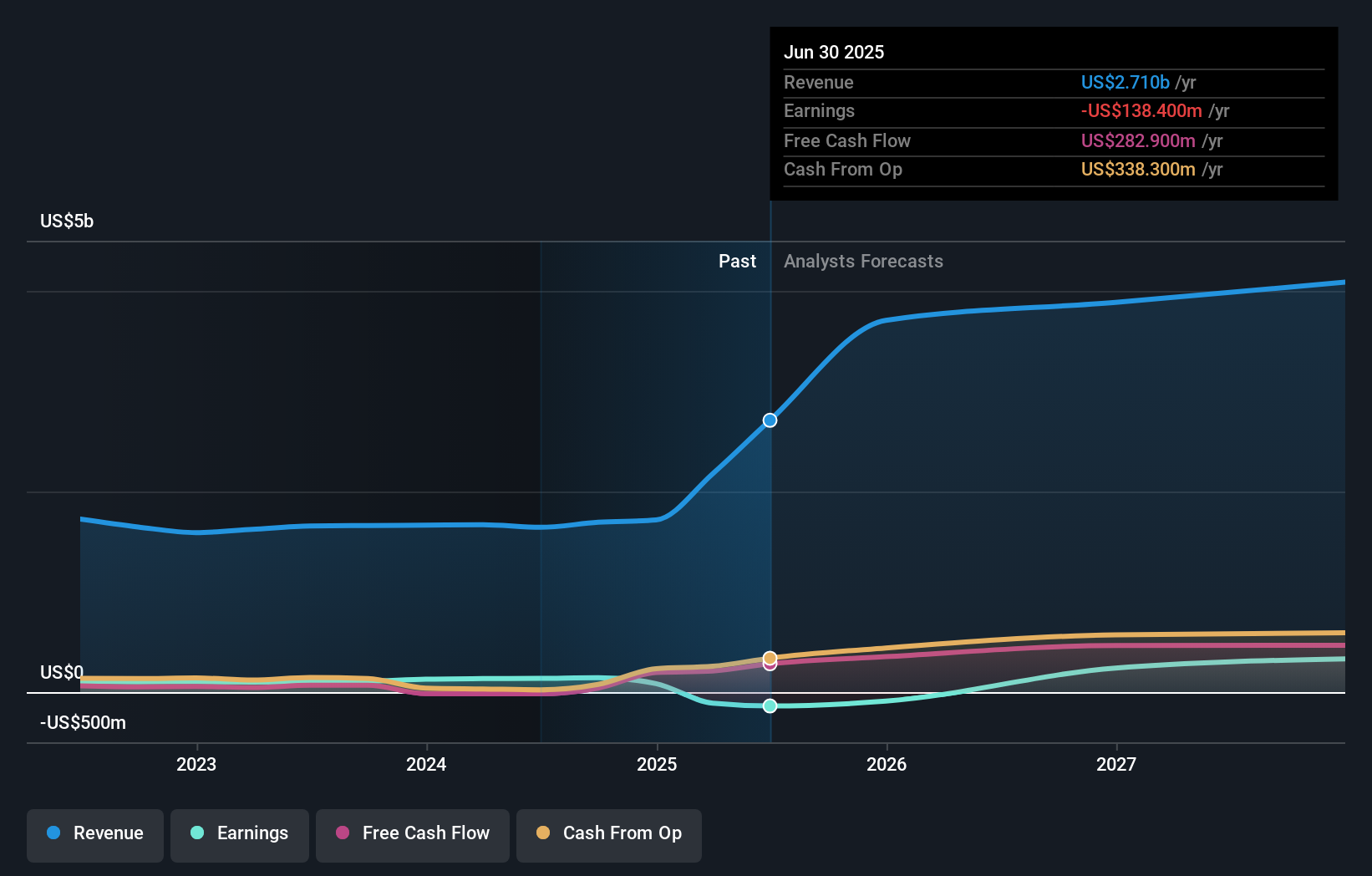

JBT Marel's outlook anticipates $4.6 billion in revenue and $591.0 million in earnings by 2028. This is based on a projected annual revenue growth rate of 19.0% and an increase in earnings of $729.4 million from the current earnings of -$138.4 million.

Uncover how JBT Marel's forecasts yield a $152.75 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St estimate fair values for JBT Marel between US$152.75 and US$180.52, based on two independent analyses. While you weigh these diverse perspectives, remember that integration risks could still impact margin expansion and future earnings.

Explore 2 other fair value estimates on JBT Marel - why the stock might be worth just $152.75!

Build Your Own JBT Marel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JBT Marel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JBT Marel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JBT Marel's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBTM

JBT Marel

Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives