- United States

- /

- Machinery

- /

- NYSE:JBTM

How Should Investors View JBT Marel After Shares Surge 12% This Week?

Reviewed by Bailey Pemberton

- Curious if JBT Marel is a hidden gem or just fairly priced? Let’s dig into what really drives its value.

- In the past week, JBT Marel shares surged 12.1%, and they’re up 19.2% over the last year, showing some real momentum after a bumpy 30-day patch.

- Industry watchers have been buzzing about JBT Marel in recent months as the company continues to expand into automated food technology and makes bold strategic acquisitions. These moves have caught the market’s attention, fueling optimism about its long-term growth prospects.

- On our core valuation checks, JBT Marel lands a 4 out of 6 on the valuation score, which means it beats the market in most categories but not all. Let's break down what this score means by exploring the main valuation approaches, and stick around for a smarter, more holistic way to judge value at the end of this article.

Approach 1: JBT Marel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and then discounting those back to today’s value using a chosen rate. This method helps investors gauge what a business is worth based on its ability to generate cash over time.

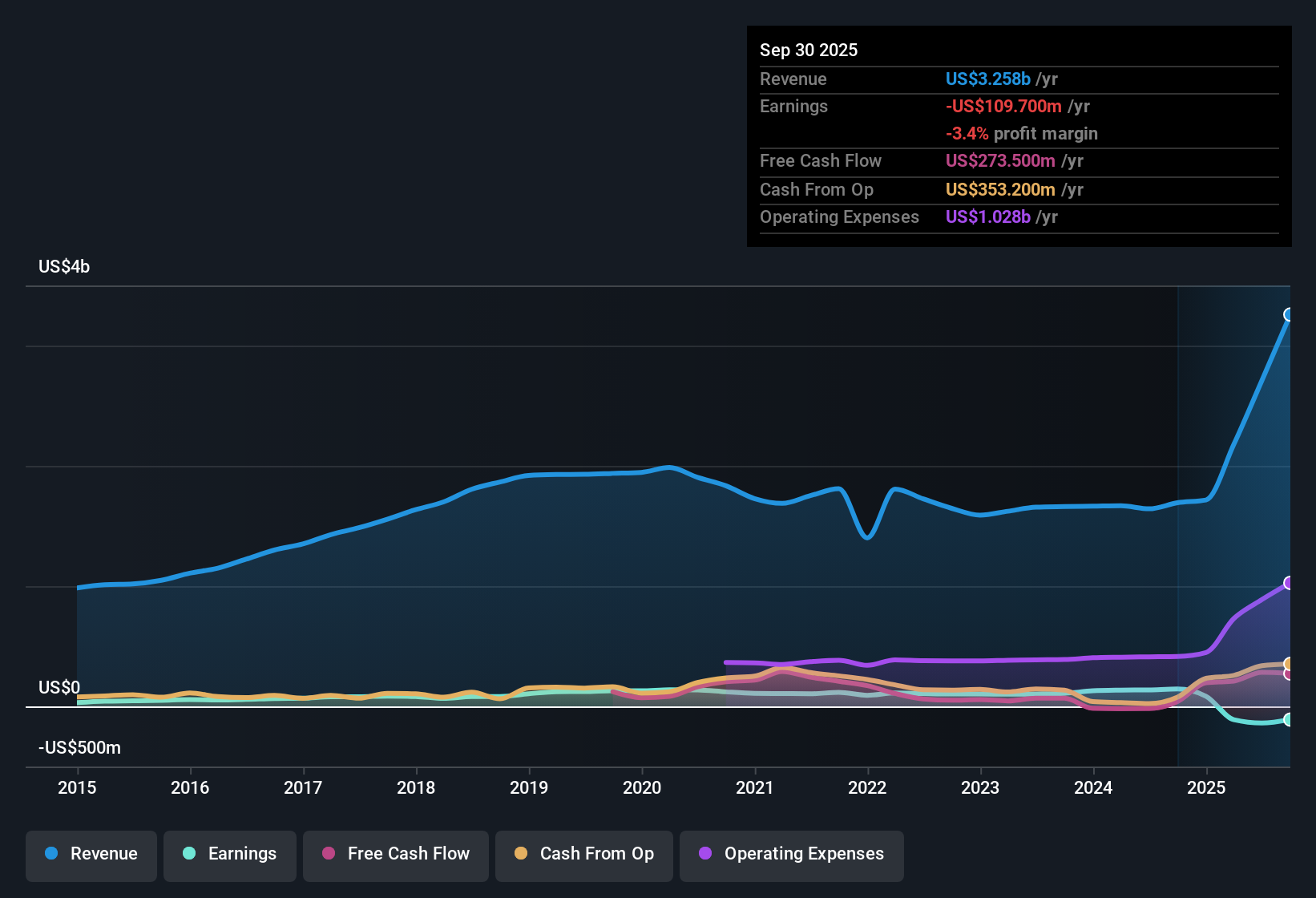

For JBT Marel, the DCF uses the 2 Stage Free Cash Flow to Equity model. The company has generated $262.5 million in Free Cash Flow over the last twelve months, and analyst consensus sees this number growing impressively in the years ahead. For example, forecasts for 2027 call for Free Cash Flow (FCF) to reach $522 million, nearly doubling from current levels. Projections continue to climb, with estimates (including Simply Wall St extrapolations) showing FCF potentially reaching $726.6 million by 2035.

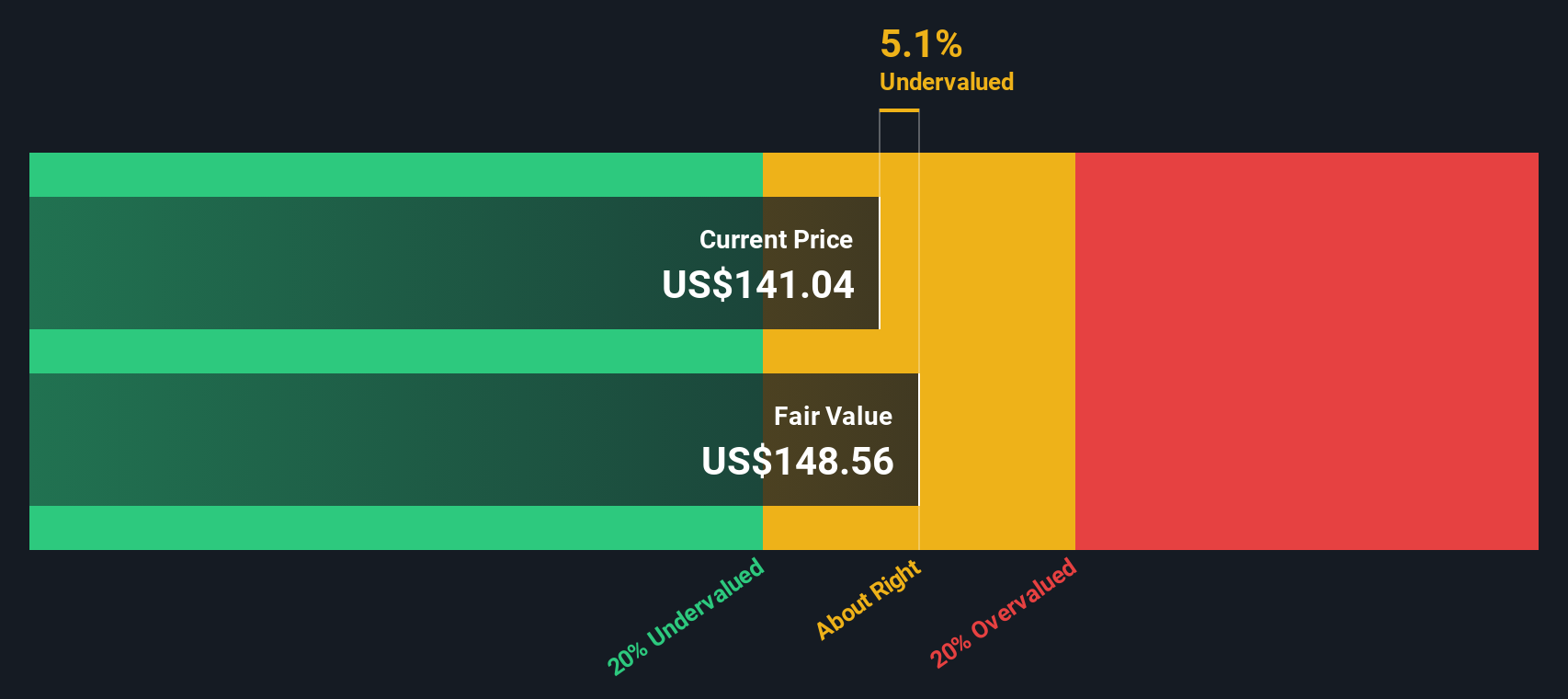

After discounting these expected future cash flows to the present, the DCF analysis calculates an intrinsic value per share of $180.28. Compared to the current share price and incorporating the latest data, the results suggest that JBT Marel stock is trading at a 21.6% discount. This makes it appear notably undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests JBT Marel is undervalued by 21.6%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: JBT Marel Price vs Sales

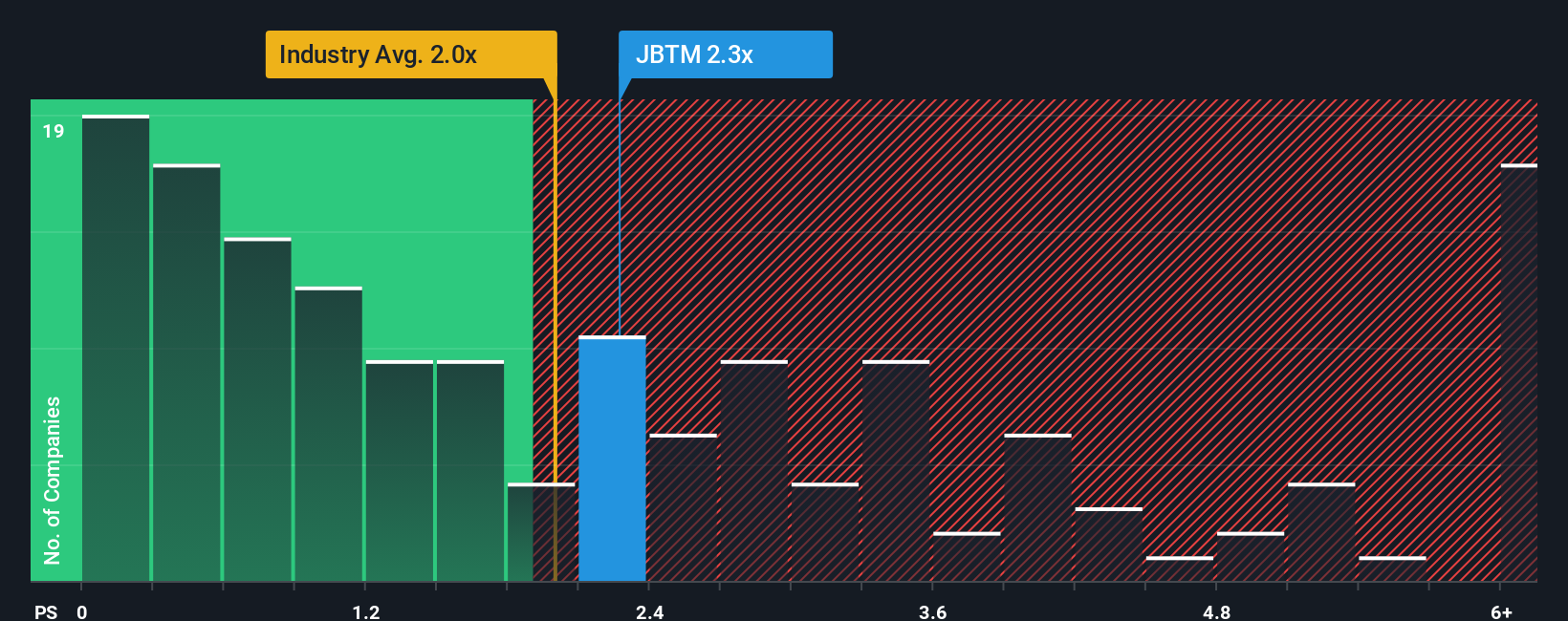

The Price-to-Sales (P/S) ratio is a useful valuation metric for companies that may not be consistently profitable but still demonstrate strong sales growth. For businesses in the Machinery sector like JBT Marel, P/S is often preferred over other multiples because it focuses on revenue, which can offer a clearer picture of value when earnings are volatile or impacted by one-off events.

Growth expectations and perceived risks play a significant role in what investors view as a “fair” P/S multiple. Higher revenue growth or robust margins usually justify a higher ratio, while greater risks or sluggish sales may warrant a discount.

Currently, JBT Marel trades at a P/S of 2.25x. That is slightly higher than the machinery industry average of 1.97x, but below the peer average of 2.86x. To get a more tailored view, Simply Wall St’s proprietary Fair Ratio for JBT Marel is 2.52x. This Fair Ratio incorporates not just industry trends and size, but also factors such as JBT Marel’s growth trajectory, profit margins, and risk profile.

The Fair Ratio aims to be a smarter benchmark than just using peers or industry averages. It captures a holistic view of value by blending hard data on growth and profitability with softer considerations like risk and company size, all specific to JBT Marel.

Comparing the actual P/S (2.25x) with the Fair Ratio (2.52x), the difference is moderate. This suggests that the stock may be somewhat undervalued according to this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JBT Marel Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story or perspective about a company, grounded in assumptions about its fair value and future growth in areas like revenue, earnings, and margins. Rather than just weighing up static numbers, Narratives connect the company's big-picture story to clear financial forecasts and a calculated fair value, bringing your investment view to life in a single, actionable framework.

Narratives are easy to create and use on Simply Wall St's Community page, where millions of investors share their outlooks. They help you make smarter decisions on when to buy or sell, because they update automatically whenever something in the company or market changes, like the latest financial results or news.

For JBT Marel, for example, one investor might create a bullish Narrative assuming strong margin expansion and robust recurring revenue, resulting in a fair value above $177 per share. A more cautious peer might emphasize ongoing integration risks and forecast a much lower fair value near $85. Narratives make it simple to compare these perspectives and to see instantly if the current share price offers an opportunity.

Do you think there's more to the story for JBT Marel? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBTM

JBT Marel

Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives