- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

A Look at Howmet Aerospace’s (HWM) Valuation After Upbeat Q3 Results and Raised Growth Guidance

Reviewed by Simply Wall St

Howmet Aerospace (HWM) just posted higher sales and net income for the third quarter, with management boosting their outlook for the rest of the year. They are also signaling growth into 2026, catching investors’ attention.

See our latest analysis for Howmet Aerospace.

The positive momentum around Howmet Aerospace’s third quarter hasn’t gone unnoticed. Its share price is now up over 86% year-to-date. Fuelled by upbeat earnings, fresh buybacks, and new debt refinancing initiatives, momentum has steadily built, reflected in an impressive 82% total shareholder return over the past twelve months and a long-term track record that’s hard to match.

With aerospace activity on the rise, you might want to see what else is happening across the sector. Check out the latest movers and rising stars with our curated aerospace and defense stock screener: See the full list for free.

With shares near record highs after an impressive run, the big question now is whether Howmet Aerospace remains attractively valued, or if the market has fully priced in its run of strong results and higher forecasts.

Most Popular Narrative: 8.4% Undervalued

Howmet Aerospace's fair value estimate stands at $225.50, according to the most widely followed narrative, which is nearly $19 above the most recent closing price. This latest view rests on projected growth in revenue and profitability over the coming years, drawing from current industry trends and internal performance drivers.

Strategic investments in automation and digital manufacturing, combined with cost rationalization and product mix optimization, are driving underlying productivity improvements and gross margin expansion. These factors are supporting robust long-term earnings growth.

Want to know what powers that next-level valuation? This narrative banks on higher profits and relentless optimization. The real surprise lies in how future margins and multi-year earnings upgrades stack up against today's sky-high price tag. Uncover the bold assumptions that make this price target possible.

Result: Fair Value of $225.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on strong aerospace production and potential supply chain disruptions remain key risks. These factors could challenge these optimistic forecasts.

Find out about the key risks to this Howmet Aerospace narrative.

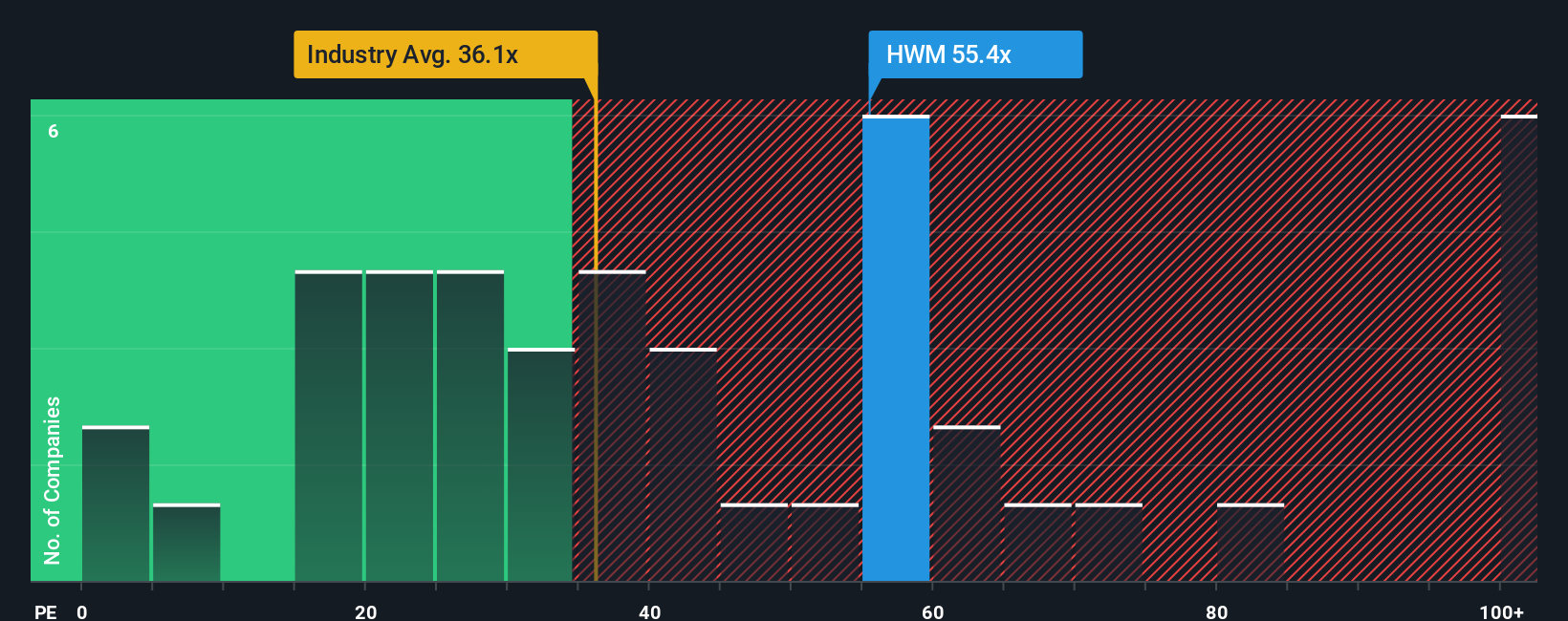

Another View: Multiples Paint a Pricier Picture

Looking from a different angle, Howmet Aerospace’s current price-to-earnings ratio sits notably above both its industry average and what the fair ratio suggests. This points to a premium valuation and highlights the risk that expectations may already be baked into the price. This could leave less room for upside if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If these views do not quite match your own, take a few minutes to dive into the numbers and shape your own story about Howmet Aerospace. It's quick and simple. Do it your way

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don't let today's winners distract you from tomorrow's gains. Broaden your investing vision with handpicked stocks that could be tomorrow's standouts. Act now before others catch on.

- Unlock growth potential by checking out these 874 undervalued stocks based on cash flows trading below their intrinsic value to give you a head start in value investing.

- Capitalize on the booming artificial intelligence field by evaluating these 25 AI penny stocks powering breakthroughs in automation and machine learning.

- Capture steady income streams with these 16 dividend stocks with yields > 3% that historically reward shareholders with reliable, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives