- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

A Look at Huntington Ingalls Industries’s Valuation Following Hyundai Collaboration and Strong Q3 Results

Reviewed by Simply Wall St

Huntington Ingalls Industries, a leader in U.S. defense shipbuilding, just reported third-quarter earnings that surpassed expectations and reaffirmed its outlook for 2025. In addition, the company announced a new collaboration with HD Hyundai Heavy Industries.

See our latest analysis for Huntington Ingalls Industries.

Momentum has been unmistakably building for Huntington Ingalls Industries. The latest strategic collaboration with HD Hyundai Heavy Industries and robust third-quarter results have fueled a 12.6% gain in the past month. This has pushed the year-to-date share price return to an impressive 71.6%. Long-term investors have also benefited, as total shareholder return reached 74.6% over one year and more than doubled over five years. This reflects growing optimism around the company’s strengthening position in defense and shipbuilding.

If you’re interested in where the next breakthroughs in defense and aerospace could come from, take the chance to explore the See the full list for free..

With the stock climbing sharply and results coming in ahead of forecasts, investors are now left to consider whether Huntington Ingalls Industries is still undervalued, or if the recent run-up has already priced in future growth.

Most Popular Narrative: 8.6% Overvalued

The narrative's fair value estimate for Huntington Ingalls Industries falls short of the latest close, raising questions about the market's optimism and what expectations are priced in. Let’s look at the growth drivers behind this call.

The accelerated shift towards autonomous and unmanned maritime systems, highlighted by HII's Mission Technologies segment winning new U.S. Navy orders for uncrewed undersea vehicles and opportunities for 200+ further vehicles, positions HII to benefit disproportionately from expansion in high-growth, technologically advanced defense segments. This supports revenue diversification and potential margin expansion.

What is powering this attention-grabbing premium? The story hinges on a bold bet: future gains will rely on a high-tech pivot, projected margin growth, and big earnings upgrades for years ahead. Want to know exactly what assumptions fuel this ambitious valuation? Find out how much higher analysts expect profits and efficiency levels to climb in the coming years.

Result: Fair Value of $296.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in major contract awards or ongoing labor market challenges could quickly undermine the current optimism and shift expectations for Huntington Ingalls Industries.

Find out about the key risks to this Huntington Ingalls Industries narrative.

Another View: Are Market Multiples Telling a Different Story?

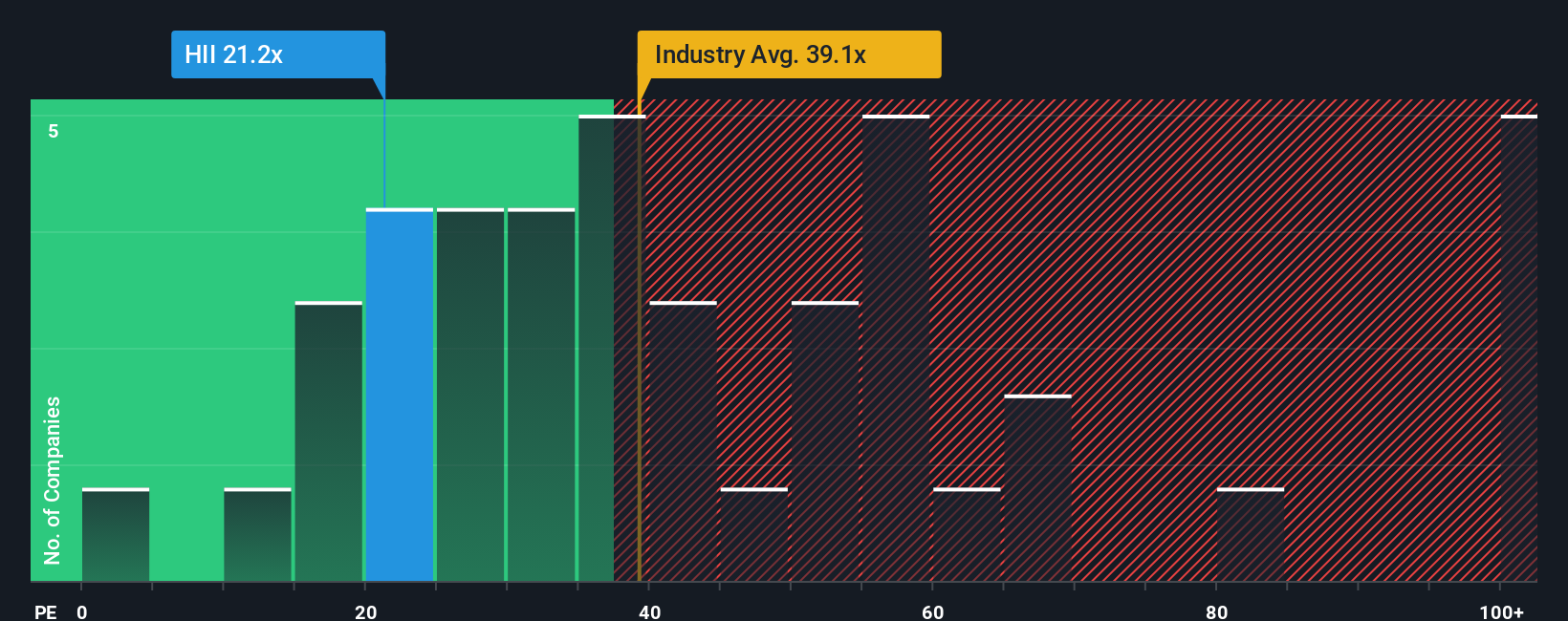

Looking beyond fair value estimates, Huntington Ingalls Industries currently trades at a price-to-earnings ratio of 22.2x. This is noticeably below its industry peers, who average 39.2x, and is also under the fair ratio of 25.9x that the market could gravitate toward. That gap may represent either an overlooked opportunity or a signal that investors are cautious about future risks. What could close this valuation gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Huntington Ingalls Industries Narrative

If you see the story differently or want to dig into the numbers on your own, it’s easy to build your own perspective in just a few minutes. Get started with Do it your way.

A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep fresh opportunities on their radar. Uncover ideas with huge upside and avoid missing out on standout stocks that could impact tomorrow’s markets.

- Unlock powerful income growth as you review top companies delivering steady returns with these 22 dividend stocks with yields > 3% yielding more than 3% annually.

- Spot game-changers in the next wave of artificial intelligence with these 26 AI penny stocks, as they shape technology’s future and disrupt entire industries.

- Catch the market’s biggest bargains by checking out these 831 undervalued stocks based on cash flows, featuring stocks offering real value based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives