- United States

- /

- Building

- /

- NYSE:HAYW

Hayward Holdings (HAYW): Valuation Insights Following Raised 2025 Sales Guidance and Improved Earnings

Reviewed by Simply Wall St

Hayward Holdings (HAYW) just released its third quarter results, showing higher earnings and revenue compared to last year. In addition, the company raised its 2025 full-year sales outlook.

See our latest analysis for Hayward Holdings.

Momentum is quietly picking up for Hayward Holdings, with a strong 8.8% share price return over the past month following higher earnings, revenue growth, and an upbeat sales outlook. Over the longer term, the three-year total shareholder return stands at an impressive 51%, which may hint at growth potential as confidence returns after a slower year.

If you want to see which other companies are attracting fresh interest, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Hayward Holdings is genuinely undervalued after its latest rally, or if all the recent optimism and upgraded outlook are already reflected in the current share price. Could there still be a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 4.7% Undervalued

According to the latest widely followed narrative, Hayward Holdings’ fair value is just above its current closing price, signaling that there may be a modest edge left for buyers. This subtle upside rests on the belief that the company’s growth drivers and margin strengths have not been fully priced in by the market.

Accelerating adoption of connected, automated pool equipment (like the new OmniX platform) increases average equipment content per pool and positions Hayward for higher-margin sales and digital revenue streams. This supports both revenue growth and EBITDA margin improvement. Increasing homeowner focus on enhancing outdoor living spaces, evidenced by resilient demand for aftermarket upgrades and technology-enabled features, expands Hayward's addressable market and supports sustained top-line growth.

Curious what fuels this subtle uptick in value? The full narrative dives into bold projections for market expansion, margin power, and a future profit multiple more typical of fast-growing sectors. Find out which specific financial assumptions are quietly moving the needle. Read on to uncover the story behind the valuation.

Result: Fair Value of $16.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including possible macroeconomic headwinds and increased competition that could pressure Hayward's margins and dampen the company's growth prospects.

Find out about the key risks to this Hayward Holdings narrative.

Another View: Multiples Suggest Caution

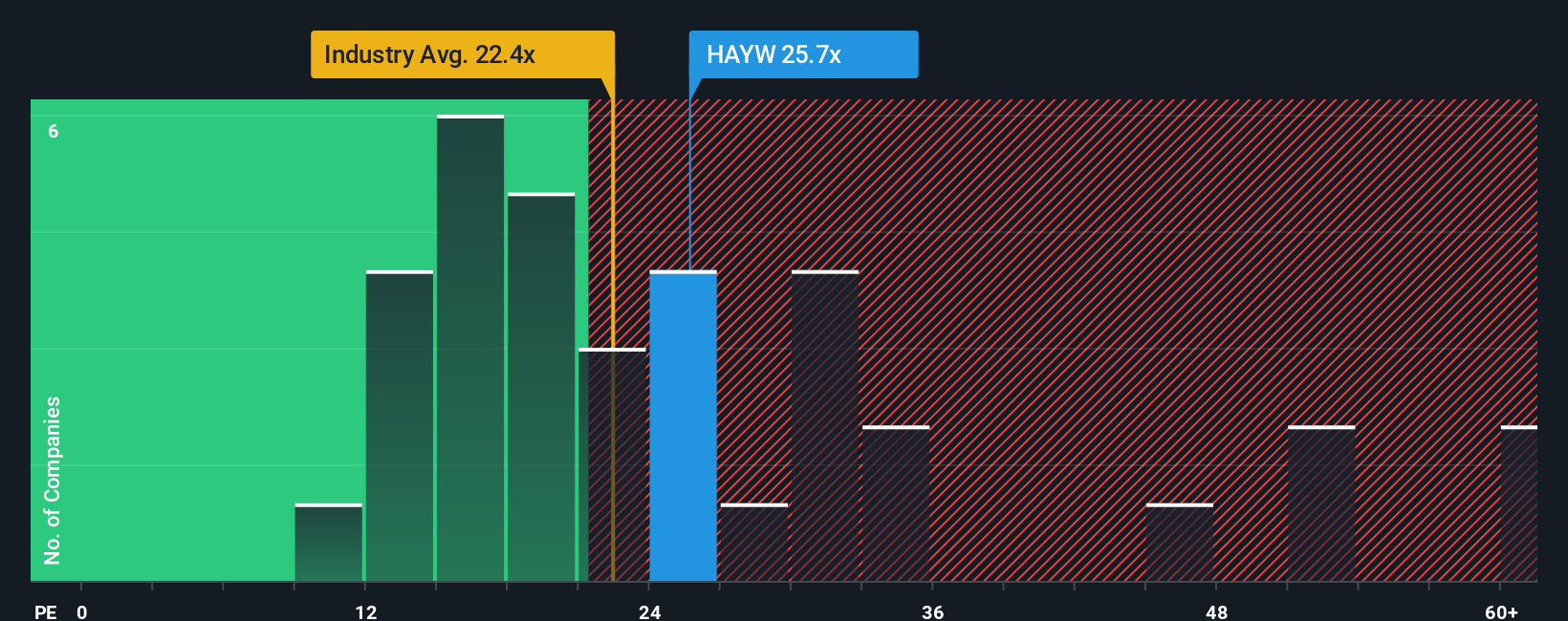

While the narrative leans toward undervaluation, a look at the earnings multiple tells a nuanced story. Hayward Holdings trades at 25.4 times earnings, which is noticeably higher than the industry average of 19.9 and above the fair ratio of 21.9. This suggests the stock is priced more optimistically than peers, leaving less room for error if expectations change. Could the market be overlooking valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hayward Holdings Narrative

If you see the story differently or want to chart your own course, exploring the data and creating a personal narrative only takes a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hayward Holdings.

Looking for more investment ideas?

Stop waiting for opportunities to come to you. Find your next edge by searching stocks with exceptional potential using these focused strategies from Simply Wall Street:

- Capitalize on steady income streams by targeting these 16 dividend stocks with yields > 3% offering yields above 3 percent for powerful compounding.

- Spot emerging tech giants before the crowd by targeting revolutionary breakthroughs through these 25 AI penny stocks on the cutting edge of artificial intelligence.

- Maximize upside by hunting these 865 undervalued stocks based on cash flows, which are identified as undervalued based on future cash flows and financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives