- United States

- /

- Trade Distributors

- /

- NYSE:GWW

Where Does Grainger Stand After Recent Pullback and Strong Cash Flow Outlook?

Reviewed by Simply Wall St

If you are wrestling with what to do about W.W. Grainger stock right now, you are not alone. Investors have watched Grainger’s shares move sideways and then downward lately, with the price dropping slightly over the past month and a pullback of over 7% in the last 90 days. Yet, when viewed from a longer-term perspective, the story brightens. The stock has delivered a solid 2.6% total return over the past year and has more than doubled over five years. Clearly, this is not a sleepy industrial name left behind by the market.

So, what is really driving these price moves? Part of it comes from the broader market’s shifting perceptions of risk and reward in industrial supply chains, especially as the economy keeps investors guessing. Grainger appears to have handled short-term headwinds better than some of its peers, but there has still been a degree of discounting lately. In fact, Grainger shares closed most recently at $994.07, about 5% below the average analyst price target. This suggests some room for upside if analysts are correct.

Still, valuation remains a sticking point for many. Using our six-point checklist for undervalued stocks, Grainger passes just one of the six, giving it a value score of 1 and raising questions about how “cheap” it really is today. Next, let’s break down each of these valuation checks and see what story the numbers are telling, or whether traditional approaches provide the full picture. Keep reading to discover an even more insightful angle on Grainger’s true value at the end of the article.

W.W. Grainger delivered 2.6% returns over the last year. See how this stacks up to the rest of the Trade Distributors industry.Approach 1: W.W. Grainger Cash Flows

A Discounted Cash Flow (DCF) model looks ahead at what a company is expected to generate in free cash over the coming years and then calculates what that future stream of cash is worth in today’s dollars. This method aims to pinpoint an investment’s “intrinsic” value by evaluating its real ability to generate money over time.

For W.W. Grainger, the most recent trailing twelve-month Free Cash Flow stands at $1.58 billion. Analysts expect this figure to grow over the years, with projections reaching $2.82 billion by 2035. By 2029, estimates put Grainger’s Free Cash Flow at $2.2 billion, reflecting solid growth expectations for a mature industrial distributor.

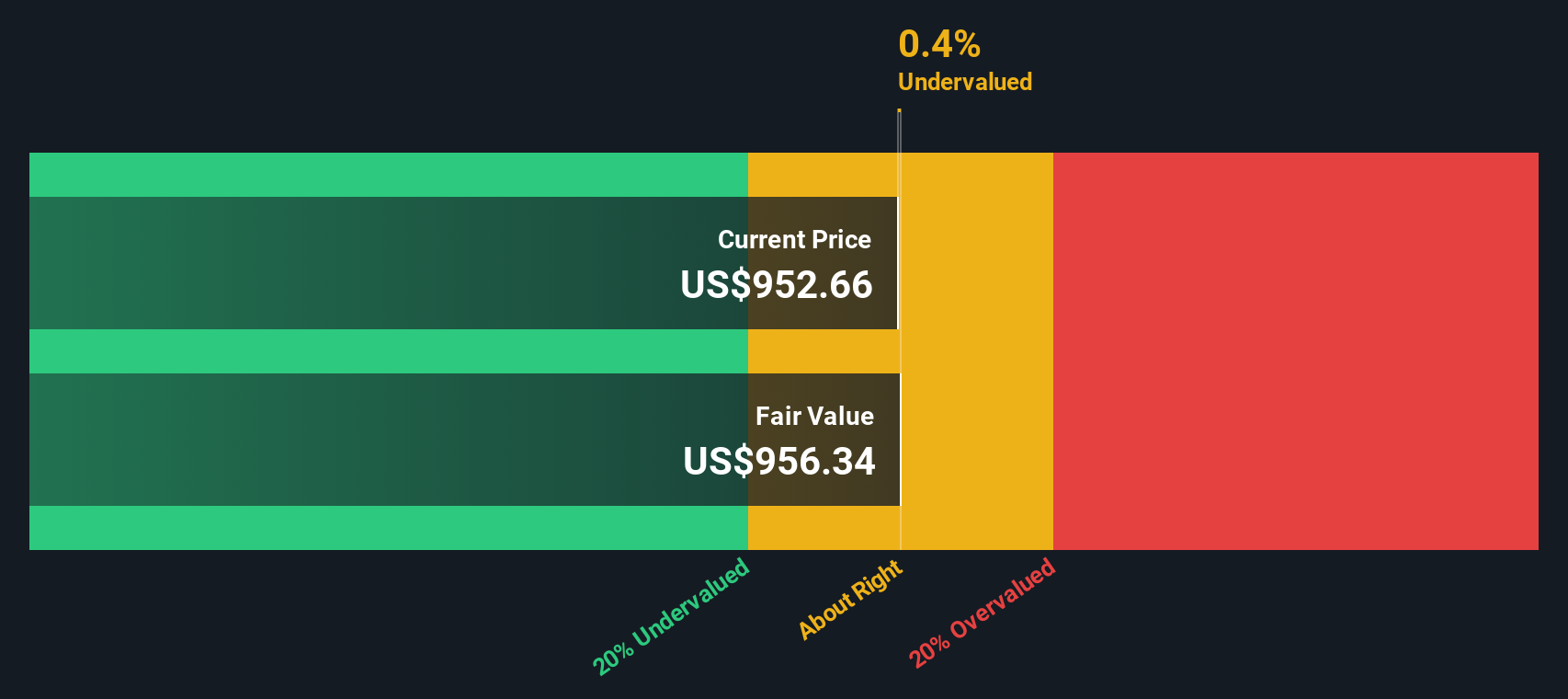

Using these projections in a two-stage model, the calculated intrinsic value of Grainger shares comes out to $899. This is roughly 10.6% above the current market price, indicating the shares are actually overvalued by this measure rather than cheap.

Result: ABOUT RIGHT

Approach 2: W.W. Grainger Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like W.W. Grainger because it links a company’s market price directly to its actual earnings. This makes the PE ratio especially relevant for investors seeking to assess whether they are paying a reasonable amount for each dollar of profit the business produces.

What constitutes a “normal” PE ratio can vary depending on expectations for future growth and the risks associated with that growth. Companies with higher anticipated growth rates or lower risks typically command higher PE multiples, while slower-growing or riskier firms tend to trade at lower ratios.

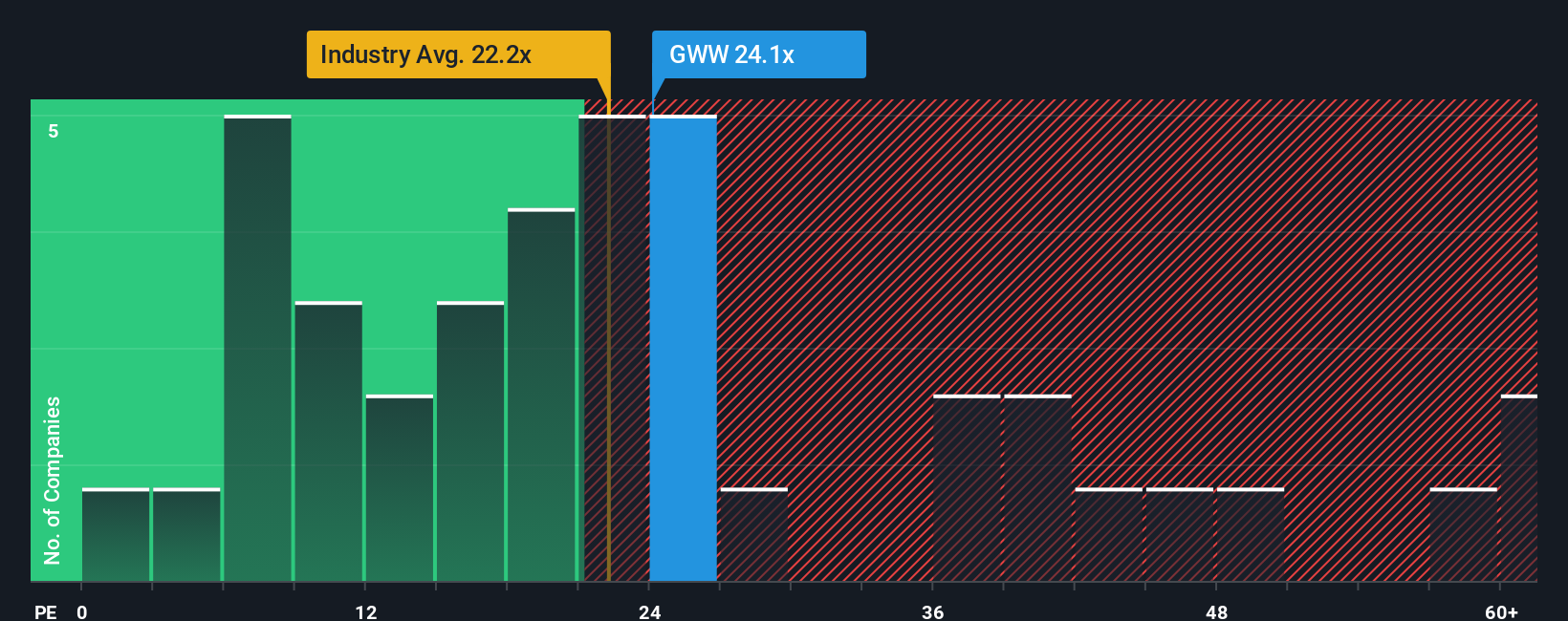

Currently, W.W. Grainger trades at a PE ratio of 24.7x. This is close to its peer average of 25.8x and is slightly above the Trade Distributors industry average of 22.2x. For added context, Simply Wall St’s proprietary Fair Ratio for Grainger is 24.3x, which considers the company’s size, earnings quality, growth outlook, and broader industry conditions.

This analysis suggests that Grainger’s shares are trading almost exactly in line with the Fair Ratio. This indicates that the current market price accurately reflects Grainger’s financial profile and prospects, rather than suggesting the shares are undervalued or trading at an excessive premium.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose Your W.W. Grainger Narrative

While traditional valuation methods focus on crunching numbers, a Narrative is the story that connects what you believe about a company’s future to your own financial forecast and an estimated fair value. Narratives allow you to summarize your perspective, such as how you see W.W. Grainger’s market position, potential challenges, and expected growth, and turn it into quantitative expectations for future earnings, revenue, and profit margins.

On Simply Wall St, Narratives make investing simpler and more human by linking millions of investors’ stories to up-to-date numbers. This allows you to compare what you believe to current market prices. You use your Narrative assumptions to estimate what the shares are really worth and see the gap between your Fair Value and today’s Price to help decide whether to buy or sell. As news, earnings, or economic trends change, Narratives update automatically, guiding your decisions in real time.

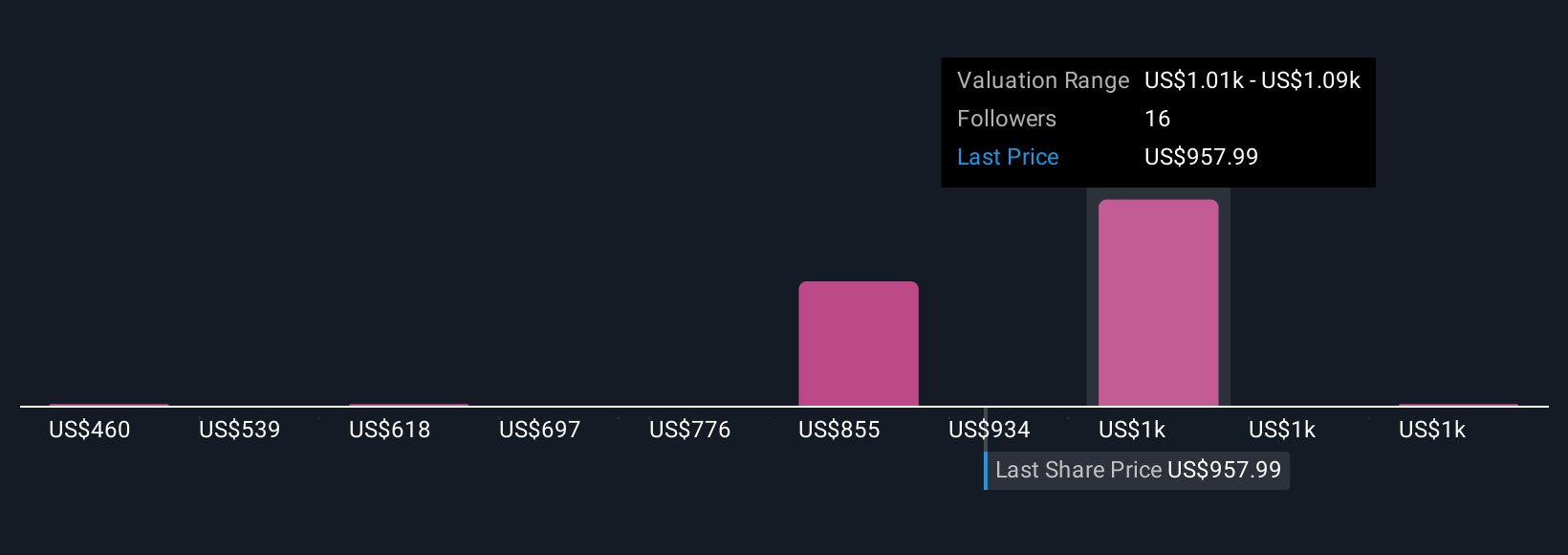

For instance, one investor might see Grainger’s enduring infrastructure role and digital transformation as reasons to set a fair value near $1,213. A more cautious view emphasizing margin headwinds or supply chain risks could put fair value closer to $930. Narratives help you decide which story matches your outlook so you can invest with clarity and confidence.

Do you think there's more to the story for W.W. Grainger? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives