- United States

- /

- Machinery

- /

- NYSE:GTES

Earnings Beat, Cautious Outlook, and Buybacks Might Change the Case for Investing in Gates Industrial (GTES)

Reviewed by Sasha Jovanovic

- Gates Industrial Corporation plc reported third quarter 2025 results in the past week, with sales reaching US$855.7 million and net income rising to US$81.6 million compared to a year ago, while also announcing a new share repurchase program of up to US$300 million and narrowing its 2025 full-year core revenue growth guidance amid subdued macroeconomic conditions.

- Although the company surpassed earnings expectations, management attributed the more cautious outlook to ongoing weakness in industrial and agriculture demand, and indicated continued restructuring including factory closures to offset challenging market pressures.

- We'll examine how the lowered 2025 revenue guidance and management's market caution may reshape Gates Industrial's investment narrative going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Gates Industrial Investment Narrative Recap

To be a shareholder in Gates Industrial, you need to believe the company’s push into higher-growth end markets such as data centers and personal mobility can offset persistent industry headwinds. The recent reduction in revenue guidance reflects the continued challenge facing industrial OEM and agriculture markets, but this does not materially alter the company’s position that margin improvement and new applications remain key short-term catalysts. The greatest risk appears to be sustained weakness in the company’s core legacy channels.

Among the latest announcements, the new US$300 million share repurchase program stands out. Although repurchases can be a sign of confidence and support earnings per share, the decision arrives at a time when management is laser-focused on restructuring activities and margin improvements, both priorities made more urgent by the muted demand environment and narrowed growth expectations.

By contrast, investors should be aware of the ongoing pressure from sluggish industrial end markets, which could...

Read the full narrative on Gates Industrial (it's free!)

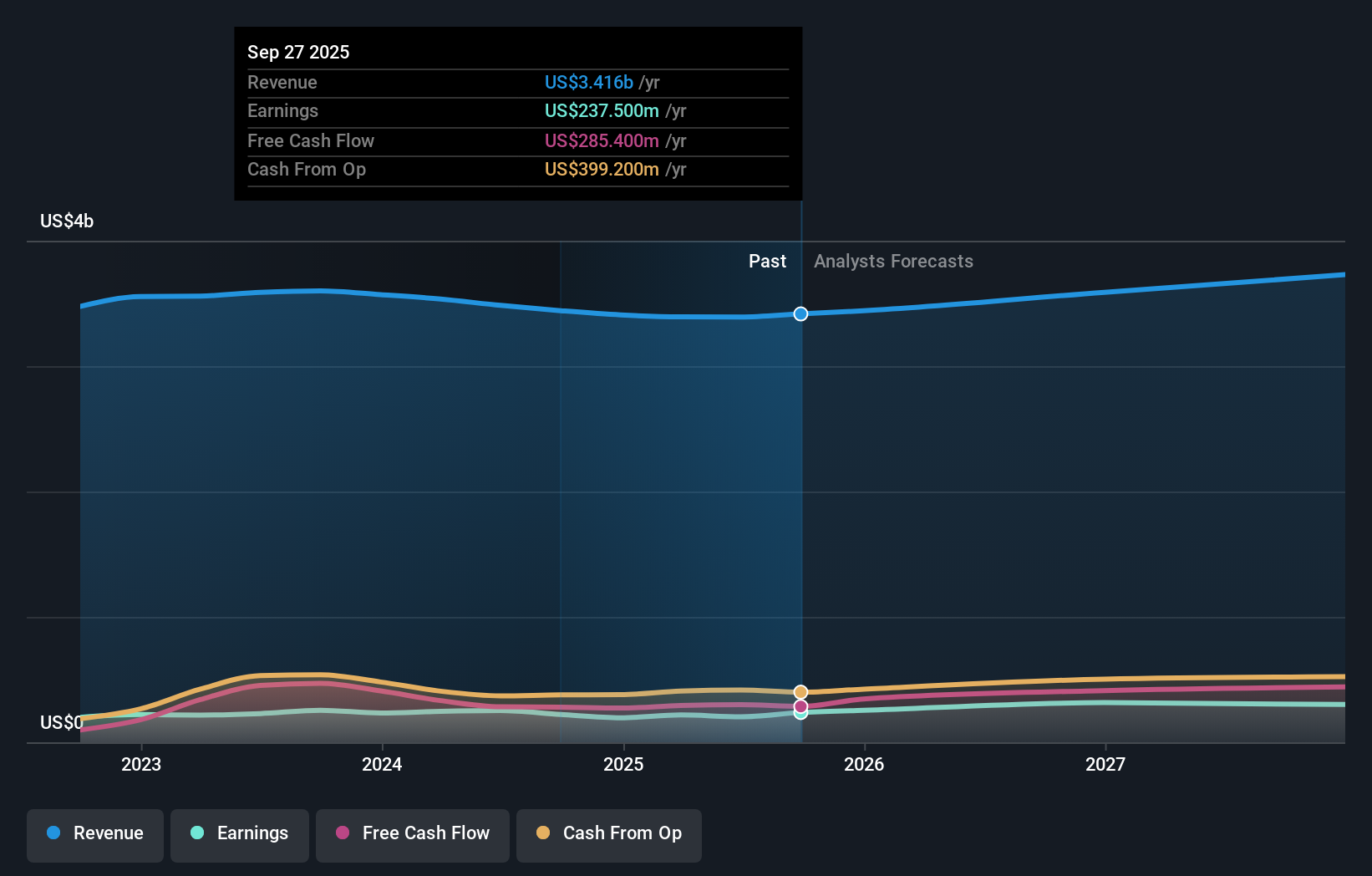

Gates Industrial's narrative projects $3.8 billion revenue and $395.4 million earnings by 2028. This requires 4.2% yearly revenue growth and a $191.9 million earnings increase from $203.5 million today.

Uncover how Gates Industrial's forecasts yield a $29.18 fair value, a 32% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community fair value estimates for Gates Industrial show just one view at US$29.18 per share, offering little range or diversity. With management narrowing revenue guidance this quarter due to softer industrial demand, you might find it useful to compare more alternative perspectives on what drives the business.

Explore another fair value estimate on Gates Industrial - why the stock might be worth as much as 32% more than the current price!

Build Your Own Gates Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gates Industrial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gates Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gates Industrial's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTES

Gates Industrial

Manufactures and sells engineered power transmission and fluid power solutions worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives