- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Eve Holding (EVEX): Assessing Valuation After Recent 24% Share Price Jump

Reviewed by Kshitija Bhandaru

Eve Holding (NYSE:EVEX) shares have shifted notably over the past month, gaining 24%. While the company has not released any major news recently, this move has investors taking a closer look at its stock performance and fundamentals.

See our latest analysis for Eve Holding.

Momentum has picked up for Eve Holding lately, with a sharp 1-month share price return of 23.6% that stands out against a more turbulent year. Despite some volatility, including a year-to-date share price fall of 14.2%, the company has delivered a 1-year total shareholder return of 36.6%. This hints at renewed optimism around its long-term vision.

If shifting sentiment in Eve Holding has piqued your interest, it could be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With such gains and notable price targets on the table, the question for investors is clear: is Eve Holding trading at a discount to its true potential, or has the market already factored in its anticipated growth?

Price-to-Book Ratio of 118x: Is it justified?

At a price-to-book ratio of 118 times, Eve Holding looks exceptionally expensive compared to both its peers and the broader Aerospace and Defense industry. With a last close of $4.55, this valuation stands out as one of the highest in the space.

The price-to-book ratio compares a company's market value to its book value, serving as a yardstick for how much investors are willing to pay for each dollar of net assets. In sectors like Aerospace and Defense, where capital intensity and asset values play a key role, this metric can signal overenthusiasm or skepticism around future profitability.

For Eve Holding, the company's multiple is far above the US industry average of 3.6x and also dwarfs the peer average of 3.5x. This stark difference signals that the market is assigning a hefty premium to Eve Holding’s assets, perhaps in anticipation of rapid future revenue growth or unique technology, though current fundamentals do not support such a spread.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 118x (OVERVALUED)

However, Eve Holding's ongoing losses and lack of reported revenue remain key risks that could challenge the current optimism around its valuation.

Find out about the key risks to this Eve Holding narrative.

Another View: Discounted Cash Flow Offers a Different Angle

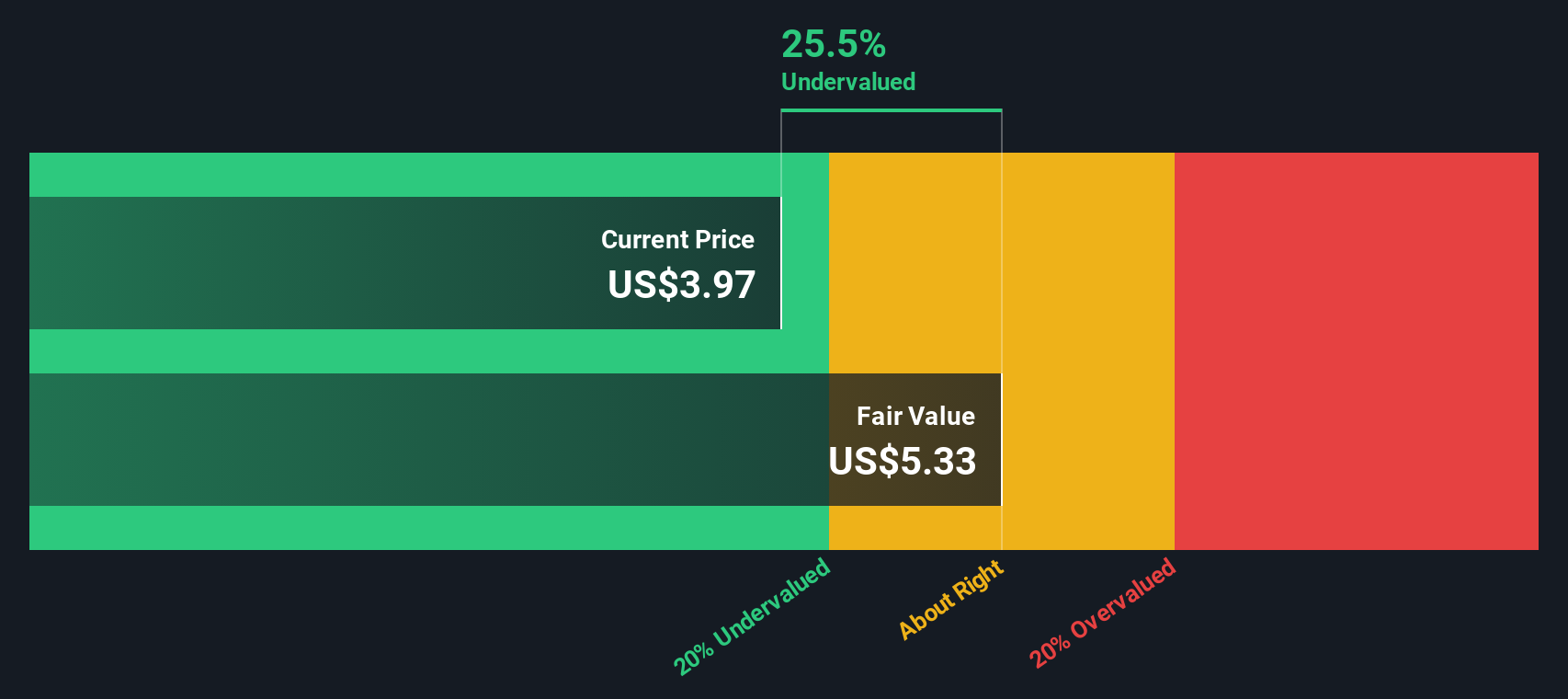

While the price-to-book ratio signals Eve Holding is overvalued compared to industry and peers, our DCF model estimates the stock is actually trading about 14.6% below its fair value. Could forward-looking cash flows be telling a more optimistic story than traditional multiples suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eve Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eve Holding Narrative

If you have a different perspective or prefer to dig into the facts for yourself, you can put together your own take in just a few minutes, Do it your way

A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your opportunity set with smart, tailored stock picks. The Simply Wall Street Screener uncovers investments others miss, so you never fall behind or overlook promising opportunities.

- Unlock the potential of tech-driven medicine by reviewing these 32 healthcare AI stocks which is poised to transform healthcare with advanced diagnostics and real-world AI applications.

- Boost your portfolio's passive income by targeting these 19 dividend stocks with yields > 3% that offers reliable yields above 3% and the potential for steady financial growth.

- Get ahead of the curve with these 79 cryptocurrency and blockchain stocks at the forefront of blockchain innovation and the evolving world of digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet and fair value.

Market Insights

Community Narratives