- United States

- /

- Construction

- /

- NYSE:DY

A Valuation Check on Dycom Industries (DY) Following Strategic New Board Appointment

Reviewed by Simply Wall St

Dycom Industries (DY) has added Stephen O. LeClair to its Board of Directors, drawing on his years of executive experience at Core & Main and HD Supply. Investors are watching to see how this board appointment shapes future strategy.

See our latest analysis for Dycom Industries.

Dycom’s share price has soared 62% so far in 2025, building on impressive momentum that has fueled a 48% total return for shareholders over the past year, and an outstanding 184% over three years. This surge suggests rising confidence in the company’s prospects, with recent board changes and ongoing performance updates keeping investor interest high.

If you want to spot the next standout performer, now is an excellent time to explore fast growing stocks with high insider ownership.

With the stock already rallying so strongly this year, the question now is whether investors are overlooking hidden value, or if Dycom’s share price has already accounted for all of its future growth potential.

Most Popular Narrative: 7.1% Undervalued

With Dycom's fair value consensus at $308.44 per share, about 7% above its last close, analysts are leaning bullish, built on expectations of multi-year growth and consistent operator demand. The narrative’s numbers stand out, hinting at sector tailwinds and major contract wins fueling the outlook.

The accelerating buildout of fiber-to-the-home and data center connectivity, driven by surging AI workloads and hyperscaler investments, is creating multi-year, visibility-rich opportunities for Dycom. This is expected to support robust backlog growth and sustained double-digit revenue expansion as these build cycles ramp into 2027 and beyond.

Want to know the bold forecasts that justify this premium? The most-followed narrative bases its target on a powerful mix of relentless revenue momentum and margin breakthroughs. Curious if future earnings targets are as aggressive as they sound? Unlock the full narrative to see which financial leaps drive this valuation.

Result: Fair Value of $308.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Dycom's reliance on major telecom clients and potential regulatory or project delays could challenge the bullish outlook if conditions change.

Find out about the key risks to this Dycom Industries narrative.

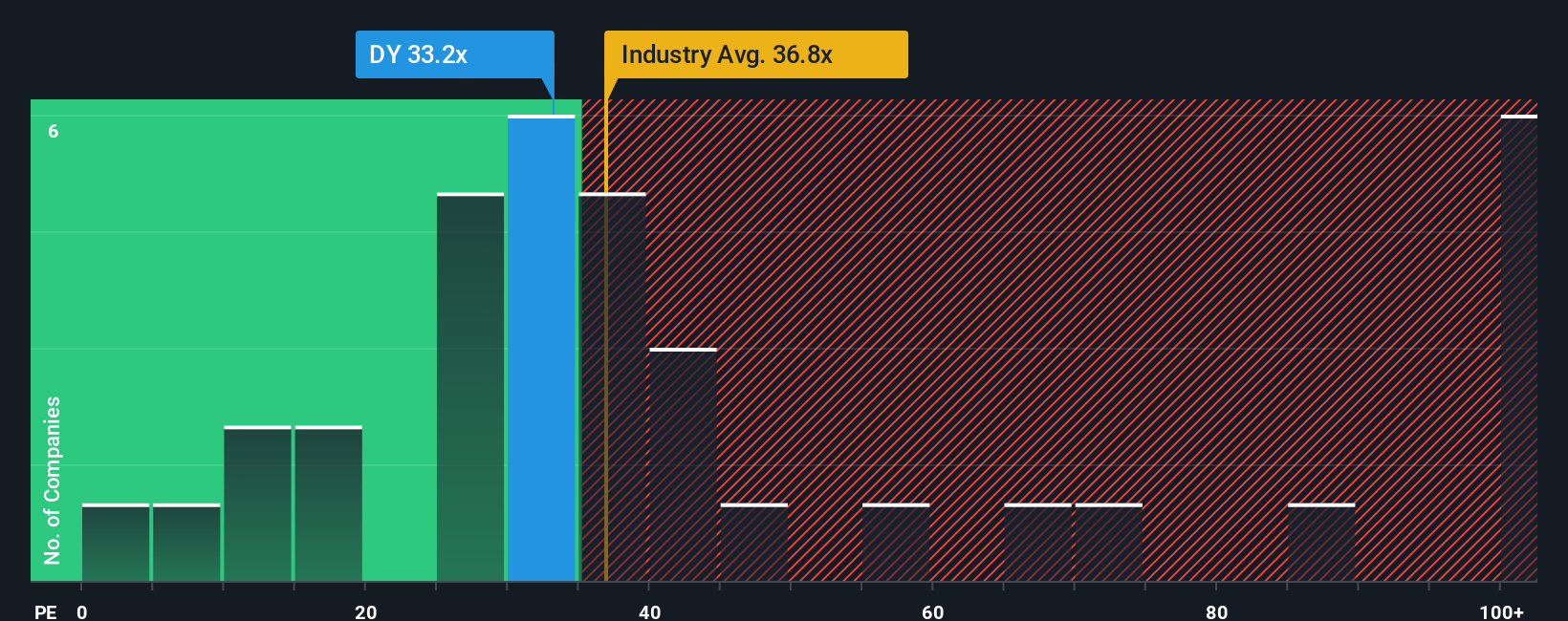

Another View: The Market Multiple Test

Taking a closer look at Dycom’s pricing through the lens of the market’s favored price-to-earnings ratio reveals a more complicated story. With Dycom trading at 31.8x earnings, it looks expensive compared to its peers at 22.7x and even sits higher than the fair ratio of 29x. This gap suggests investors might be paying up for recent strength. Could the optimism already be priced in, or is there more room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dycom Industries Narrative

If you have a different view or want to dive deeper into the numbers, you can shape your own Dycom story in just a few minutes. Do it your way.

A great starting point for your Dycom Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not let a hot market pass you by. If you want to stay ahead, scan the market for opportunities that others are missing using the Simply Wall Street Screener. Now is an ideal moment to spot leaders in tomorrow’s growth sectors.

- Capitalize on the surging momentum in digital assets by checking out these 82 cryptocurrency and blockchain stocks which is making waves in blockchain innovation and secure payment systems.

- Uncover robust income by evaluating these 100+ dividend stocks with yields > 3% that consistently deliver attractive, sustainable yields above 3%.

- Target rapid growth stories in cutting-edge automation and smart technology with these 100+ AI penny stocks which are redefining what is possible in today’s world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DY

Dycom Industries

Provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives