- United States

- /

- Machinery

- /

- NYSE:DE

Deere’s North American Demand Uncertainties Raise New Questions About Its Long-Term Vision (DE)

Reviewed by Sasha Jovanovic

- In recent days, Deere has faced analyst estimate revisions and management updates highlighting ongoing uncertainties in North American agriculture demand, as well as concerns around equipment order delays and macroeconomic pressures affecting its Production & Precision Agriculture and Small Agriculture & Turf segments.

- Despite mixed outlooks and lowered earnings expectations, Deere's management has pointed to a broad range of potential outcomes for 2026, signaling both risks and resilience as the company navigates evolving market conditions.

- We’ll assess how this renewed management caution around North American agriculture demand influences Deere’s investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Deere Investment Narrative Recap

To own Deere as a shareholder, you have to believe in its ability to weather cycles in North American agriculture and unlock long-term value from precision ag technology, regardless of short-term volatility. The latest analyst estimate cuts and management's cautious outlook do temper near-term optimism, but do not materially impact the company's biggest catalyst: boosting technology adoption and recurring revenue. North America's demand slump, marked by lower equipment sales and order delays, remains the clearest risk for earnings in the months ahead.

Among recent announcements, the launch of Operations Center PRO Service stands out for its link to Deere’s push for higher-value, tech-enabled offerings. This digital tool enhances equipment management for operators and could play a key role as Deere leans on software and data services to offset cyclic soft spots, an important thread to monitor as management reiterates cost discipline and technology investment as levers to meet their wide range of outlooks for 2026.

In contrast, what investors might not be expecting is the risk that sustained end-market weakness in North America...

Read the full narrative on Deere (it's free!)

Deere's outlook anticipates $45.1 billion in revenue and $8.6 billion in earnings by 2028. This assumes a 0.7% annual revenue decline and a $3.4 billion increase in earnings from the current $5.2 billion level.

Uncover how Deere's forecasts yield a $524.95 fair value, a 12% upside to its current price.

Exploring Other Perspectives

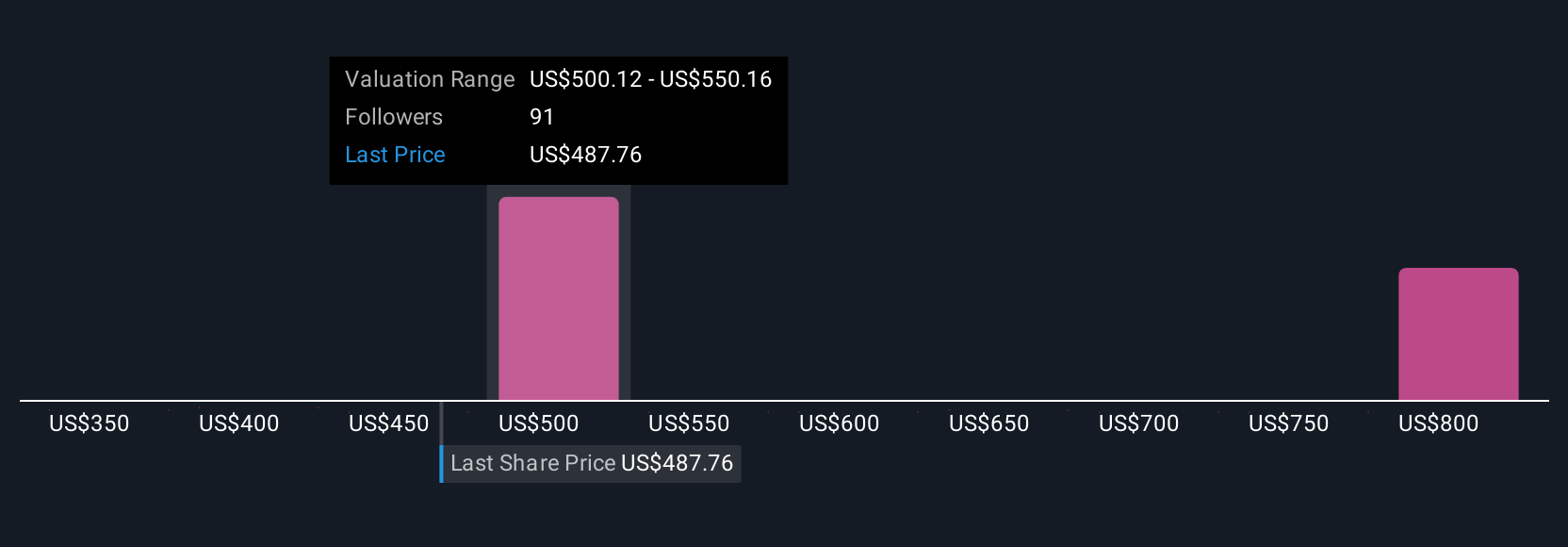

Six Community estimates for Deere's fair value range from US$430 to US$819, with multiple buckets above US$600. While opinions differ widely, order delays and softer North American agriculture demand remain central to near-term performance, reminding you to explore these alternative viewpoints and assess the wider impact for yourself.

Explore 6 other fair value estimates on Deere - why the stock might be worth 8% less than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives