- United States

- /

- Electrical

- /

- NYSE:BW

Babcock & Wilcox Enterprises (BW) Is Up 55.4% After Securing US$1.5 Billion AI Data Center Power Deal – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Babcock & Wilcox Enterprises recently announced a series of major developments, including a more than US$1.5 billion agreement with Applied Digital to design and install gigawatt-scale natural gas power plants tailored for AI Data Center infrastructure, along with the planned redemption of all outstanding 8.125% Senior Notes due 2026.

- These initiatives point to an acceleration of Babcock & Wilcox's expansion into advanced energy markets, emphasizing its role in powering emerging high-demand sectors and managing its capital structure.

- We’ll explore how Babcock & Wilcox’s entrance into AI Data Center power supply could reshape the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Babcock & Wilcox Enterprises' Investment Narrative?

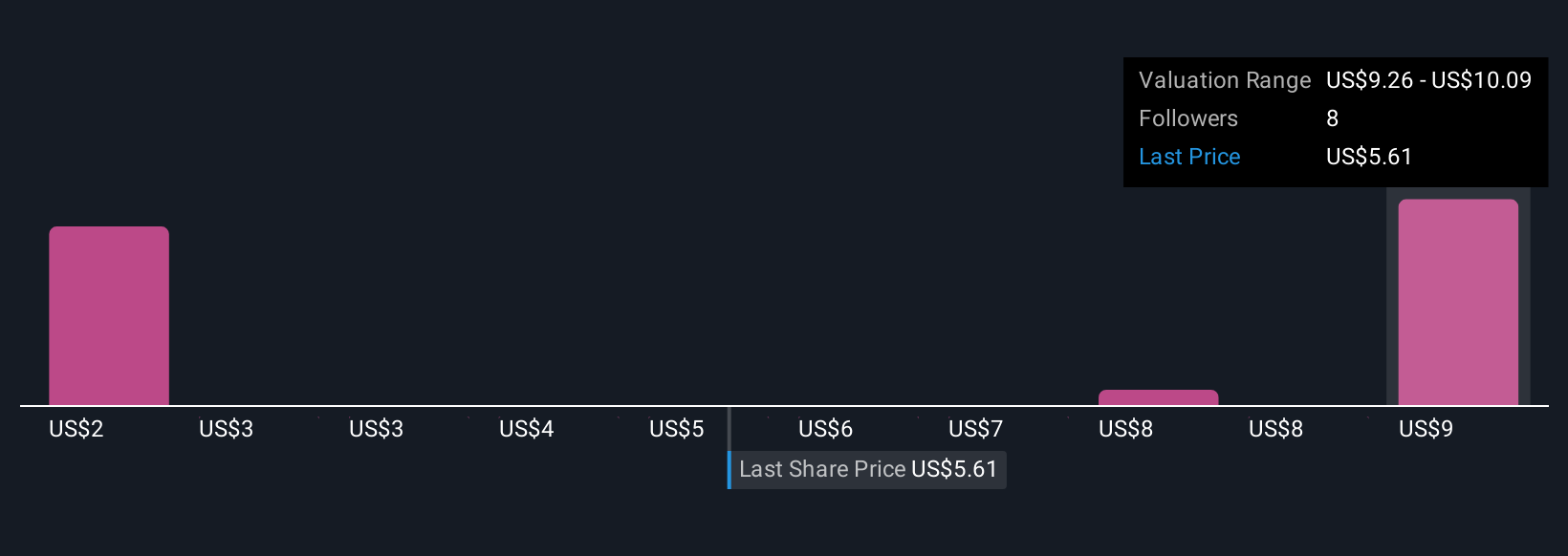

For anyone considering Babcock & Wilcox Enterprises, the investment case now pivots to a belief in its ability to transform momentum in advanced energy projects into sustained financial stability. The news of a US$1.5 billion agreement to build gigawatt-scale natural gas plants for AI data centers is a clear signal of the company's aggressive push to secure growth in the high-demand digital infrastructure sector. Alongside this, management’s decision to redeem all remaining 8.125% Senior Notes due 2026 demonstrates an effort to improve the balance sheet and manage debt risk. While these catalysts offer a fresh narrative and have driven very large short-term share price gains, they also raise the stakes on execution, especially given lingering concerns over cash runway, ongoing losses, and past share price volatility. Whether this shift decreases or magnifies risk depends largely on the company's ability to convert contract wins into real earnings, a question many are likely still weighing.

But with big contracts come bigger questions about sustained profitability, an angle investors shouldn’t ignore.

Exploring Other Perspectives

Explore 4 other fair value estimates on Babcock & Wilcox Enterprises - why the stock might be worth as much as 73% more than the current price!

Build Your Own Babcock & Wilcox Enterprises Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Babcock & Wilcox Enterprises research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Babcock & Wilcox Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Babcock & Wilcox Enterprises' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Babcock & Wilcox Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BW

Babcock & Wilcox Enterprises

Provides energy and emissions control solutions to industrial, electrical utility, municipal, and other customers in the United States, Canada, the United Kingdom, Indonesia, and Philippines.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives