- United States

- /

- Industrials

- /

- NYSE:BBUC

Brookfield Business (NYSE:BBUC) Valuation in Focus After Major Corporate Simplification and Earnings Update

Reviewed by Simply Wall St

Brookfield Business (NYSE:BBUC) just announced plans to convert into a single listed corporation, aiming to boost trading liquidity and unlock greater interest in its shares. This reorganization comes as the company updates the market with its latest earnings results and ongoing acquisition efforts.

See our latest analysis for Brookfield Business.

Brookfield Business’s announcement of a corporate simplification comes amid a period of high volatility for its stock. Despite a sharp drop in the share price over the past week, with a 14.4% seven-day decline, long-term momentum remains: the year-to-date share price return is an impressive 27.8% and the three-year total shareholder return stands at 31.3%. Investors are reacting to both near-term operational challenges and the company’s ongoing efforts to streamline its structure and strengthen its financial position.

If recent news on corporate streamlining got your attention, it could be the perfect cue to broaden your investing scope and discover fast growing stocks with high insider ownership

With shares trading well below intrinsic value based on recent calculations, yet facing ongoing losses and economic uncertainty, investors have to wonder: Is this a rare buying opportunity, or are markets already pricing in future growth?

Price-to-Sales of 0.3x: Is it justified?

Brookfield Business is trading at a price-to-sales (P/S) ratio of 0.3x, which is notably below its peers and sector benchmarks. With the last close price at $31.22, this low multiple suggests that the market may be overlooking revenue potential relative to similar companies.

The price-to-sales ratio compares a company's market capitalization to its total revenue, offering a way to gauge how much investors are willing to pay for every dollar of sales. This is especially relevant for unprofitable firms, where earnings-based multiples provide little insight.

Brookfield Business’s low P/S ratio indicates shares are valued lower than the broader Global Industrials industry average of 0.8x and direct peers at 0.6x. Such a sizeable gap could signal untapped value if revenues are stable or set to grow.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.3x (UNDERVALUED)

However, with persistent net losses and uncertainty about sustainable revenue growth, investors should note that these risks could challenge the undervaluation thesis for Brookfield Business.

Find out about the key risks to this Brookfield Business narrative.

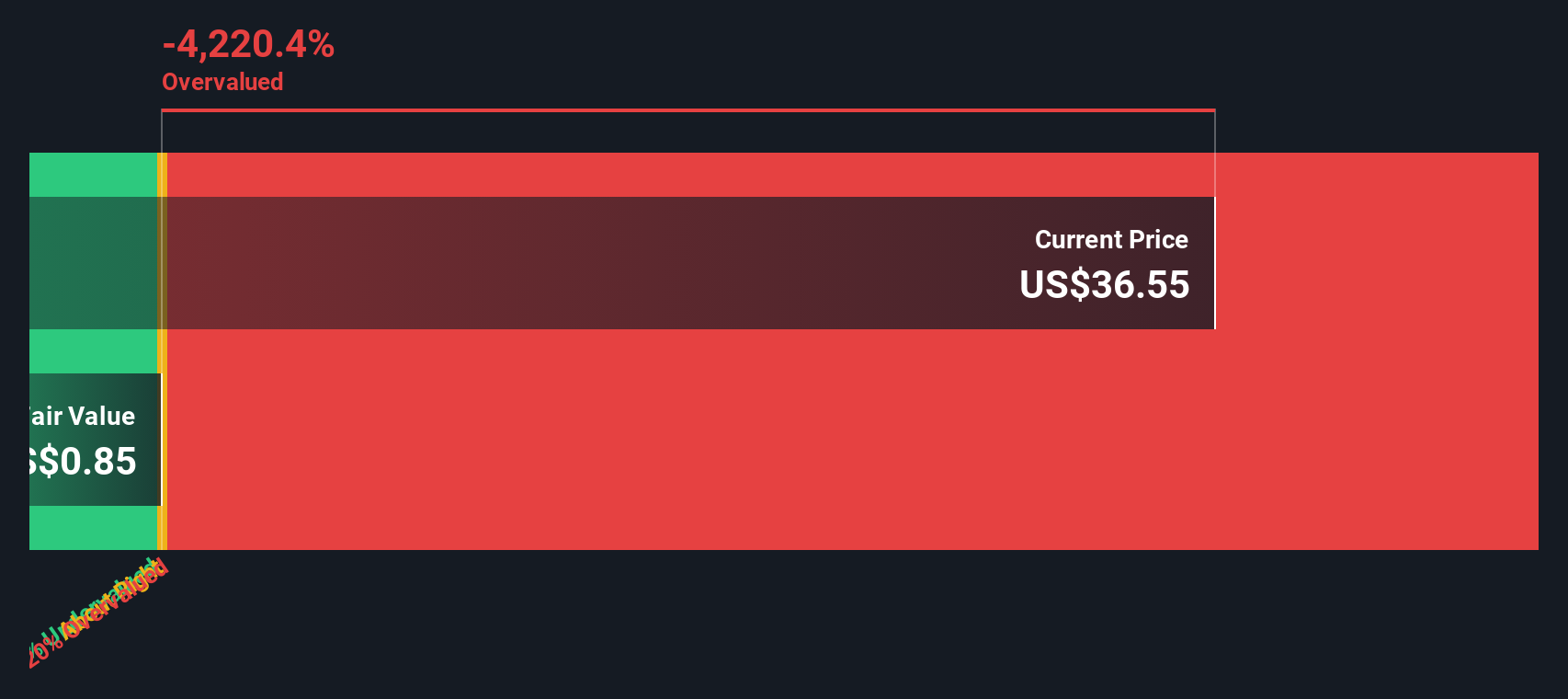

Another View: Discounted Cash Flow Says Shares May Be Overvalued

While the price-to-sales ratio paints Brookfield Business as undervalued compared to peers, our DCF model tells a different story. Based on forecasted cash flows, Brookfield shares are actually trading well above our estimate of fair value at $0.82. Can these contrasting signals help investors find the truth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Business for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Business Narrative

If you see things differently or prefer personal analysis, you can easily dive into the data and shape your own story in just a few minutes, then Do it your way

A great starting point for your Brookfield Business research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss your chance to stay ahead of the market. These three hand-picked opportunities could help you spot tomorrow’s outliers with just a few clicks.

- Unlock potential for steady income, and browse rising stars with generous yields by starting your research with these 16 dividend stocks with yields > 3%.

- Access a curated selection of affordable growth candidates and get a head start on value investing through these 870 undervalued stocks based on cash flows.

- Capitalize on advancements in healthcare technology, and see which businesses are redefining medicine with these 32 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United States, Australia, Brazil, the United Kingdom, and internationally.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives