- United States

- /

- Industrials

- /

- NYSE:BBU

Is Brookfield Business Partners' (BBU) Sharp Drop in Sales Changing Its Investment Case?

Reviewed by Sasha Jovanovic

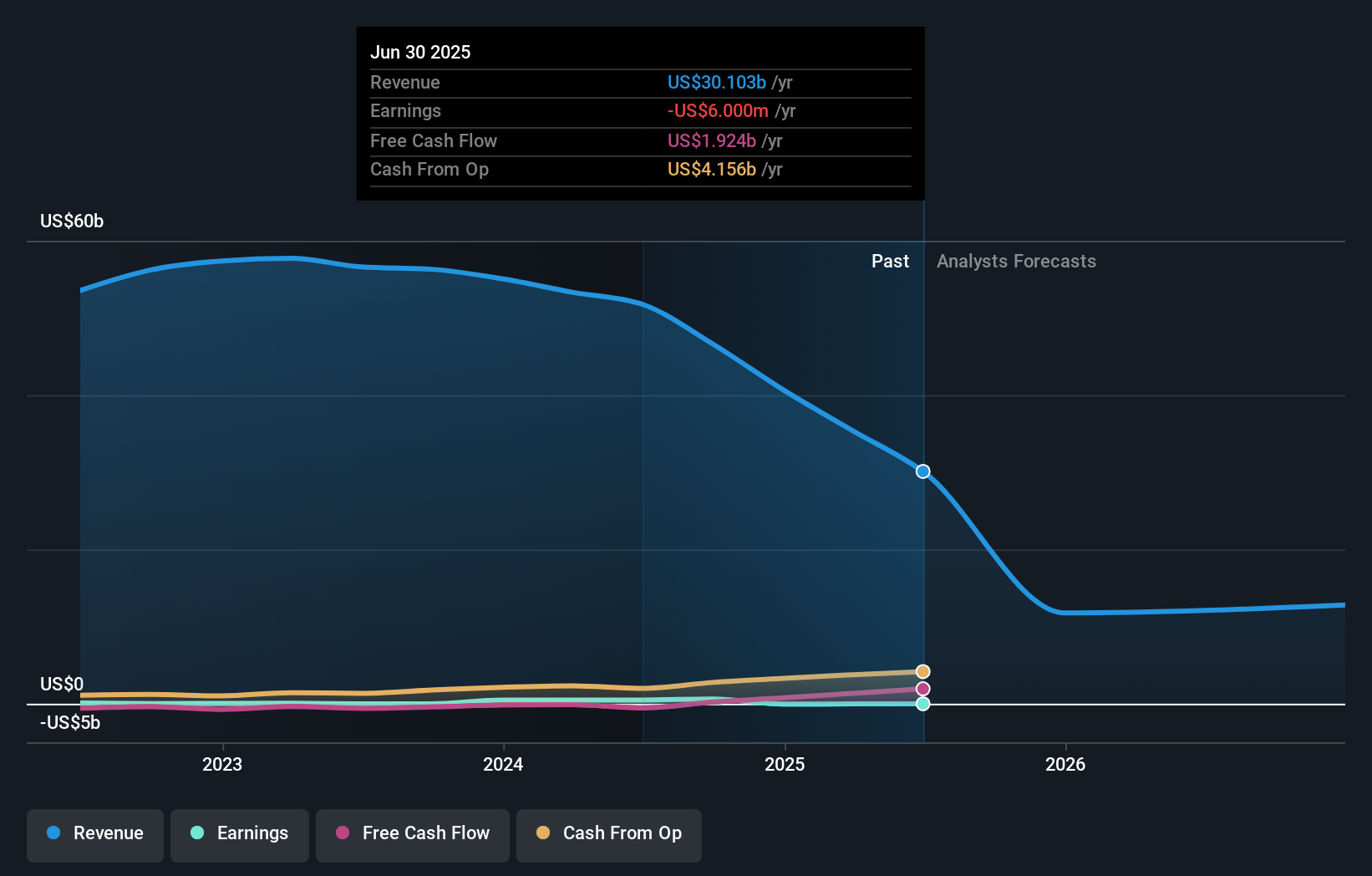

- Brookfield Business Partners L.P. recently reported third-quarter earnings, revealing sales of US$6.92 billion and a net loss of US$25 million, compared to US$9.23 billion in sales and US$103 million in net income a year earlier.

- This shift from profitability to loss, alongside a sizable year-over-year decline in revenue, points to challenges impacting the company’s underlying operations.

- We’ll examine how the significant drop in quarterly sales may impact Brookfield Business Partners’ overall investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Brookfield Business Partners' Investment Narrative?

The bigger-picture investment case for Brookfield Business Partners centers on its ability to generate value through active management, restructuring, and strategic divestitures of businesses worldwide. To stay invested, shareholders need confidence that management can successfully execute turnaround opportunities and unlock value from its portfolio, especially during periods of operational volatility. The just-reported quarterly results, with both a pronounced sales decline and a swing from profit to loss, now pose questions about whether short-term pressures could delay or derail anticipated catalysts, like the sale of the La Trobe Financial Services unit, which had been viewed as a key near-term driver. These results could also heighten existing risks related to profitability and cash flow, given Brookfield’s ongoing commitment to dividends and share buybacks. Whether these headwinds materially alter the investment thesis will depend on the company’s progress in stabilizing revenues and delivering on upcoming asset sales, especially as the market assesses if the latest earnings miss signals a more persistent issue or a temporary setback.

But, if revenue weakness proves persistent, there may be pressure on cash returns and future asset values. Despite retreating, Brookfield Business Partners' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business Partners - why the stock might be worth over 3x more than the current price!

Build Your Own Brookfield Business Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brookfield Business Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business Partners' overall financial health at a glance.

No Opportunity In Brookfield Business Partners?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Community Narratives