- United States

- /

- Industrials

- /

- NYSE:BBU

Brookfield Business Partners (NYSE:BBU): Valuation Insights Following Corporate Restructuring Plan and Q3 Earnings Release

Reviewed by Simply Wall St

Brookfield Business Partners (NYSE:BBU) announced a plan to simplify its corporate structure into a single, publicly traded Canadian corporation. This announcement coincided with the release of its third-quarter earnings, which showed a net loss and lower sales year-over-year.

See our latest analysis for Brookfield Business Partners.

Brookfield Business Partners’ share price has been on a volatile run lately, with a sharp one-day decline of 8.3% after earnings and restructuring news. This capped a choppy week. Still, momentum over the past three months has been strong, reflected in a 25.9% 90-day share price return and a robust 25.3% total shareholder return for the year. This suggests longer-term investors remain optimistic despite recent turbulence.

If the recent shakeup in Brookfield’s strategy has you thinking about new opportunities, it could be the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

Given Brookfield’s recent losses and ambitious restructuring plans, the main question now is whether the sharp pullback represents an attractive entry point or if the market has already priced in all foreseeable growth.

Price-to-Sales of 0.2x: Is it justified?

Brookfield Business Partners trades at a price-to-sales (P/S) ratio of just 0.2x, far below both its industry and peer group averages. The last close was $31.04, signaling that the stock appears deeply undervalued compared to similar companies.

The price-to-sales multiple shows how much investors are willing to pay for each dollar of revenue the company generates. For a diversified industrial company like Brookfield, this ratio provides a quick snapshot of value that is less distorted by current losses compared to earnings-based metrics.

At just 0.2x, Brookfield’s P/S is a fraction of the global industrials average (0.8x) and is significantly below its peers (1.2x). Such a discount is rare and could mean the market is overlooking some potential, or it could be reflecting ongoing losses and uncertain growth forecasts. If the market begins to price Brookfield closer to those sector averages in the future, there could be substantial upside.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, unresolved losses and potential challenges in the execution of the restructuring could temper optimism if recovery or growth does not materialize as expected.

Find out about the key risks to this Brookfield Business Partners narrative.

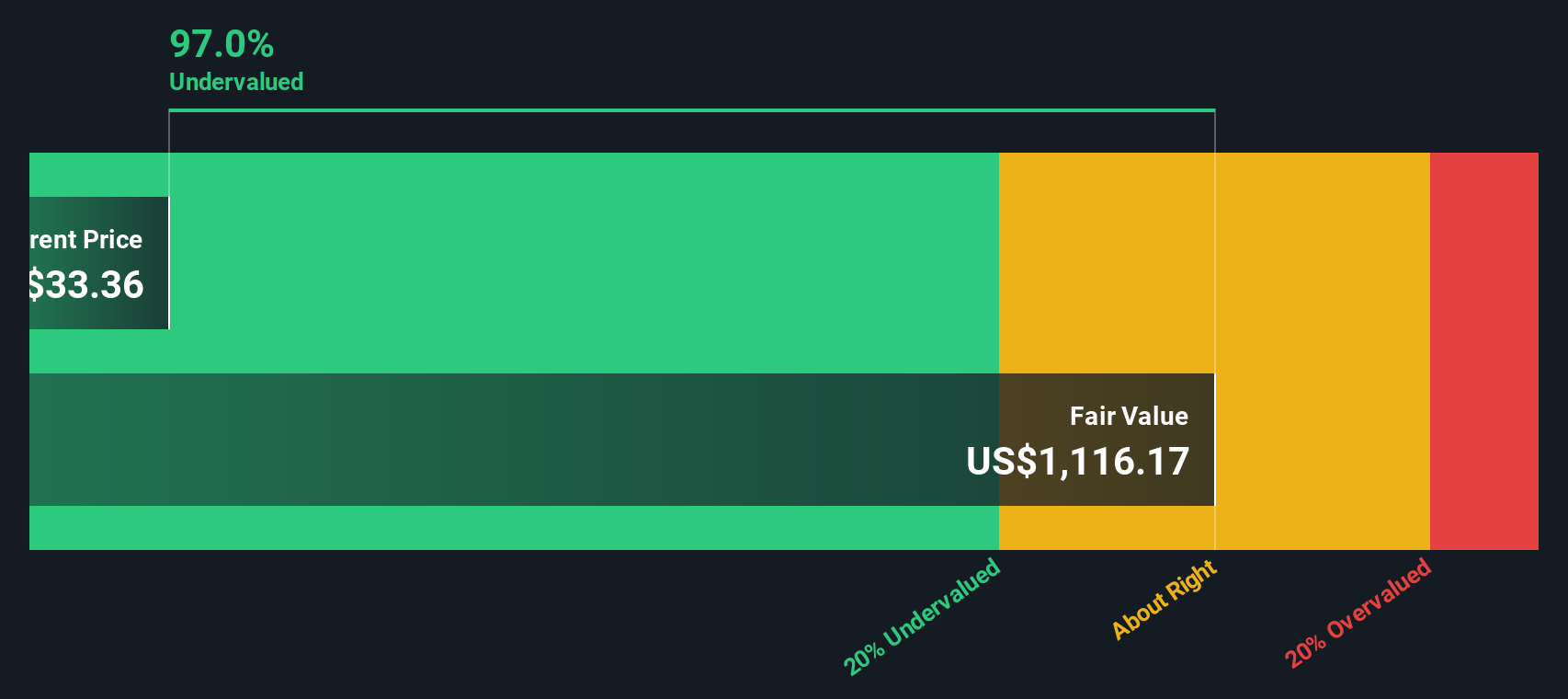

Another View: Discounted Cash Flow Signals Massive Undervaluation

While the price-to-sales ratio points to value compared to peers, our DCF model presents an even starker picture. It estimates Brookfield Business Partners’ fair value to be $135.18, which is more than four times its recent share price. This wide gap suggests the market may be deeply underestimating the company’s long-term potential. However, it remains to be seen whether these forecasts can withstand recent losses and restructuring risks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Business Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Business Partners Narrative

If you have a different perspective or want to take a hands-on approach, you can quickly assemble your own view using the same data. Do it your way

A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your investing journey by checking out these unique opportunities. Don’t miss a chance to spot hidden value or the next big trend; your watchlist could look very different tomorrow.

- Unlock serious income potential by investigating high-yield contenders through these 16 dividend stocks with yields > 3% with consistently strong dividend returns and robust financial health.

- Tap into the latest healthcare breakthroughs, from smart diagnostics to AI-assisted research, with these 32 healthcare AI stocks on companies reshaping patient outcomes.

- Seize deep value opportunities by scanning these 874 undervalued stocks based on cash flows for stocks trading below their intrinsic worth and poised for a turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Community Narratives