- United States

- /

- Building

- /

- NYSE:AWI

Armstrong World Industries (AWI): Valuation Perspective Following Earnings Beat and Geometrik Acquisition

Reviewed by Kshitija Bhandaru

Armstrong World Industries (AWI) just posted second quarter 2025 earnings and revenue that beat expectations, sparking fresh investor confidence. The company also announced it is acquiring Geometrik Manufacturing, which will expand its wood manufacturing presence in North America.

See our latest analysis for Armstrong World Industries.

Following this upbeat earnings beat and acquisition news, Armstrong World Industries stock is riding a clear wave of momentum and recently touched an all-time high. With a 41.5% share price return year-to-date and a robust 47.6% total shareholder return over the last twelve months, the market is increasingly rewarding the company’s consistent growth and strong operating track record.

If Armstrong’s recent performance has you thinking bigger, now is the time to see what else is out there by exploring fast growing stocks with high insider ownership

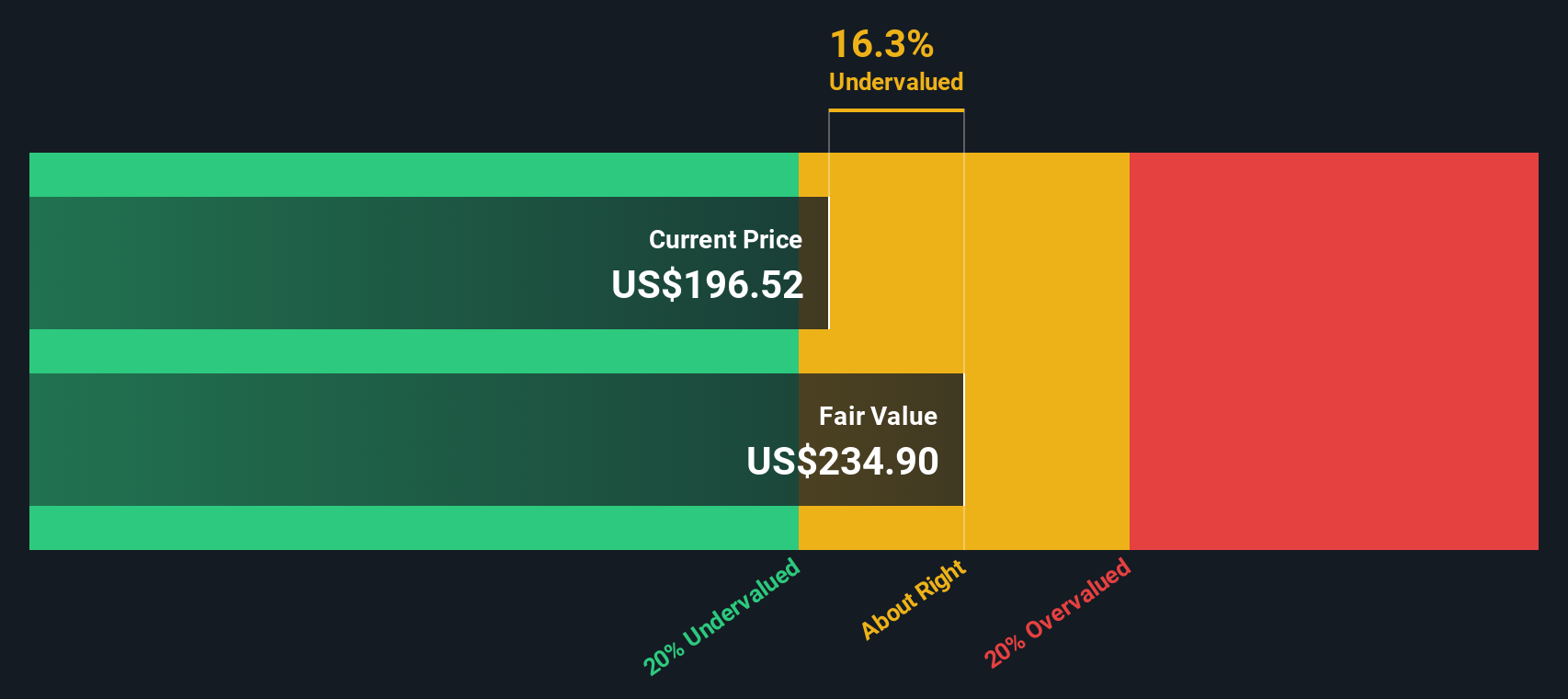

Yet with AWI breaking records and its shares nearing analyst targets, the real question for investors now is whether Armstrong World Industries remains undervalued or if the market has already priced in the company’s future growth.

Most Popular Narrative: Fairly Valued

With Armstrong World Industries closing at $198.30, almost matching its most widely followed fair value estimate of $195.67, the narrative sees little gap left for re-rating. This view closely reflects the confidence of analysts in recent expectations and performance.

Ongoing strategic acquisitions (for example, 3form and Zahner) and successful integration are broadening Armstrong's addressable market to capture additional spaces within commercial buildings and accelerate cross-selling opportunities. These developments support both revenue growth and improved net margins through scale and operational synergies.

Want to know why these strategic moves matter for the company’s valuation? There is a key earnings driver and margin leap hidden in the fine print. Uncover what really powers consensus expectations for those curious enough to look closer!

Result: Fair Value of $195.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in commercial construction or rising costs could quickly challenge the upbeat outlook and prompt a reassessment of Armstrong’s fair value.

Find out about the key risks to this Armstrong World Industries narrative.

Another View: DCF Value Points to Undervaluation

While most analysts see Armstrong as fairly priced based on its current share price and expected earnings, the SWS DCF model tells a different story. It estimates AWI's fair value at $234.45, which is over 15% above where shares are currently trading. Could this suggest the market is underappreciating Armstrong’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Armstrong World Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Armstrong World Industries Narrative

If you see things differently or enjoy charting your own course, discovering your own Armstrong World Industries narrative is both quick and easy. Create yours in under three minutes with Do it your way.

A great starting point for your Armstrong World Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop with just one great opportunity. Quick moves in the market are often won by those who seek out new trends and fresh leaders before anyone else.

- Capture the potential of surging monthly payouts when you scan through these 19 dividend stocks with yields > 3% delivering yields above 3%.

- Jump ahead of the curve with these 25 AI penny stocks that are powering the next wave of breakthroughs in artificial intelligence and automation.

- Tap into future-focused sectors as these 26 quantum computing stocks bring quantum computing advancements closer to reality and create new investment frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWI

Armstrong World Industries

Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives