- United States

- /

- Building

- /

- NYSE:AWI

A Look at Armstrong World Industries’s Valuation Following Raised Earnings Outlook and Strong Quarterly Results

Reviewed by Simply Wall St

Armstrong World Industries (AWI) just posted quarterly earnings showing both higher sales and net income compared to last year. The company also raised its full-year earnings outlook. These moves are catching the attention of investors.

See our latest analysis for Armstrong World Industries.

Following this upbeat earnings news and a new share buyback update, Armstrong World Industries’ stock has held onto strong momentum this year, with a 33.5% year-to-date share price return and a 23.6% total shareholder return over the past twelve months. Looking further back, the company’s three- and five-year total shareholder returns of 144% and 178% are a testament to steady, long-term value creation, even after a recent pullback from all-time highs.

If you’re keeping an eye on companies building momentum off solid fundamentals, it could be worth taking the next step and discovering fast growing stocks with high insider ownership

With recent gains and a strong earnings outlook, the question now is whether Armstrong World Industries’ impressive run still leaves room for upside, or if the market has already priced in its future growth potential.

Most Popular Narrative: 6.9% Undervalued

With Armstrong World Industries closing at $187.08 and the most widely followed narrative putting fair value at $200.89 per share, expectations are running high. This sizable gap sets the stage for bullish debate over what could drive the next move in the stock.

Ongoing strategic acquisitions (for example, 3form and Zahner) and successful integration are broadening Armstrong's addressable market to capture additional spaces within commercial buildings and accelerate cross-selling opportunities. These efforts aim to support both revenue growth and improved net margins through scale and operational synergies.

What’s sparking this optimism? The narrative banks on aggressive expansion, bold integration plans, and ambitious margin goals often seen among fast-growing leaders. Want to know which financial bets are driving analysts’ conviction? Discover the uncommon projections behind this fair value call.

Result: Fair Value of $200.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if commercial construction demand remains soft or anticipated margin improvements fail to materialize, Armstrong World Industries’ projected upside could quickly evaporate.

Find out about the key risks to this Armstrong World Industries narrative.

Another View: Market Multiple Puts a Different Spin on Value

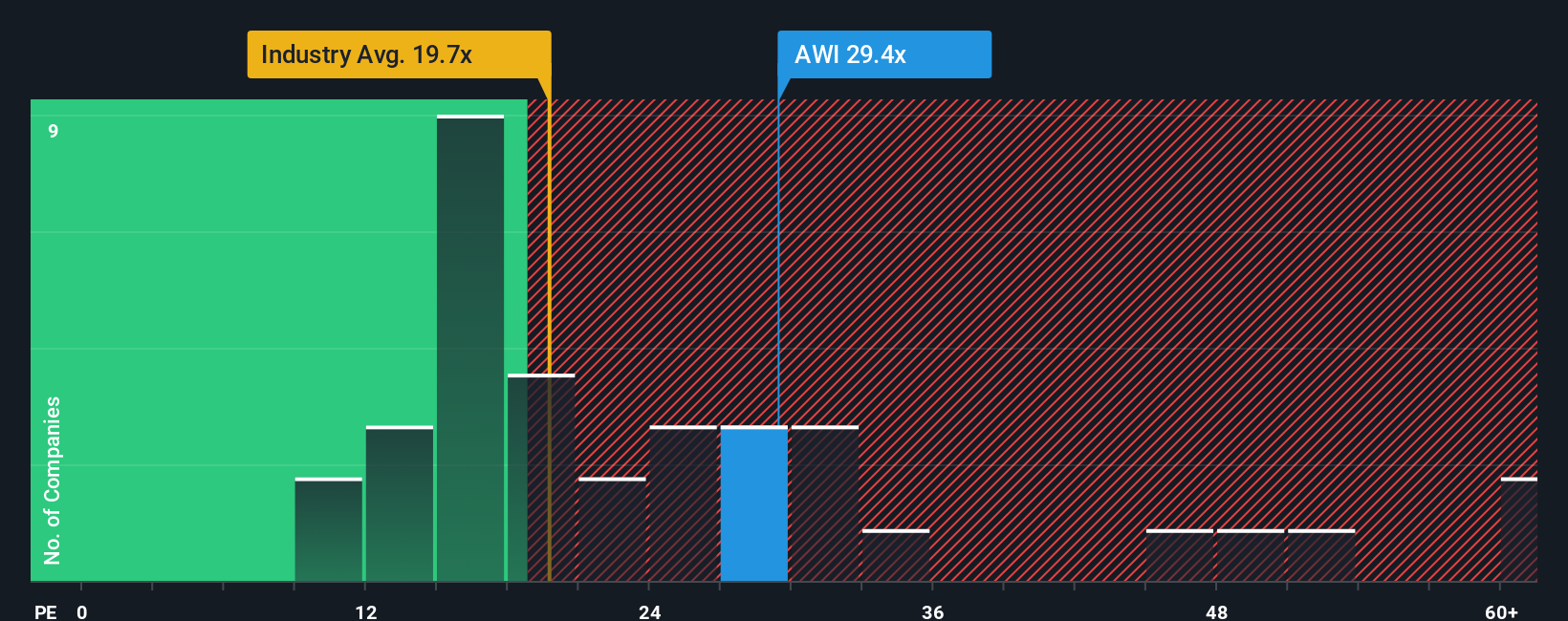

Looking through the lens of the price-to-earnings ratio, Armstrong World Industries trades at 26.4x, which is richer than the US Building industry’s average of 19.5x and above the fair ratio of 21.8x that the market could eventually shift toward. While peers, on average, command a much higher 40.4x, this high premium suggests risk if sentiment cools. So, is momentum truly supported, or does valuation risk linger just below the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Armstrong World Industries Narrative

Prefer your own take or curious to see what the numbers tell you? Dive in and shape your unique perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Armstrong World Industries.

Looking for More Investment Ideas?

Why limit yourself to one opportunity when smarter investments are always within reach? Power your portfolio by checking out these handpicked themes before others do:

- Boost your passive income with a selection of reliable companies found in these 17 dividend stocks with yields > 3% offering attractive yields above 3%.

- Ride the next technological wave by targeting standout innovators among these 25 AI penny stocks who are reshaping industries through artificial intelligence breakthroughs.

- Capture overlooked value by focusing on these 848 undervalued stocks based on cash flows that the market may have missed, all based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWI

Armstrong World Industries

Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives