- United States

- /

- Construction

- /

- NYSE:APG

APi Group (APG): Assessing Valuation After Upbeat Q3 Earnings and Raised 2025 Outlook

Reviewed by Simply Wall St

APi Group (APG) delivered a strong set of third quarter earnings, showing solid year-over-year growth in both sales and net income. The company also raised its revenue outlook for 2025, signaling continued momentum.

See our latest analysis for APi Group.

After APi Group’s upbeat third quarter report and improved 2025 outlook, investors have taken notice. The share price has surged 51.3% year-to-date, reflecting strong business momentum. The three-year total shareholder return of 186% highlights sustained long-term growth. Recent elevated insider selling has not slowed its broader trajectory, as market confidence remains supported by consistent execution and upgraded forecasts.

If you’re looking for more market leaders showing strong growth alongside active insider ownership, now is the perfect time to discover fast growing stocks with high insider ownership

With APi Group shares already up over 50% this year and the company forecasting further growth, investors must weigh whether there is further upside ahead or if the stock's strong prospects are fully reflected in the current price.

Most Popular Narrative: 12.7% Undervalued

The latest narrative assigns APi Group a fair value that is 12.7% above its recent closing price, highlighting why analysts remain optimistic even after a year of strong returns. This positions the company as one to watch during a period of evolving sector dynamics and heightened investor attention.

Consistent expansion in recurring contracts, now targeted to reach 60% or more of revenue by 2028, supports higher adjusted EBITDA margins and predictable cash generation. This further improves earnings quality and financial resilience.

Want insight into the bold growth assumptions behind this valuation? The strategy depends on a powerful mix of recurring contracts and ambitious margin targets. Wondering how these levers combine to shape the company’s future price? Unlock the full narrative to discover the surprising numbers that drive this forecast.

Result: Fair Value of $41.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and challenges integrating acquisitions remain key risks that could restrain APi Group’s margin gains and future growth trajectory.

Find out about the key risks to this APi Group narrative.

Another View: High Market Valuation Signals Caution

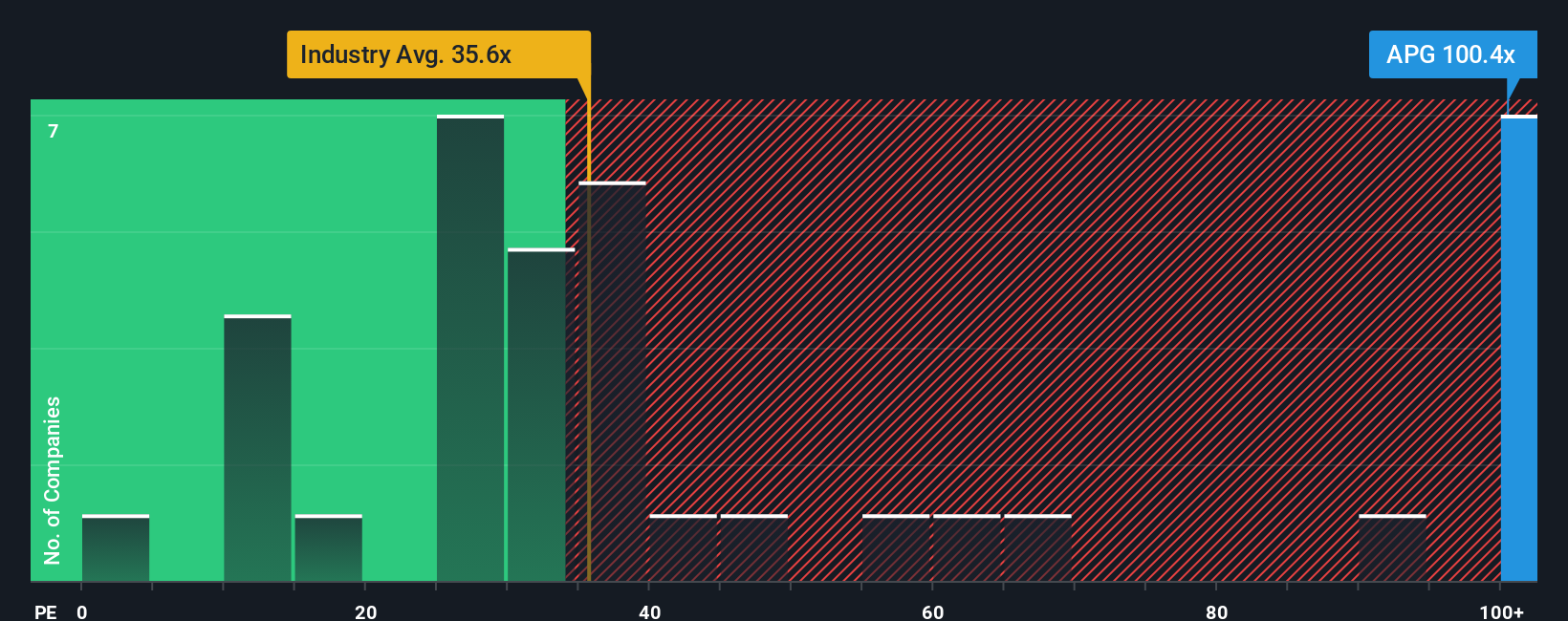

Looking at market valuation, APi Group trades at a price-to-earnings ratio of 96.6x, far above both the industry average of 33.5x and the peer average of 27.8x. Even compared to its fair ratio of 57.3x, the premium is striking. Does this premium signal untapped growth or suggest elevated risk for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own APi Group Narrative

If you see things differently or want to dive deeper into the numbers, you can always analyze the data yourself and build a personalized view in just a few minutes with Do it your way

A great starting point for your APi Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More High-Potential Investment Opportunities?

Smart investors know that the winners of tomorrow can be found today when you broaden your search. Let Simply Wall Street help you seize exciting market opportunities now.

- Capture income potential and secure your portfolio with steady performers by checking out these 16 dividend stocks with yields > 3%, offering yields over 3%.

- Harness the surge in artificial intelligence advancements by reviewing these 24 AI penny stocks, transforming industries and redefining what’s possible.

- Capitalize on high-growth possibilities in companies trading below their projected cash flows. See these 870 undervalued stocks based on cash flows you won’t want to miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APG

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives