- United States

- /

- Building

- /

- NYSE:AOS

How Lowered Guidance and Buybacks Could Shape A. O. Smith’s (AOS) Long-Term Investment Case

Reviewed by Sasha Jovanovic

- A. O. Smith Corporation recently reported third quarter results, highlighting US$942.5 million in sales and US$132 million in net income, while also lowering its full-year 2025 guidance due to challenges in China and softer demand in residential construction.

- Management emphasized active evaluation of acquisition opportunities, underpinned by strong liquidity, and continued significant share buybacks, reflecting ongoing efforts to strengthen the core business and enhance shareholder returns.

- With lowered annual guidance driven by persistent China headwinds, we’ll explore how these updates might impact A. O. Smith’s long-term outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

A. O. Smith Investment Narrative Recap

To own a stake in A. O. Smith, you need confidence that ongoing investments in high-efficiency products and geographic expansion will counterbalance headwinds in mature markets like North America and persistent uncertainty in China. The recent quarterly update reinforces that while US commercial performance remains solid, the largest short term catalyst, margin improvement from product mix and innovation, appears intact; however, China’s softness continues to present the most pressing risk, weighing on current guidance and earnings predictability.

The latest acquisition-focused commentary from management stands out this quarter, signaling the company's readiness to strengthen its core offerings or expand into new areas should appropriate opportunities arise. How effectively A. O. Smith deploys its “dry powder” for deals could influence revenue resilience and the success of ongoing transformation efforts, especially if China-driven revenue risks remain unresolved.

Yet, in contrast to steady progress on margin expansion, investors should be aware that ongoing volatility in China’s demand and policy support means...

Read the full narrative on A. O. Smith (it's free!)

A. O. Smith's outlook anticipates $4.3 billion in revenue and $634.5 million in earnings by 2028. This scenario is based on a 4.6% annual revenue growth rate and a $115.9 million increase in earnings from the current $518.6 million.

Uncover how A. O. Smith's forecasts yield a $78.18 fair value, a 18% upside to its current price.

Exploring Other Perspectives

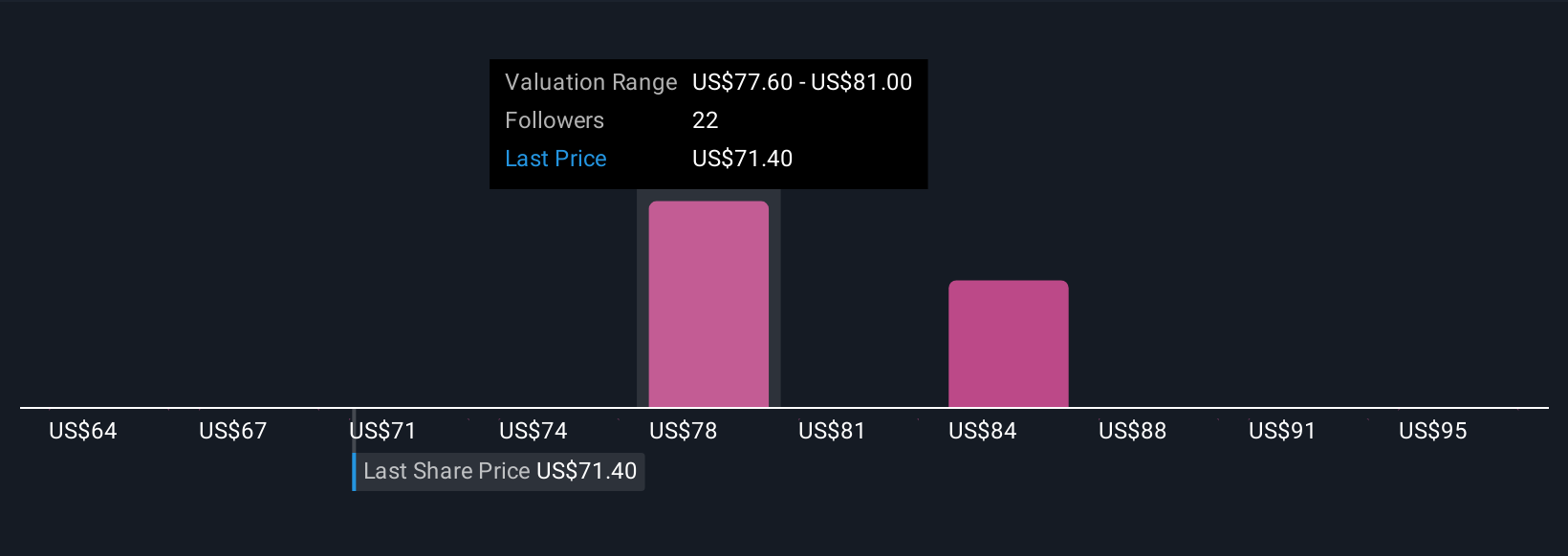

Five members of the Simply Wall St Community estimate A. O. Smith’s fair value from US$70 to US$98 per share. While some focus on the potential uplift from digital innovation and product upgrades, China’s challenges continue to shape the broader conversation around future growth and earnings stability.

Explore 5 other fair value estimates on A. O. Smith - why the stock might be worth as much as 48% more than the current price!

Build Your Own A. O. Smith Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your A. O. Smith research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free A. O. Smith research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate A. O. Smith's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AOS

A. O. Smith

Manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives