- United States

- /

- Electrical

- /

- NYSE:AMPX

Evaluating Amprius Technologies’s Valuation Following Strong Q3 Sales Growth and Narrowing Losses

Reviewed by Simply Wall St

Amprius Technologies (AMPX) just released its third-quarter earnings, and the results caught investors’ attention. The company’s sales more than doubled from last year, while net losses narrowed considerably over both quarters and the past nine months.

See our latest analysis for Amprius Technologies.

Amprius Technologies’ story this year has been one of building momentum, fueled by surging sales and narrowing losses. After its latest earnings, the company’s 1-day share price pullback of nearly 5% follows an astounding 68% gain over the past three months and a 351% year-to-date share price increase. With a total shareholder return of over 400% in the past year, optimism about Amprius’ growth potential is clearly resonating with investors, especially as recent results point to continued progress.

If Amprius’ breakout year has you looking for more high-potential moves, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares soaring but recent gains now pausing, the question for investors is clear: is Amprius still undervalued, or has the market already priced in every bit of future growth potential?

Most Popular Narrative: 15.7% Undervalued

According to the most widely followed narrative, Amprius Technologies appears attractively valued, with its calculated fair value outpacing the last close of $12.92 per share. Investors are paying close attention to near-term catalysts driving this assessment.

• Ongoing investment in automation and manufacturing capacity (supported by government contracts like the $10.5M Defense Innovation Unit award) positions Amprius to capture a larger share of future high-margin opportunities in defense and critical infrastructure. This enhances both revenue visibility and earnings stability.

• First-mover advantage, validated technology, and policy tailwinds for domestic and friendly-nation battery sourcing (NDAA-compliant, U.S. DoD engagement) position the company to secure long-term supply agreements. This helps transition to recurring, higher-margin revenue streams and improves forward earnings quality.

Want the growth blueprint behind this pricing? The linchpin: projections for revenue and margin inflection that are bold—even for battery innovators. Curious what numbers fuel the narrative and drive this high-stakes fair value? Dive in to discover which financial leaps underpin the story.

Result: Fair Value of $15.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on aviation and drone markets, along with production scale-up challenges, could quickly shift the current growth narrative if demand or execution falters.

Find out about the key risks to this Amprius Technologies narrative.

Another View: Price-to-Sales Raises Questions

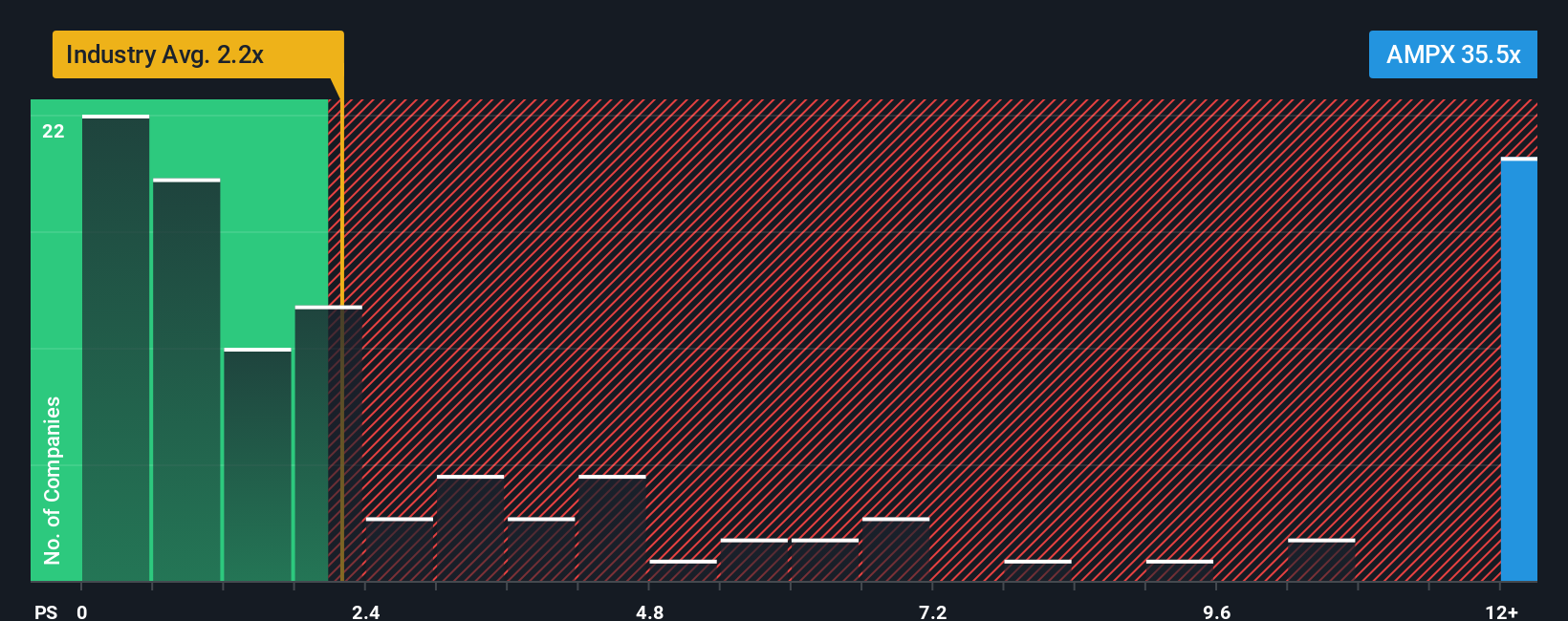

While many see Amprius Technologies as undervalued, our look at its price-to-sales ratio paints a different picture. At 28.9x, it is far above both the industry average of 2.2x and the peer average of 20.5x. It is also well above its fair ratio of 2.8x. This big gap highlights potential valuation risk if market excitement fades. Could expectations be getting too far ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

Prefer to chart your own course through the numbers or have an alternative view? Dig into the data directly and see how quickly your own narrative can take shape. Do it your way.

A great starting point for your Amprius Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a great opportunity slip by. Expand your watchlist with stocks offering unique upside potential. The best moves often come from finding tomorrow’s standouts before everyone else does.

- Tap into emerging mega-trends reshaping our lives by reviewing these 25 AI penny stocks making breakthroughs in automation and digital intelligence.

- Secure steady income streams by checking out these 15 dividend stocks with yields > 3% with market-beating yields and a track record of rewarding shareholders.

- Ride the next big wave as financial technology and digital assets grow by researching these 82 cryptocurrency and blockchain stocks at the intersection of innovation and finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives