- United States

- /

- Electrical

- /

- NYSE:AMPX

Amprius Technologies (AMPX) Is Up 5.4% After Major Drone Order and CFO Appointment - What’s Changed

Reviewed by Sasha Jovanovic

- In September, Amprius Technologies secured a US$35-million purchase order from a recurring drone customer and entered new supply agreements with Empirical Systems Aerospace and Nordic Wing for its SiCore battery cells, while also appointing Ricardo Rodriguez as chief financial officer.

- This series of developments highlights Amprius' advancing commercial traction and organizational focus as it builds on achieving positive gross margins in a highly competitive battery market.

- We'll explore how these major new contracts and leadership changes could impact Amprius Technologies' investment narrative and future growth outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Amprius Technologies Investment Narrative Recap

For anyone interested in Amprius Technologies, the central investment thesis is the company’s high-growth potential in advanced, lightweight battery solutions for the UAV and electric aviation markets, sectors that demand energy density and reliability. This month’s US$35-million drone order and new supply agreements add visible near-term revenue but don’t eliminate significant risks: the business remains highly dependent on a concentrated customer base, where any slowdown or lost contract could sharply impact results.

The September supply agreement with Empirical Systems Aerospace directly reflects rising customer adoption and real-world performance gains for Amprius’ SiCore cells, which support the main growth catalyst: surging commercial drone demand driven by defense and environmental mandates. However, much of the revenue growth is still concentrated in a narrow segment, so diversification remains an open issue for future stability.

By contrast, investors should also be aware that Amprius’ reliance on the aviation and drone sectors means the company remains exposed if customer...

Read the full narrative on Amprius Technologies (it's free!)

Amprius Technologies' outlook anticipates $306.6 million in revenue and $13.4 million in earnings by 2028. This implies an 89.8% annual revenue growth rate and a $52.1 million increase in earnings from current earnings of -$38.7 million.

Uncover how Amprius Technologies' forecasts yield a $14.67 fair value, a 19% upside to its current price.

Exploring Other Perspectives

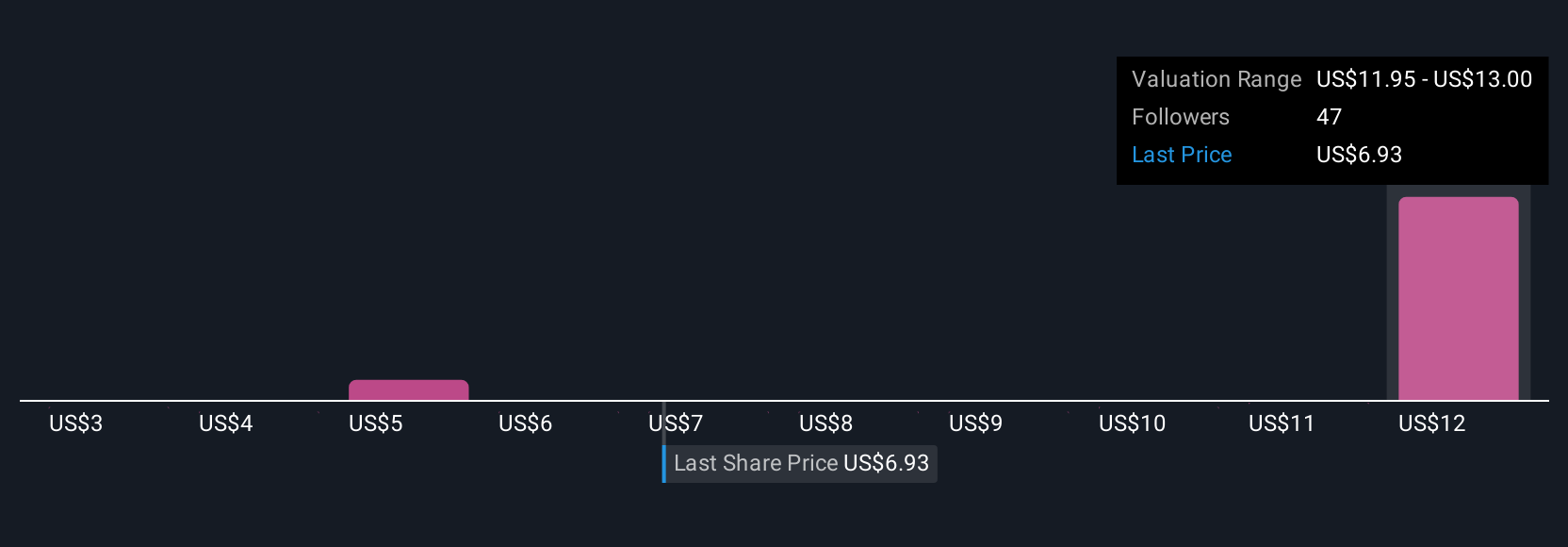

Fair value estimates from nine Simply Wall St Community members span US$4.67 to US$28.91, showing wide disagreement on Amprius’ future potential. With much of its revenue still concentrated in the aviation sector, it’s important to weigh both optimistic demand projections and exposure to sector-specific setbacks as you review these perspectives.

Explore 9 other fair value estimates on Amprius Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Amprius Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Amprius Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amprius Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives