Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like AMETEK (NYSE:AME), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide AMETEK with the means to add long-term value to shareholders.

View our latest analysis for AMETEK

How Quickly Is AMETEK Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years AMETEK grew its EPS by 10% per year. That's a good rate of growth, if it can be sustained.

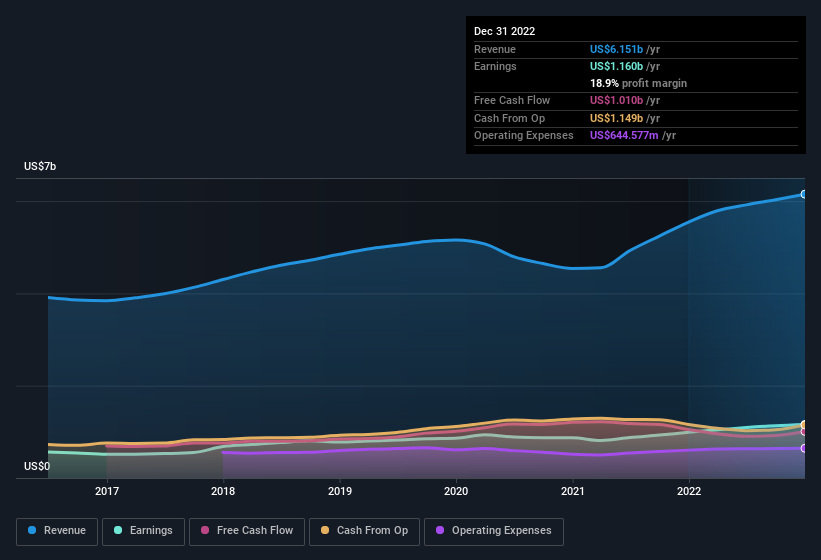

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. AMETEK maintained stable EBIT margins over the last year, all while growing revenue 11% to US$6.2b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for AMETEK's future EPS 100% free.

Are AMETEK Insiders Aligned With All Shareholders?

Owing to the size of AMETEK, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth US$175m. We note that this amounts to 0.5% of the company, which may be small owing to the sheer size of AMETEK but it's still worth mentioning. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Does AMETEK Deserve A Spot On Your Watchlist?

One positive for AMETEK is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We should say that we've discovered 1 warning sign for AMETEK that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments and electromechanical devices in the North America, Europe, Asia, and South America, and internationally.

Excellent balance sheet with questionable track record.