- United States

- /

- Trade Distributors

- /

- NYSE:AIT

Applied Industrial Technologies (AIT): Evaluating Valuation Following Strong Q1 Results, Raised Guidance, and Buybacks

Reviewed by Simply Wall St

Applied Industrial Technologies (AIT) grabbed investor attention following its fiscal first quarter results, which showed higher sales and net income compared to last year. The company also raised its guidance and completed a round of share buybacks.

See our latest analysis for Applied Industrial Technologies.

AIT's steady operational momentum has been mirrored in its modest 2025 share price gains, with an 8.8% year-to-date return even as the momentum has cooled since summer. Solid first-quarter results, fresh buybacks, and a dividend affirmation have all helped to reinforce the longer-term picture. AIT has delivered a remarkable 107% total shareholder return over three years and nearly 296% over five, proving its strength goes well beyond short-term moves.

If Applied Industrial’s ongoing M&A ambitions have you thinking bigger, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With solid results and management signaling confidence through buybacks and a raised outlook, investors now face a key question: is Applied Industrial Technologies trading at a bargain, or has the market already anticipated its next phase of growth?

Most Popular Narrative: 14% Undervalued

With analysts marking fair value at $303.33 compared to a recent close of $259.66, market expectations are leaning notably higher for Applied Industrial Technologies. This setup hints at bullish sentiment fueled by catalysts beyond the latest earnings report.

The accelerating build-out of data center, semiconductor, and advanced manufacturing infrastructure is increasing demand for industrial automation, robotics, and flow control solutions. This positions Applied Industrial Technologies to capture higher-margin sales and expand its addressable market, supporting long-term revenue and margin growth.

Curious why this price target stands out? This fair value thesis hinges on a powerful combination of projected top-line expansion, margin improvement, and a premium profit valuation that is rarely seen outside high-growth sectors. Want to see what could send expectations even higher? Click to uncover just what analysts are betting on for the next few years.

Result: Fair Value of $303.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in legacy industrial sectors or slower than expected integration of acquisitions could weigh on revenue growth and threaten margin expansion.

Find out about the key risks to this Applied Industrial Technologies narrative.

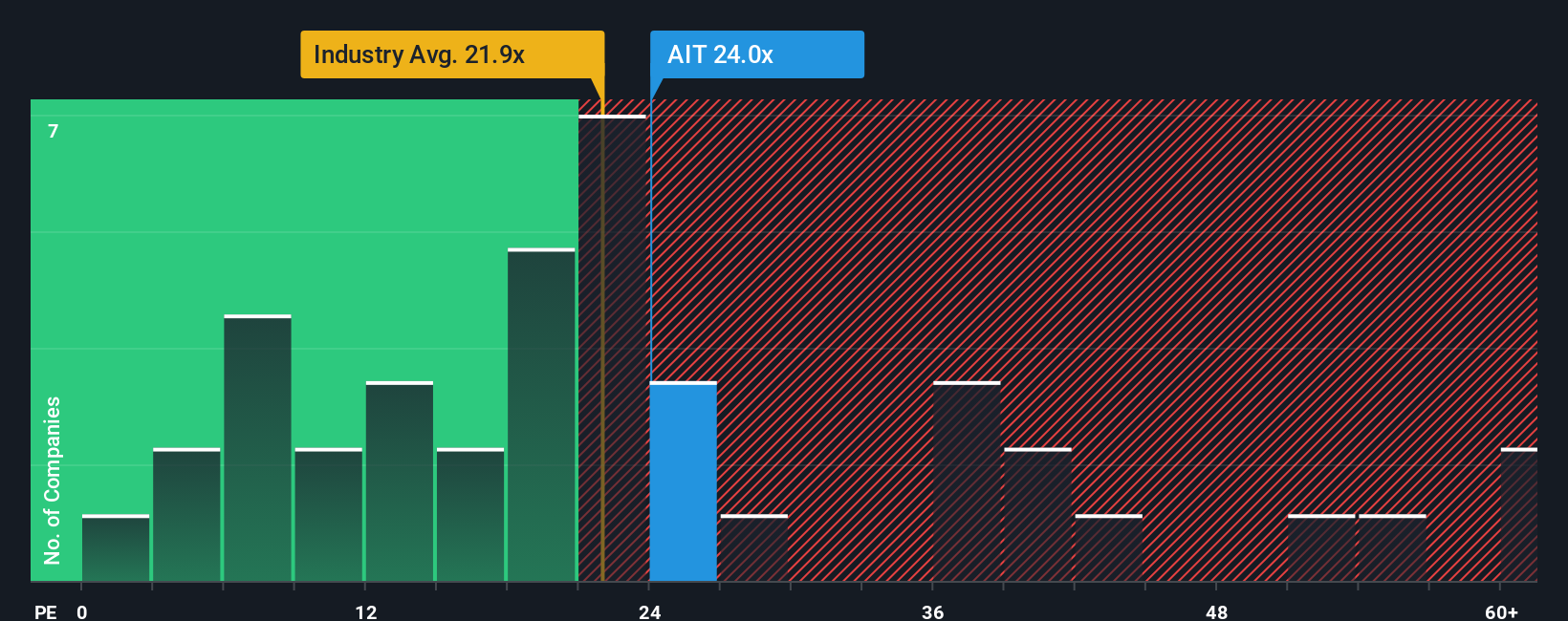

Another View: Market Multiples Raise Caution

While analysts see room for upside, the current price-to-earnings ratio stands at 24.4x. This is higher than industry peers at 21x and above the fair ratio of 21.8x. This gap suggests Applied’s shares are priced at a premium, which could increase valuation risks if growth stalls. Could expectations be getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Industrial Technologies Narrative

If you want to challenge these perspectives or prefer a hands-on approach, you can assemble your own view in just a few minutes. Do it your way.

A great starting point for your Applied Industrial Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Portfolio-Worthy Opportunities?

Don’t stop here. Cast your net wider to uncover investments others might miss. Take advantage of unique Simply Wall Street screeners designed to reveal compelling stocks beyond the usual picks.

- Capture reliable yield and steady income by checking out these 17 dividend stocks with yields > 3% offering payouts above 3% for cash flow peace of mind.

- Ride the AI revolution by targeting these 25 AI penny stocks that blend rapid innovation with real market growth, keeping your portfolio on the cutting edge.

- Uncover potential bargains and accelerate your gains by acting quickly on these 859 undervalued stocks based on cash flows. These stocks could be slipping under most investors’ radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIT

Applied Industrial Technologies

Distributes industrial motion, power, control, and automation technology solutions in the United States, Canada, Mexico, Australia, New Zealand, Singapore, and Costa Rica.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives