- United States

- /

- Construction

- /

- NYSE:AGX

Major Texas Power Plant Wins Could Be a Game Changer for Argan (AGX)

Reviewed by Sasha Jovanovic

- Gemma Power Systems, a wholly owned subsidiary of Argan, Inc., recently secured major engineering, procurement, and construction (EPC) contracts for two large-scale natural gas-fired power plants in Texas, including an 860 MW facility in the ERCOT market and a 1,350 MW combined-cycle plant for CPV Basin Ranch Energy Center.

- These project wins add significant value to Argan's project backlog and highlight the company's ability to secure large-scale infrastructure projects with features such as optional carbon capture integration.

- We'll explore how this addition to Argan's project backlog reinforces its multi-year revenue growth outlook and expanded sector capabilities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Argan Investment Narrative Recap

To be a shareholder in Argan, you need to believe in the continued demand for large-scale natural gas-fired power projects, even as the broader energy mix evolves. The recent Gemma contract wins directly bolster Argan’s record project backlog, reinforcing the most important short-term catalyst: multi-year revenue visibility and project execution, though the company’s concentration in gas-fired work remains the biggest risk and is not diminished by these wins.

Among Argan’s recent corporate announcements, the October 30 notification that Gemma will proceed with the 1,350 MW CPV Basin Ranch project in Texas stands out. This contract further extends project backlog and highlights management’s capability to secure and begin major energy projects, directly supporting Argan’s growth catalyst of increasing project execution amid sector-wide grid modernization efforts.

However, it’s important to note that despite rising backlog, Argan’s heavy focus on gas-fired plants could prove a headwind if utility preferences shift faster than expected toward renewables and...

Read the full narrative on Argan (it's free!)

Argan's outlook projects $1.5 billion revenue and $142.0 million earnings by 2028. This scenario assumes 18.1% annual revenue growth and an increase in earnings of $24.8 million from the current $117.2 million.

Uncover how Argan's forecasts yield a $262.00 fair value, a 16% downside to its current price.

Exploring Other Perspectives

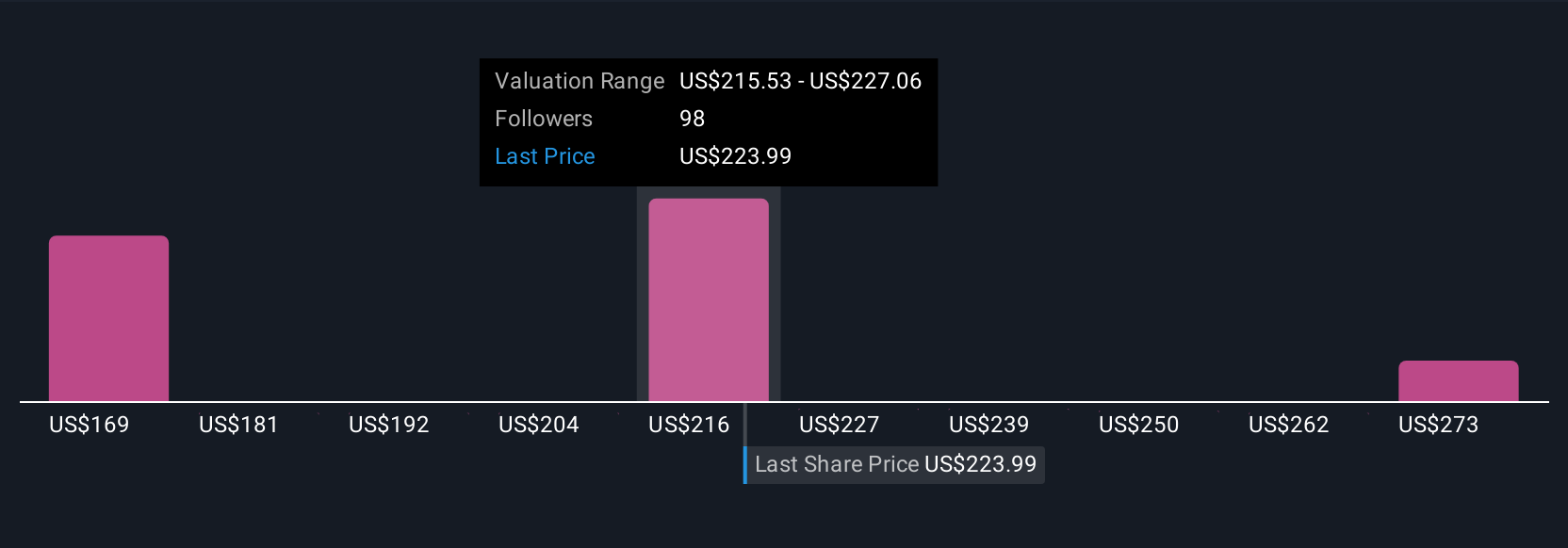

Eight fair value estimates from the Simply Wall St Community put Argan shares between US$229.49 and US$284.68. With multi-year revenue growth tied to gas-heavy infrastructure, you can see how opinions on future performance span a wide spectrum.

Explore 8 other fair value estimates on Argan - why the stock might be worth 26% less than the current price!

Build Your Own Argan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives