- United States

- /

- Construction

- /

- NYSE:ACA

Arcosa (ACA): Is the Market Overlooking the True Value?

Reviewed by Simply Wall St

Arcosa (ACA) shares have been drawing attention lately as investors look for new signals around the company’s performance and outlook. In recent weeks, the stock has delivered mixed returns, which has sparked interest in what is driving these moves.

See our latest analysis for Arcosa.

Arcosa’s share price has seen a notable rally lately, rising over 11% for the month, even after a dip last week. While the stock’s 1-year total shareholder return is down 6.5%, its 3-year and 5-year total returns remain exceptional. This suggests that longer-term momentum is still working in investors’ favor.

If you’re looking for more opportunities with strong performance and ownership trends, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The real question for investors now is whether Arcosa’s recent gains still leave room for value, or if the market has already priced in its strong earnings and growth prospects. Is this a genuine buying opportunity, or has future growth been fully reflected in the stock price?

Most Popular Narrative: 16.2% Undervalued

Arcosa's most widely followed valuation narrative pegs fair value noticeably higher than the last close price, implying meaningful upside if those assumptions play out. Market watchers are debating whether that outlook is justified. Here is a close look at the underlying argument.

Accelerating investment in grid modernization, data center development, and renewable energy integration is boosting demand for utility and transmission structures, leading to a record backlog and prompting capacity expansions expected to support higher earnings growth and margin accretion.

What is really powering this bullish narrative? It centers on bold projections for revenue, profit margins, and a future profit multiple that hints at confidence rarely seen in this sector. To find out which assumptions are baked in and what the market might be missing, dive into the full narrative now.

Result: Fair Value of $118.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected shifts in government spending or setbacks with recent acquisitions could quickly challenge Arcosa’s strong growth story and current valuation outlook.

Find out about the key risks to this Arcosa narrative.

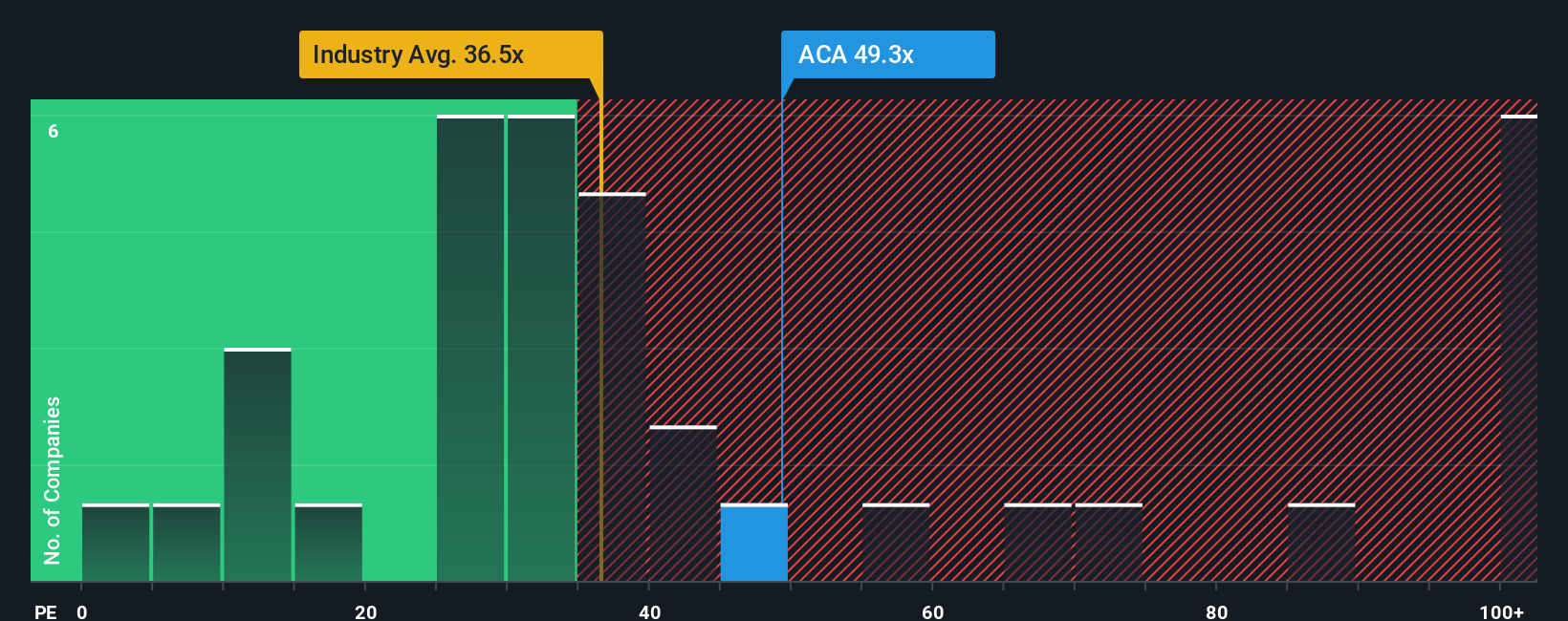

Another View: Market Ratios Tell a Different Story

While the fair value narrative suggests Arcosa shares are undervalued, a look at its price-to-earnings ratio paints a different picture. At 32.8x, the company's P/E is higher than both the peer average of 25.8x and its estimated fair ratio of 28.5x. This gap means investors today may be taking on more valuation risk than the industry norm. Could the market adjust expectations, or is Arcosa’s growth potential enough to justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arcosa Narrative

If you see things differently or want to chart your own path, it’s easy to dig into the data and craft your own perspective in just a few minutes. Do it your way

A great starting point for your Arcosa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Set yourself up for success by seizing fresh opportunities. Don’t watch from the sidelines while others spot the next big winner. Use Simply Wall Street’s powerful tools for inspiration:

- Maximize your income potential with companies offering steady yields by checking out these 16 dividend stocks with yields > 3%, delivering returns above 3%.

- Catch the latest breakthroughs in medicine and artificial intelligence by exploring these 32 healthcare AI stocks, transforming diagnostics and patient care.

- Jumpstart your portfolio growth with these 875 undervalued stocks based on cash flows, that the market may have overlooked, before everyone else takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACA

Arcosa

Provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives