Stock Analysis

- United States

- /

- Electrical

- /

- NasdaqGS:WIRE

Encore Wire Corporation's (NASDAQ:WIRE) Shares Lagging The Market But So Is The Business

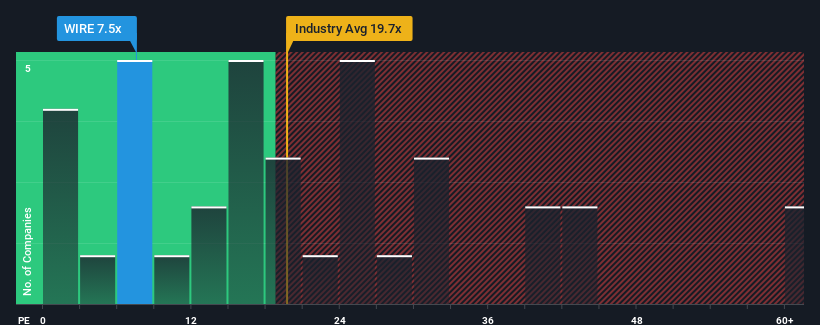

With a price-to-earnings (or "P/E") ratio of 7.5x Encore Wire Corporation (NASDAQ:WIRE) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Encore Wire has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Encore Wire

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Encore Wire's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's bottom line. Even so, admirably EPS has lifted 866% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 31% over the next year. That's not great when the rest of the market is expected to grow by 10.0%.

In light of this, it's understandable that Encore Wire's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Encore Wire's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Encore Wire you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Encore Wire is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WIRE

Encore Wire

Encore Wire Corporation engages in manufacture and sale of electrical building wires and cables in the United States.

Flawless balance sheet and fair value.