- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

VSE Corporation (VSEC): Evaluating Valuation After Upbeat Revenue Growth and Upgraded Full-Year Outlook

Reviewed by Simply Wall St

VSE (VSEC) just posted third quarter results showing solid revenue gains and bumped up its full-year outlook. Even with quarterly net income down, investors have plenty to consider as momentum continues building for the company.

See our latest analysis for VSE.

This upbeat guidance did not go unnoticed in the market as VSE’s share price has gained 14% over the last month, building on a remarkable 90% year-to-date price return. While the company’s robust acquisition pipeline and raised revenue outlook have fueled recent momentum, its long-term track record is even more impressive. A five-year total shareholder return of 449% underscores sustained value creation.

If you’re intrigued by VSE’s momentum, now’s your chance to broaden your horizons and discover fast growing stocks with high insider ownership

With shares surging and the company boosting its outlook, investors face a pivotal question: Is VSE still trading below its true value, or has the market already factored in all the anticipated growth?

Most Popular Narrative: 14.4% Undervalued

According to the most widely followed narrative, VSE’s fair value estimate stands well above the latest close, implying investors may be overlooking crucial growth drivers fueling future upside.

Significant investments and recent strategic acquisitions (TCI, Kellstrom, Turbine Weld) are expanding VSE's capacity and footprint in higher-growth, higher-margin aftermarket aviation distribution and MRO services. This supports robust future revenue growth and diversification of the customer base.

Want to know which future profit margins and blockbuster revenue projections power this bullish target? One bold move, a series of bets, and aggressive growth assumptions could be behind this optimism. Find out which surprising industry trends and management shifts shape the narrative and the valuation.

Result: Fair Value of $206.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps with new acquisitions or a downturn in the aviation aftermarket could quickly challenge today's bullish outlook for VSE.

Find out about the key risks to this VSE narrative.

Another View: High Price Relative to Earnings

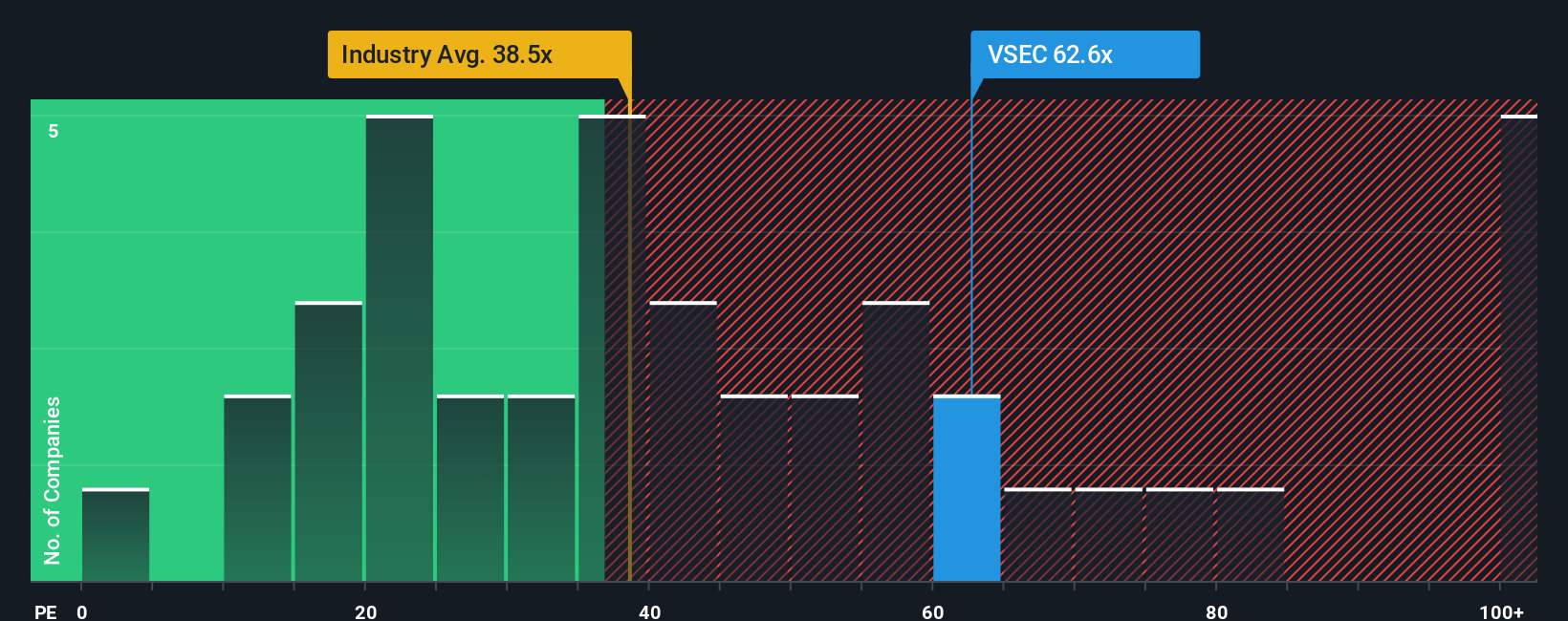

While the leading narrative points to significant upside, a look at VSE's earnings ratio delivers a different message. Currently, shares trade at 62.3 times earnings, far above the industry average (38.5x), peer average (61.2x), and even our fair ratio of 39.6x. Being priced at such a premium suggests investors are expecting continued stellar growth. However, if momentum fades, the outlook could change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own VSE Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding VSE.

Looking for More Investment Ideas?

Smart investors never limit their horizons. Don’t let other promising stocks slip past your radar when potential opportunities are just a click away. Your next great idea might be only one search away.

- Unlock potential value plays by checking out these 883 undervalued stocks based on cash flows for stocks poised for a rebound, backed by strong cash flows and healthy outlooks.

- Tap into market-shaping growth stories with these 25 AI penny stocks highlighting companies leading breakthroughs in AI, automation, and digital transformation.

- Supercharge your passive income by exploring these 16 dividend stocks with yields > 3% that deliver reliable yields above 3% and help strengthen your portfolio’s foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives