- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Shoals Technologies Group (SHLS): Evaluating Valuation After Record Revenue and Upbeat Growth Guidance

Reviewed by Simply Wall St

Shoals Technologies Group (SHLS) just delivered a standout earnings report, notching record revenue and notable growth in net income for the third quarter. The expanding order backlog and upbeat guidance are drawing fresh attention from investors.

See our latest analysis for Shoals Technologies Group.

The latest quarterly results lit a spark under Shoals Technologies Group’s shares, with momentum kicking in long before earnings and propelling a 92% share price return over the past 90 days. Despite some recent volatility, as shares slipped 14% in the last week, the company’s one-year total shareholder return is still an impressive 59%. This suggests investor confidence is building on the back of strong revenue growth, expanding orders, and a bolstered executive team.

If you’re curious where strong momentum might show up next, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

The question now is whether Shoals Technologies Group’s impressive gains mean the stock remains undervalued, or if the current price already reflects all the future growth investors are hoping for. Is there still a buying opportunity here?

Most Popular Narrative: 4% Overvalued

The most widely followed narrative now places fair value just below the current $9.08 share price, hinting that recent optimism may already be reflected in the stock. As expectations shift and new price targets emerge, the following perspective captures the core factors fueling these projections.

Shoals is actively expanding its product suite into fast-growing adjacent markets, such as battery energy storage systems (BESS) and international solar projects. This positions the company to capture new revenue streams and reduce dependency on U.S. policy, which is expected to support top-line growth and diversification.

Curious what bold growth bets and profitability leaps are driving this new target? There is a pivotal financial forecast inside this narrative, based on significant expansion hopes, margin shifts, and a surprisingly confident bottom line estimate. Want to see the full financial vision and where analysts think Shoals’ numbers could land?

Result: Fair Value of $8.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and the unpredictable cost of legal issues remain key risks. These factors have the potential to weigh on profitability going forward.

Find out about the key risks to this Shoals Technologies Group narrative.

Another View: Discounted Cash Flow Challenges the Market

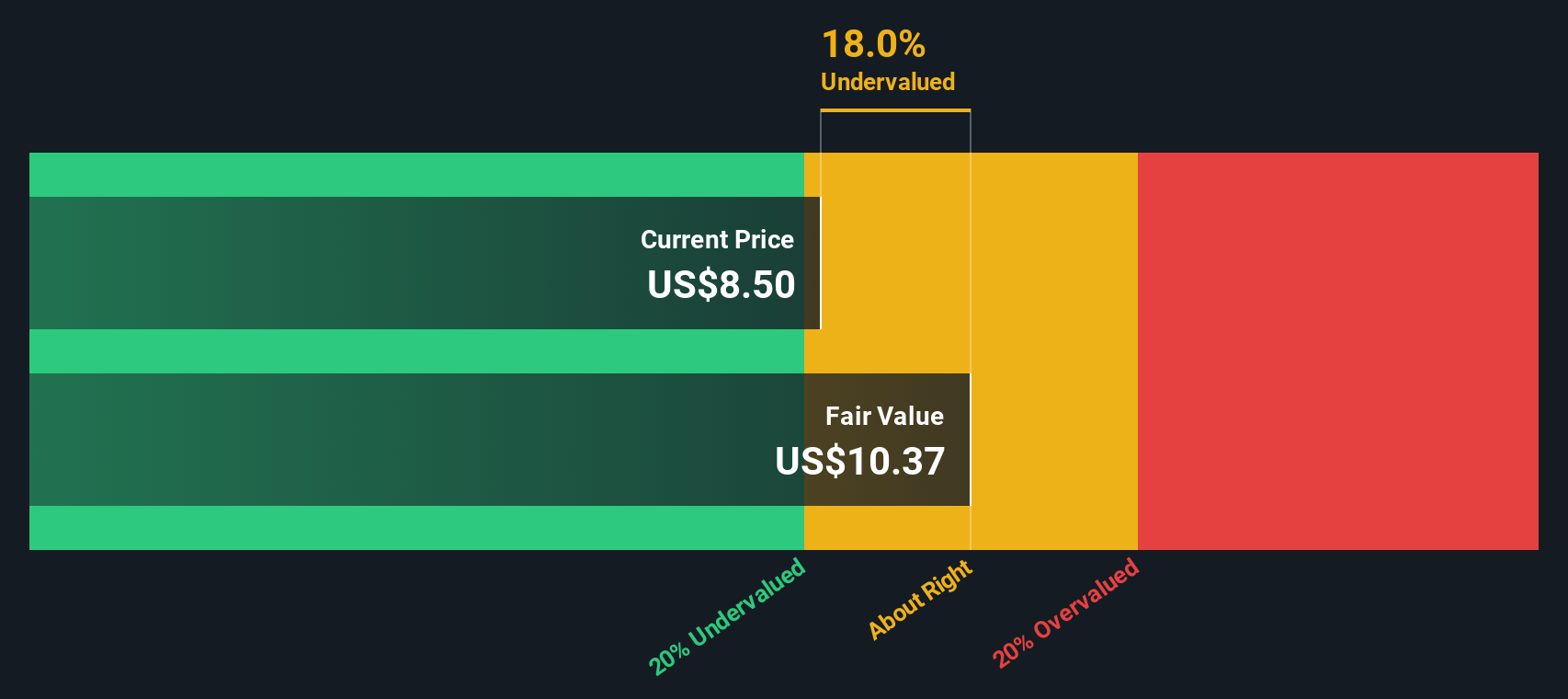

Our SWS DCF model offers a different perspective on Shoals Technologies Group. Unlike earnings-based multiples, which suggest the stock is expensive relative to industry peers, the DCF model estimates fair value at $10.39, about 12.6% above the current share price. Could the market be underestimating Shoals’ long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shoals Technologies Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shoals Technologies Group Narrative

Don’t just take these narratives at face value. Explore the numbers yourself and put together your unique outlook in just a few minutes with Do it your way.

A great starting point for your Shoals Technologies Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Plays?

Act now and elevate your portfolio with ideas you won’t want to miss. These hand-picked screeners help you find stocks primed for growth, innovation, or dependable returns before the crowds catch on.

- Capture the upside of emerging technologies by seizing opportunities in these 27 quantum computing stocks, where pioneering companies push the boundaries of computing and reshape entire industries.

- Grow your passive income with stability by targeting companies offering strong yields in these 16 dividend stocks with yields > 3%, setting your portfolio up for consistent cash flow and long-term gains.

- Join the leading edge of digital finance by tapping into these 82 cryptocurrency and blockchain stocks, spotting businesses set to transform global transactions with blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives