- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Does Shoals Technologies Group’s (SHLS) Earnings Rebound and Leadership Shift Reinforce Its Growth Ambitions?

Reviewed by Sasha Jovanovic

- Shoals Technologies Group recently reported third quarter 2025 earnings, highlighting US$135.8 million in sales and a swing to net income, and appointed David Van Bibber, an executive with over 25 years of experience, as its new Chief Accounting Officer effective November 10, 2025.

- This combination of improved financial results and leadership changes comes as the company guides for higher fourth quarter revenue and expands into high-growth markets like battery storage and data centers.

- We'll examine how Shoals' strong third quarter results and new leadership appointment may influence its outlook and investment case.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Shoals Technologies Group Investment Narrative Recap

To be a Shoals Technologies Group shareholder, you need to believe in the accelerating demand for power infrastructure in renewable and data center markets, where Shoals is intensifying its focus. While the recent appointment of an experienced Chief Accounting Officer may help shore up internal controls and support expansion, it does not materially change the short-term catalyst of rapidly growing utility-scale solar demand or the biggest risk: ongoing margin pressure amid competitive pricing and higher costs.

The company’s strong third quarter results, US$135.8 million in sales and a swing to net income, stand out. This performance aligns closely with the short-term growth catalyst of utility-scale projects, with Shoals guiding for even higher revenue next quarter and actively expanding in battery storage and data center power solutions.

However, investors should also be aware that despite upbeat earnings and guidance, margin compression from pricing pressures and rising costs…

Read the full narrative on Shoals Technologies Group (it's free!)

Shoals Technologies Group is projected to achieve $589.7 million in revenue and $80.2 million in earnings by 2028. This outlook assumes annual revenue growth of 13.8% and an earnings increase of $59.1 million from current earnings of $21.1 million.

Uncover how Shoals Technologies Group's forecasts yield a $8.72 fair value, in line with its current price.

Exploring Other Perspectives

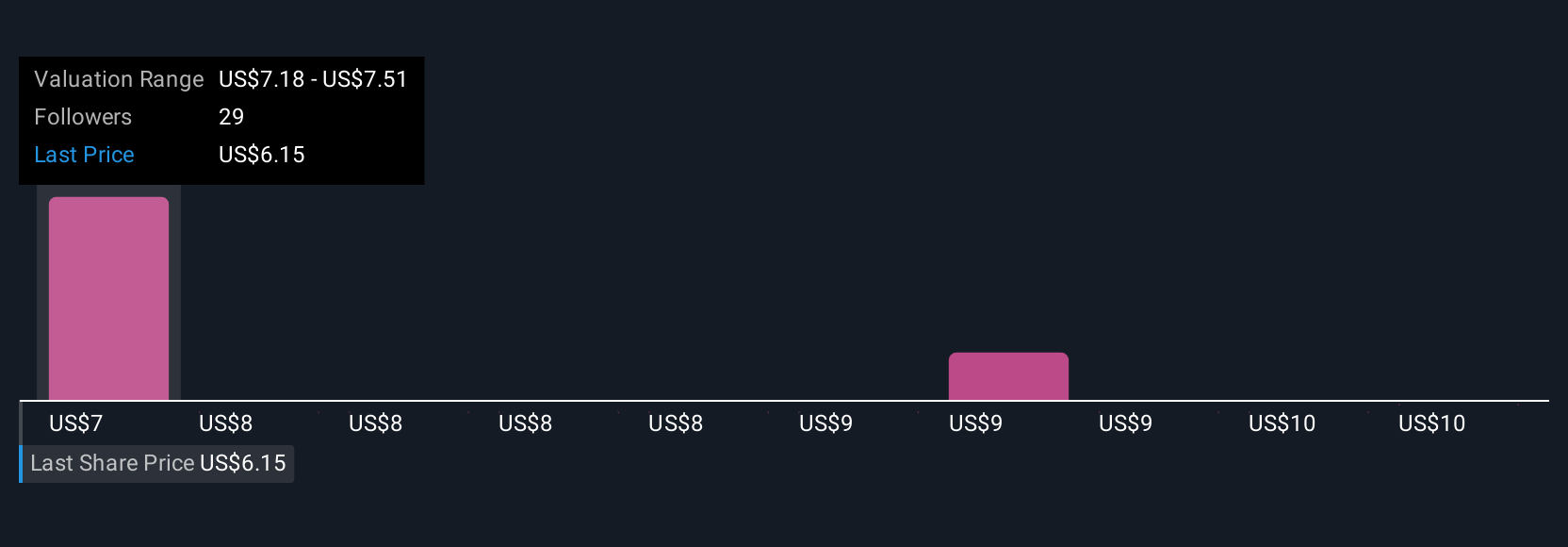

Simply Wall St Community contributors set fair value estimates between US$8.73 and US$11.94, with three unique viewpoints considered. Amid this range of expectations, the risk of margin compression remains a top concern for Shoals and could shape how profits trend going forward.

Explore 3 other fair value estimates on Shoals Technologies Group - why the stock might be worth as much as 34% more than the current price!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

No Opportunity In Shoals Technologies Group?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives