- United States

- /

- Building

- /

- NasdaqGS:ROCK

Should Gibraltar Industries’ (ROCK) Return to Net Losses Despite Higher Sales Prompt Investor Reassessment?

Reviewed by Sasha Jovanovic

- Gibraltar Industries reported third-quarter and nine-month 2025 results on October 30, showing higher sales year-over-year but shifting from net income to a US$89.06 million net loss for the quarter and a US$41.94 million net loss for the year to date.

- Despite increased revenues, the swing to losses and more cautious full-year earnings guidance highlighted underlying profitability challenges and raised questions about the sustainability of recent operational improvements.

- We'll now explore how the company's return to net losses, despite revenue growth, influences the broader investment narrative and future expectations.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gibraltar Industries Investment Narrative Recap

To be a shareholder in Gibraltar Industries today, you need to believe the company can navigate its post-renewables strategy and drive recurring profits from its core building products and structures businesses. The recent swing to net losses in the third quarter, despite higher sales, puts short-term attention squarely on margin resilience and the company’s ability to restore steady earnings, a key risk for now, with the catalyst being a potential recovery in residential and infrastructure demand. At this stage, the impact of these results appears material, given the scale of the reported losses and revised full-year guidance. Among recent announcements, the revised 2025 earnings guidance is most relevant. Gibraltar reiterated expectations for solid full-year revenue between US$1.15 billion and US$1.175 billion, but GAAP EPS guidance of US$3.67 to US$3.77 is now lower than last year’s US$4.58, a decline partly explained by last year’s divestment gain. This guidance update sharpens investor focus on how fast the business can reestablish margin stability and growth. By contrast, what investors should be particularly aware of is the increasing reliance on the Residential segment, where revenue declines and margin pressure have started to ...

Read the full narrative on Gibraltar Industries (it's free!)

Gibraltar Industries' narrative projects $1.1 billion revenue and $135.8 million earnings by 2028. This requires a 6.0% annual revenue decline and a $0.2 million decrease in earnings from the current $136.0 million.

Uncover how Gibraltar Industries' forecasts yield a $85.00 fair value, a 38% upside to its current price.

Exploring Other Perspectives

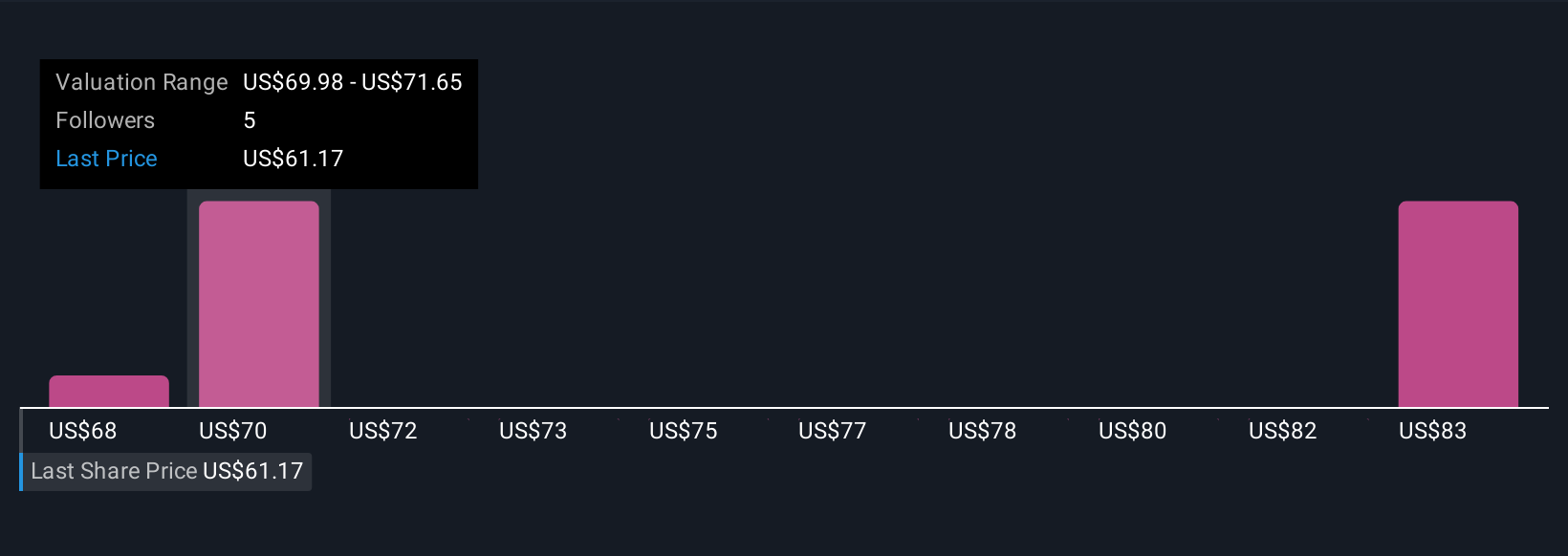

Fair value estimates from three Simply Wall St Community members cluster between US$68.31 and US$90.43 per share. With some participants flagging earnings pressure and business concentration as key risks, you can explore how such diverse expectations reflect a spectrum of confidence in Gibraltar’s profitability recovery.

Explore 3 other fair value estimates on Gibraltar Industries - why the stock might be worth as much as 47% more than the current price!

Build Your Own Gibraltar Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gibraltar Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Gibraltar Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gibraltar Industries' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROCK

Gibraltar Industries

Manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives