- United States

- /

- Electrical

- /

- NasdaqCM:PSIX

What Recent Supply Chain Wins Could Mean for Power Solutions International’s Share Price in 2025

Reviewed by Bailey Pemberton

- If you have ever wondered whether Power Solutions International could be one of the market’s best kept secrets or simply overpriced, you are not alone. Let’s dive in together and find out what’s really driving its value.

- Despite powering ahead with 134.6% gains over the past year (and an eye-popping 3653.7% rise over three years), the stock has pulled back sharply, dropping 23.3% in just the last week.

- Recent headlines have brought attention to supply chain improvements and new large-scale customer deals, which might help explain both the remarkable long-term surge and the recent volatility. The company’s strategic partnerships and industry recognition have also fueled investor debates about Power Solutions International's future potential.

- On our valuation scorecard, Power Solutions International scores a 5 out of 6 for undervaluation checks, setting us up perfectly to explore what’s driving this score and whether there’s an even smarter way to think about value. More on that by the end of this article.

Approach 1: Power Solutions International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common way to estimate a company’s worth by projecting its future cash flows and then discounting them back to today’s dollars. In other words, it helps investors figure out what a business is really worth based on how much money it’s expected to generate in the years ahead.

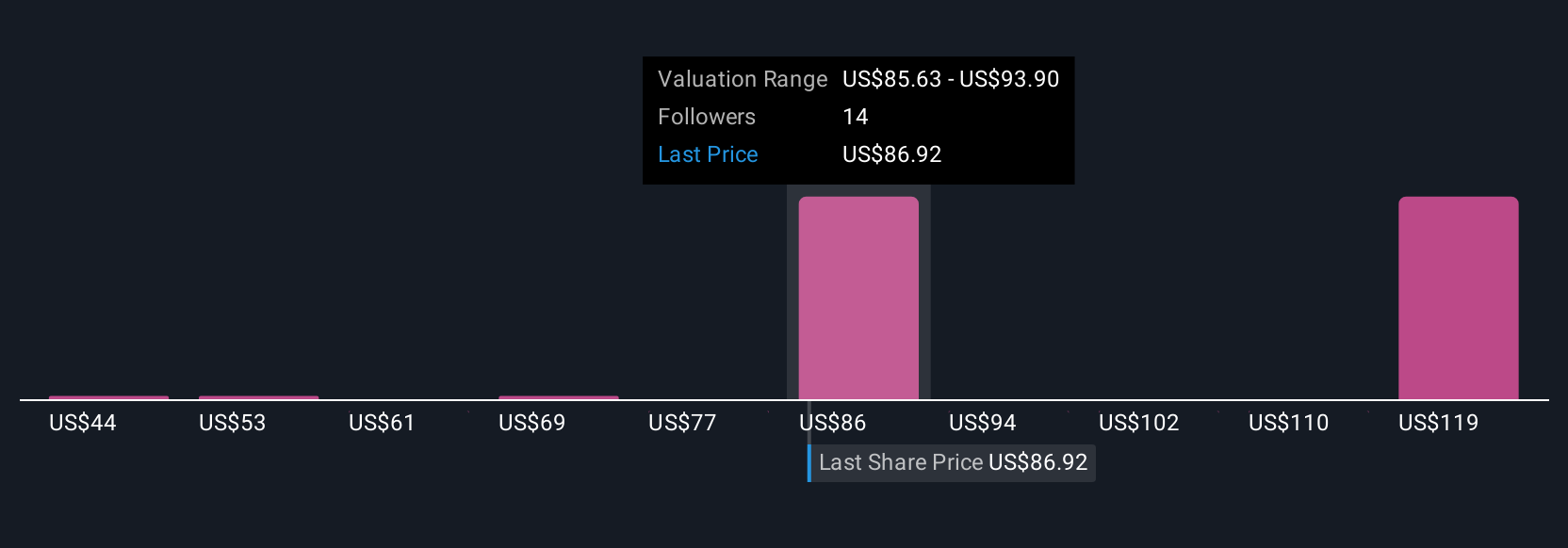

Power Solutions International currently generates a Free Cash Flow (FCF) of $54.25 million, with analysts projecting strong growth ahead. According to the latest forecast, FCF is expected to reach $89 million by 2026. From there, further growth is extrapolated, with estimates climbing to nearly $230 million by 2035. These projections use a two-stage model: initial growth based on analyst input, followed by a more moderate long-term trend.

When these cash flows are discounted using the DCF approach, the intrinsic value of Power Solutions International shares is calculated to be $110.52. With the current share price trading at a 40.6% discount to this value, the model suggests that the stock is significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Power Solutions International is undervalued by 40.6%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Power Solutions International Price vs Earnings

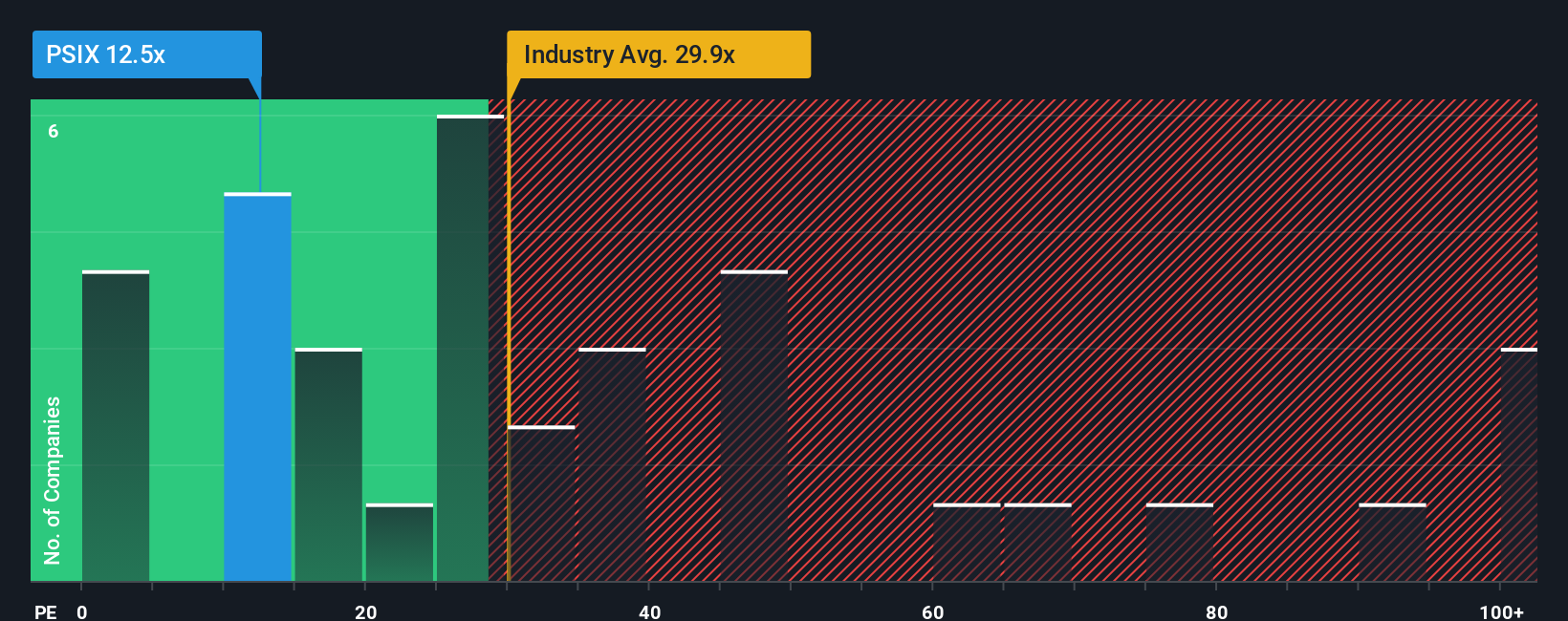

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like Power Solutions International. Since it compares a company’s share price to its per-share earnings, it offers a simple way to gauge how much investors are willing to pay for each dollar of profit. PE is especially useful when the business is consistently profitable, making it easier to benchmark against other companies and the broader industry.

It’s important to remember that what counts as a “fair” PE ratio depends on growth prospects and risk. Companies with stronger earnings growth or lower perceived risk often command higher PE ratios, while those with sluggish growth or higher risk tend to trade at lower multiples.

Power Solutions International’s current PE stands at 12.5x. This is much lower than both the broader Electrical industry average of 29.9x and the average among its peer group of 35.1x. However, instead of only comparing to these benchmarks, we also look at the Simply Wall St “Fair Ratio,” which blends in key ingredients such as earnings growth rate, industry characteristics, profit margins, company size, and risk profile to calculate what PE the stock should truly deserve.

This Fair Ratio aims to avoid the pitfalls of simple industry and peer comparisons. By baking in important factors like growth and risk alongside market cap and margins, it offers a more tailored and robust target multiple for each company. For Power Solutions International, the Fair Ratio is 25.5x, roughly double its current valuation.

The company’s PE is significantly below this fair value level, suggesting the stock remains attractively priced relative to what its growth and overall profile should command in the market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Power Solutions International Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative brings your own perspective and story about a company into the investment process, connecting your views on Power Solutions International’s future revenue, earnings, and margins directly to a financial forecast and a calculated fair value.

Unlike traditional models, Narratives put the “why” behind the numbers, helping you see how your expectations for the business shape what you believe the stock is worth. These Narratives are simple to create and are a key feature on Simply Wall St’s Community page, where millions of investors share and update their views.

By linking your Narrative to shifts in news or earnings, you will see your fair value and forecast adjust instantly as new information arrives, making it easier to decide whether to buy or sell based on how the current price compares to your evolving fair value estimate.

For example, some investors see Power Solutions International’s fair value as high as $150 based on bold growth assumptions, while others, factoring in more cautious outlooks, land as low as $70. This shows just how personal and dynamic Narratives can be.

Do you think there's more to the story for Power Solutions International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PSIX

Power Solutions International

Designs, engineers, manufactures, markets, and sells engines and power systems in the United States, North America, the Pacific Rim, Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives