- United States

- /

- Electrical

- /

- NasdaqCM:PSIX

Is Power Solutions International (PSIX) Ready to Meet Evolving Data Center Needs Amid Rapid Growth?

Reviewed by Sasha Jovanovic

- Power Solutions International reported record third-quarter financial results, highlighting a surge in sales and net income, driven by significant demand from the data center sector and an optimistic full-year 2025 sales growth outlook of 45% compared to 2024.

- An important consideration is that while data center demand is fueling rapid sales expansion, the company's largest gas engines may not fully fit the needs of the biggest hyperscale data centers.

- We'll explore how Power Solutions International's focus on data center growth is shaping its investment narrative amid evolving industry requirements.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Power Solutions International's Investment Narrative?

To own shares of Power Solutions International right now, you need to believe that robust growth in data center power solutions can offset challenges elsewhere in the business. The company just posted record quarterly sales and net income, underscoring surging demand from the data center sector and supporting a bold outlook for 2025. That said, the recent earnings news had a sharp short-term impact as shares fell steeply, investors may be questioning if PSI’s gas engine products are truly well suited for the largest hyperscale data centers, given current technical limitations. While power systems growth is a clear catalyst, other segments like industrial and transportation are showing flat performance, and the recent spike in manufacturing volume has come with a hit to gross margins. With volatile share price moves and management reshuffling, the risk profile is shifting: execution in data center markets now matters more than ever. Yet despite this optimism, PSI’s largest gas engines may not match evolving demands from hyperscale data centers.

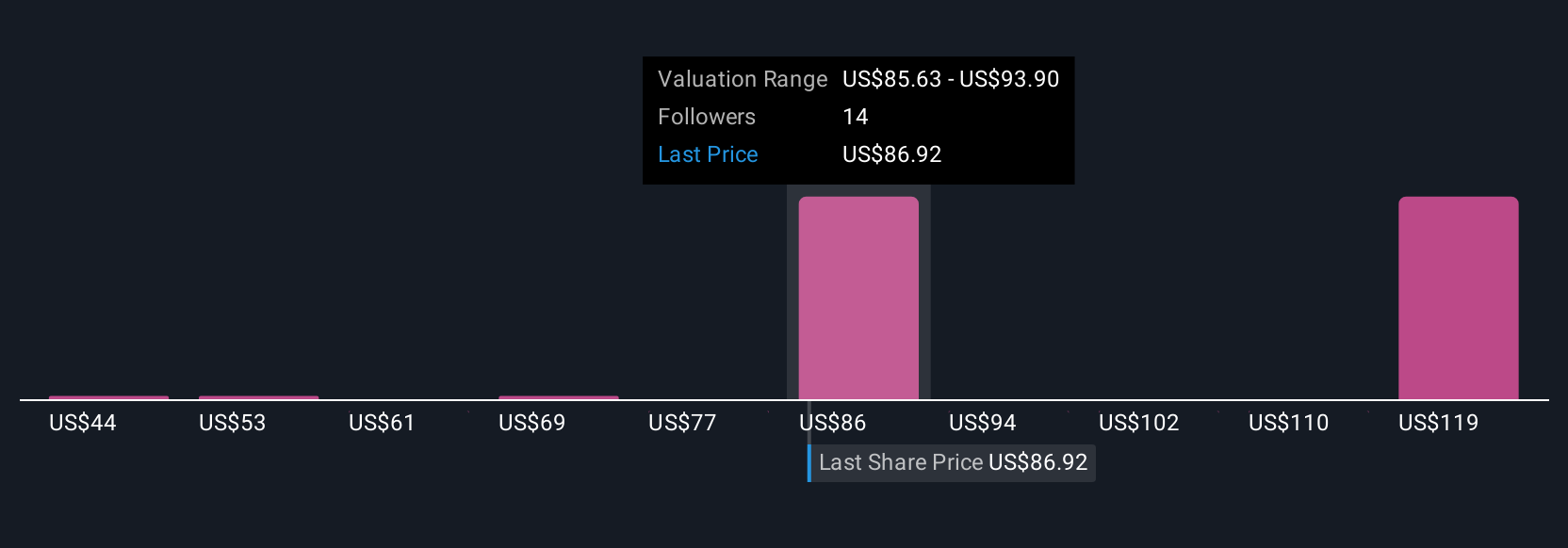

Despite retreating, Power Solutions International's shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 8 other fair value estimates on Power Solutions International - why the stock might be worth 13% less than the current price!

Build Your Own Power Solutions International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Solutions International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Power Solutions International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Solutions International's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PSIX

Power Solutions International

Designs, engineers, manufactures, markets, and sells engines and power systems in the United States, North America, the Pacific Rim, Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives