- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (PLUG): Valuation After Strategic Electrolyzer Launch in Dutch H2 Hollandia Project

Reviewed by Simply Wall St

Plug Power (PLUG) has begun installation of its 5 MW electrolyzer for the H2 Hollandia project in the Netherlands, marking a new stage of commercial deployment in the growing European hydrogen market.

See our latest analysis for Plug Power.

Plug Power’s shares have surged 72% over the last 90 days, recapturing momentum even as the 1-year total shareholder return stands at a solid 33.2%, while the three-year figure remains deeply negative. The recent rally reflects renewed optimism tied to the company’s expansion in Europe and ongoing commitment to green hydrogen, following a period of heavy losses and muted growth expectations.

If you’re interested in what’s next for clean energy innovation, now’s a great moment to discover fast growing stocks with high insider ownership

But with shares rebounding sharply after heavy declines, should investors see Plug Power as a bargain at current levels? Alternatively, has the recent surge already priced in the company’s future growth potential?

Most Popular Narrative: 4.6% Undervalued

The most-watched narrative values Plug Power at $2.78 per share, just above the last close of $2.65. With only a slim discount to fair value remaining, the latest analyst consensus hinges on new policy tailwinds and operational execution.

Strong policy momentum and new government funding in both the US and Europe are catalyzing the pace of final investment decisions (FIDs) for large-scale hydrogen projects. This positions Plug Power to capture significant new orders and recurring revenues as regulatory support further expands the addressable market.

Curious what’s behind the value call? This narrative’s math hinges on aggressive margin expansion and a steep re-rating. Even more striking are the bold share count and profit assumptions embedded in the outlook. Find out which levers drive that price target.

Result: Fair Value of $2.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative margins and reliance on government incentives could still undermine Plug Power’s growth narrative if operational improvements stall or if policy winds shift.

Find out about the key risks to this Plug Power narrative.

Another View: Multiples Tell a Different Story

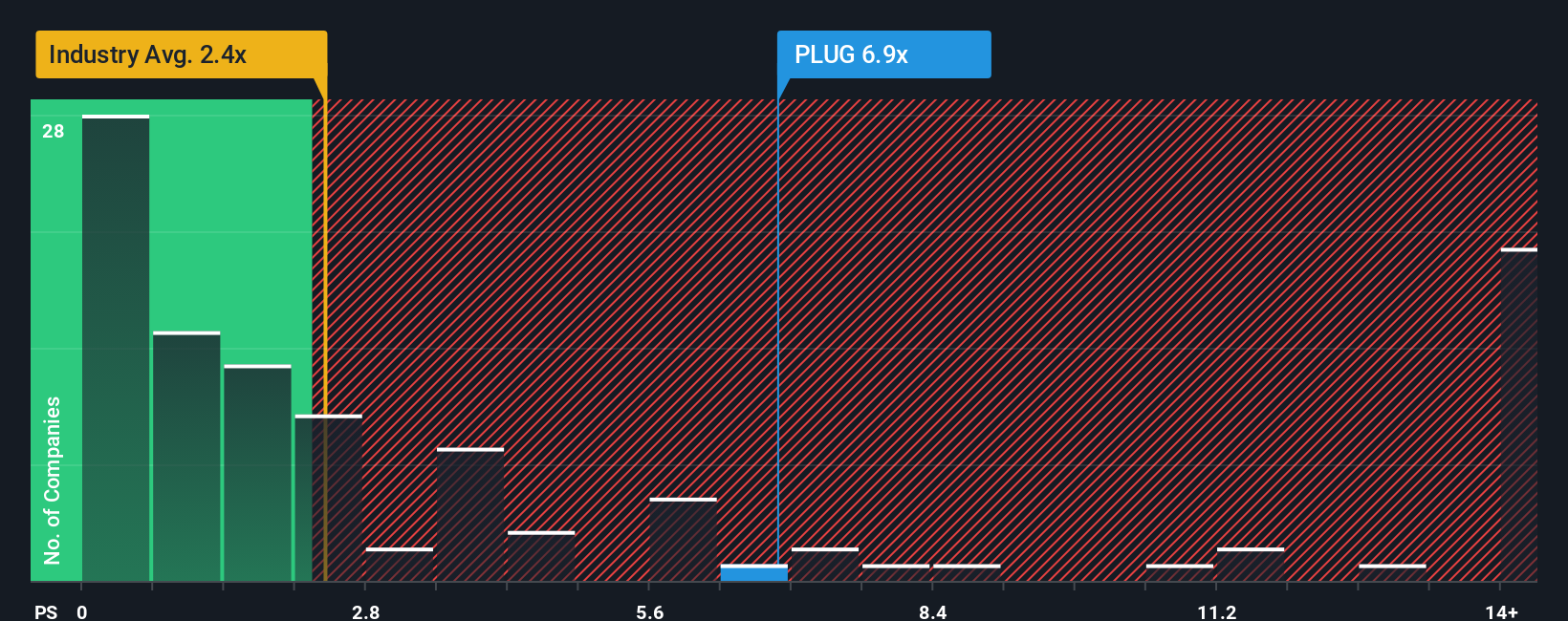

Looking at the price-to-sales ratio, Plug Power stands out as expensive. Its ratio of 4.7x is more than double the industry average of 2.2x and significantly above the peer average of 3.1x. Even compared to the fair ratio of just 0.2x, it appears overvalued. Could this premium signal real growth ahead, or is there a risk that the price could adjust downward if expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plug Power Narrative

If you see the numbers differently, or want to test your own assumptions, you can easily build a personalized view in just a few minutes with Do it your way.

A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your portfolio ahead of the curve by tapping into new opportunities the market has to offer. Don’t wait. These could be tomorrow’s big winners.

- Maximize your potential returns with these 884 undervalued stocks based on cash flows that are priced below their true worth. This can give you a head start before the crowd catches on.

- Uncover passive income opportunities by tapping into these 16 dividend stocks with yields > 3% offering reliable yields and steady cash flow for a healthier portfolio.

- Seize the future by evaluating these 25 AI penny stocks, where leading-edge artificial intelligence businesses are transforming industries at an incredible pace.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives