- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Does Plug Power's Data Center Pivot and Liquidity Push Signal a Turning Point for PLUG?

Reviewed by Sasha Jovanovic

- In the past week, Plug Power announced plans to generate more than US$275 million in liquidity by monetizing assets, releasing restricted cash, and cutting maintenance expenses, while also signing a non-binding agreement to enter the U.S. data center power market through collaboration with a developer.

- This move marks a shift in Plug Power's strategy, suspending activity around the Department of Energy loan program to prioritize higher-return hydrogen initiatives and financial stability.

- Let's explore how Plug Power's renewed financial discipline and entry into data center backup power could reshape its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Plug Power Investment Narrative Recap

To be a Plug Power shareholder, you have to believe in the transformative potential of hydrogen as a cornerstone for clean energy, and Plug’s ability to turn industry partnerships and new client wins into sustained revenue growth. The recent announcement to unlock over US$275 million in liquidity and pivot to higher-return projects addresses critical short-term cash flow needs, but does not materially resolve persistent profitability risks, as ongoing cash burn and widening net losses remain the most important near-term concern.

Among Plug’s recent updates, the start of installation at the H2 Hollandia green hydrogen hub in the Netherlands stands out. This project, directly tied to a solar park, highlights Plug’s move from demonstration to commercial-scale deployment, potentially reinforcing catalysts such as project-based revenue growth and further commercialization of electrolyzer technology, though it does not fully alleviate uncertainties around larger US and European projects.

On the other hand, investors should be mindful that despite new liquidity actions, the company’s substantial negative cash flow from operations and continued need for outside funding could mean...

Read the full narrative on Plug Power (it's free!)

Plug Power's narrative projects $1.2 billion revenue and $124.7 million earnings by 2028. This requires 22.2% yearly revenue growth and a $2.1 billion increase in earnings from current earnings of -$2.0 billion.

Uncover how Plug Power's forecasts yield a $2.78 fair value, a 8% upside to its current price.

Exploring Other Perspectives

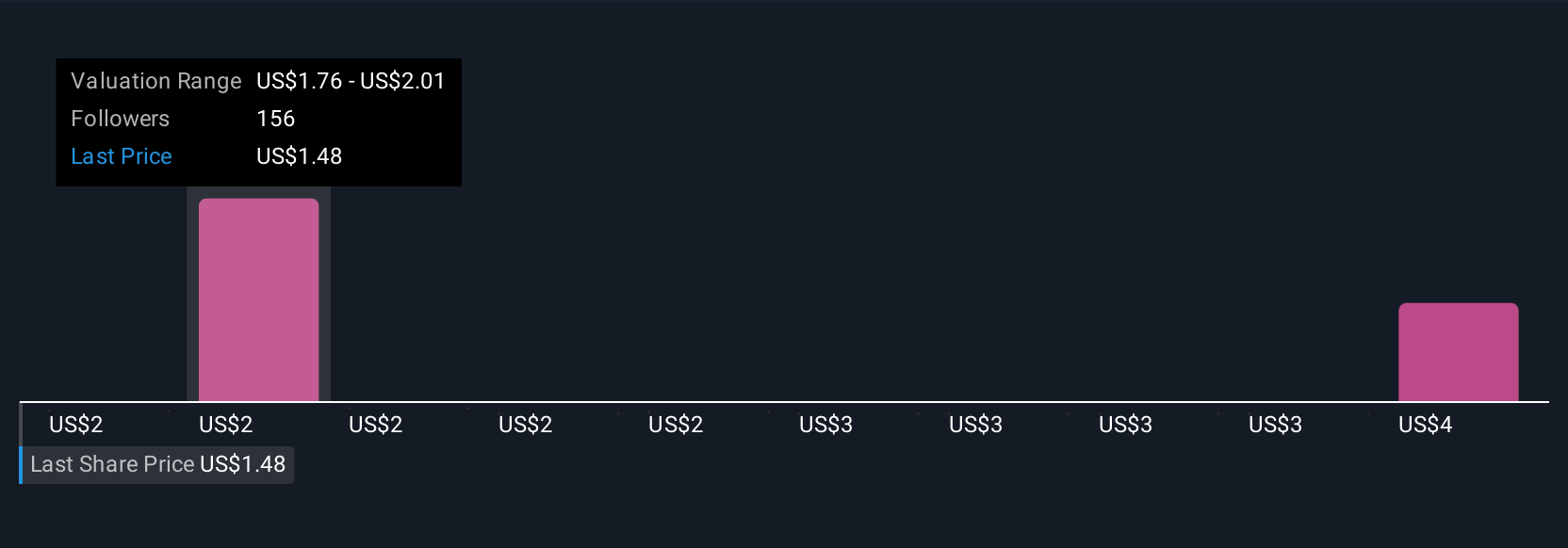

Twenty community members on Simply Wall St have fair value estimates for Plug Power ranging from US$1.52 to US$6.98 per share. Yet with continued cash burn and large net losses in focus, the path to improved profitability is still an unresolved question for many market participants. Explore how others weigh these factors and see why views can differ so much.

Explore 20 other fair value estimates on Plug Power - why the stock might be worth over 2x more than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Plug Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plug Power's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives