- United States

- /

- Electrical

- /

- NasdaqGS:PLPC

A Fresh Look at Preformed Line Products (PLPC) Valuation After Quarterly Profit Drop and Strong Sales Growth

Reviewed by Simply Wall St

Preformed Line Products (PLPC) just released third quarter results, revealing a jump in sales compared to last year. However, a sharp drop in net income for the quarter has caught investors’ attention.

See our latest analysis for Preformed Line Products.

Despite the dip in quarterly profits, Preformed Line Products' share price momentum has remained strong. The stock has notched a 63.25% year-to-date price return and reached $209.66, fueled by robust sales growth and a three-year total shareholder return of 153.25%.

If a sudden swing in results has you thinking about other opportunities, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

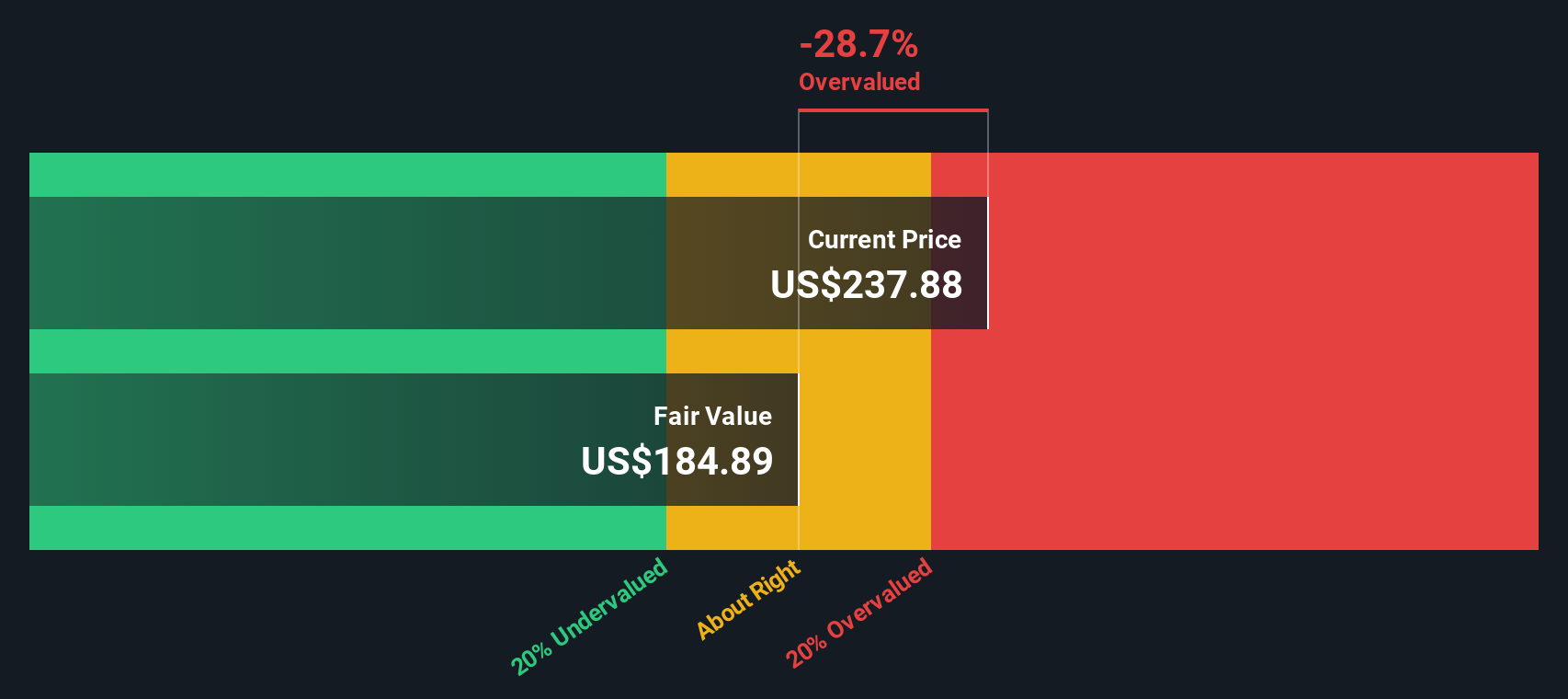

With shares surging and sales growing fast, but net income stalling, investors face a pivotal question: is Preformed Line Products currently trading below its true value, or is the market already betting on more growth ahead?

Price-to-Earnings of 27.6x: Is it justified?

Preformed Line Products trades at a price-to-earnings (P/E) ratio of 27.6x, notably higher than the typical value investors expect from industrial stocks. This surpasses its estimated fair P/E ratio of 24.9x, putting the current market price at a premium.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings generated by the company. For Preformed Line Products, a high P/E can signal the market’s belief in significant future profit growth or confidence in the quality of earnings.

While the company is priced below the US Electrical industry average P/E of 29.9x and is an even better relative value compared to peer averages of 33.9x, the stock still sits above its calculated fair ratio. This means the market has priced in optimism, but there is a level, reflected by the fair ratio, where prices could normalize if expectations change.

Explore the SWS fair ratio for Preformed Line Products

Result: Preferred multiple of 27.6x (OVERVALUED)

However, a sudden slowdown in revenue growth or a miss on future earnings could quickly disrupt the current optimism surrounding Preformed Line Products.

Find out about the key risks to this Preformed Line Products narrative.

Another View: What Does the DCF Say?

Looking at Preformed Line Products through our DCF model, the stock appears overvalued, trading at $209.66 while the fair value estimate stands at $181.88. This approach suggests the market price could be factoring in more optimism than the fundamentals alone support. Is the current premium justified? Or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Preformed Line Products for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Preformed Line Products Narrative

If you have a different perspective or want to dig deeper on your own, you can build a custom analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Preformed Line Products.

Looking for More Ways to Invest with Confidence?

Smart investors seize every advantage. Use the Simply Wall St Screener to uncover your next winning idea, or you might miss the market’s next breakout.

- Grow your returns by targeting income investments and check out these 16 dividend stocks with yields > 3% with robust yields and strong fundamentals.

- Get ahead of the curve in healthcare innovation and browse these 32 healthcare AI stocks powering breakthroughs in medical technology and AI-driven care.

- Ride the wave of disruptive financial technology and access these 82 cryptocurrency and blockchain stocks unlocking opportunities in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLPC

Preformed Line Products

Designs and manufactures products and systems that are used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable, data communication, and other industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives