- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

A Look at Mercury Systems (MRCY)'s Valuation Following Strong Earnings, Revenue Growth, and $200M Buyback

Reviewed by Simply Wall St

Mercury Systems (MRCY) just posted quarterly results that came in above expectations, supported by strong revenue and backlog growth as a result of accelerated deliveries on key defense programs. Following these results, the company also announced a $200 million share buyback.

See our latest analysis for Mercury Systems.

Mercury Systems' rapid manufacturing ramp-up and new buyback plan have been bright spots in an otherwise turbulent year for the stock. The share price jumped 38% over the past three months and soared 75% year-to-date. Momentum appears to be building, which reflects receding uncertainty and renewed confidence in the company’s defense sector positioning.

If these defense-driven gains have you curious about what else is on the move, discover new opportunities with our curated See the full list for free..

With shares up sharply and management signaling confidence through both results and buybacks, is Mercury Systems still undervalued at these levels? Or is the rally simply markets pricing in all the future growth?

Most Popular Narrative: 8.7% Undervalued

With Mercury Systems' fair value estimated by the most popular narrative at $81.13, the last close at $74.07 points to a potential value gap. This narrative focuses on sector momentum, operational upgrades, and recent contract wins as key drivers behind its pricing outlook.

Expanding penetration into programs that require secure, high-performance embedded processing and open-architecture modular solutions positions Mercury to benefit from the defense sector's shift toward greater digitization and AI/ML adoption. This supports higher-margin, higher-value contracts and improved long-term gross and net margins. Prioritization of domestic sourcing and supply chain re-shoring in sensitive defense technologies creates a competitive advantage for Mercury as a U.S.-based supplier. This increases contract win rates with both prime contractors and government agencies, which should enhance revenue visibility and future backlog quality.

Want to understand why this valuation stands out? It hinges on bold forecasts for revenue growth and margin expansion, paired with an ambitious profit expectation that is rare in defense stocks. The full narrative uncovers which financial assumptions underpin the confidence behind this premium fair value. Do not miss the figures that could shift your view.

Result: Fair Value of $81.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legacy contract burdens and non-repeatable revenue pull-forwards could slow Mercury Systems’ growth and threaten the optimistic fair value outlook.

Find out about the key risks to this Mercury Systems narrative.

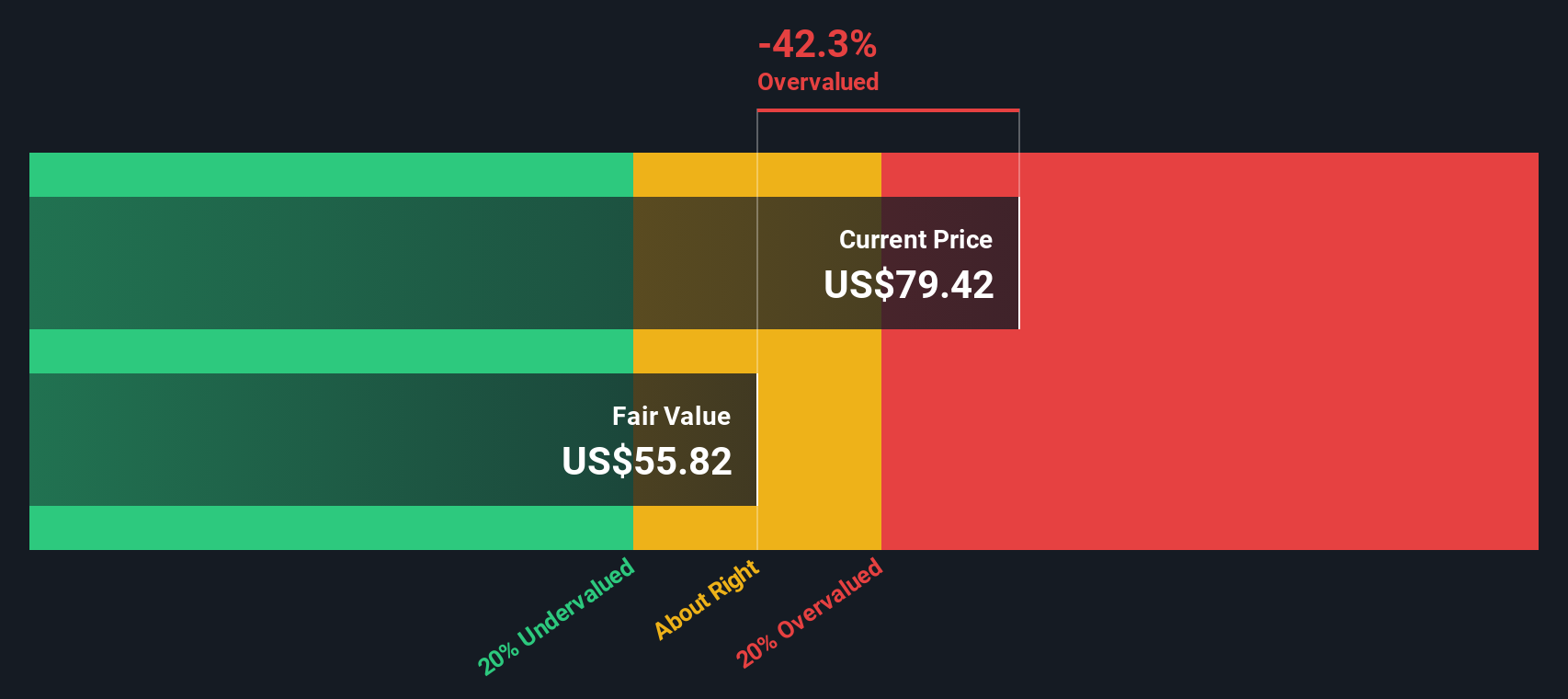

Another View: SWS DCF Model Weighs In

Looking at Mercury Systems from our DCF model perspective, the numbers tell a different story. The SWS DCF model estimates fair value at $43.30, which is well below the current market price of $74.07. This suggests the market could be getting ahead of itself and pricing in more optimism than the company's future cash flows justify. But can strong contract wins and operational upgrades keep driving upside? Or will expectations return to earth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury Systems Narrative

If you have a different perspective or want to dig deeper based on your own insights, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of the crowd and spot real opportunities, use these smart tools to uncover stocks with strong upside and unique potential before others catch on.

- Pinpoint under-the-radar stocks trading below their intrinsic value by reviewing these 874 undervalued stocks based on cash flows which offers compelling growth potential and solid fundamentals.

- Maximize future income by targeting reliable payouts through these 16 dividend stocks with yields > 3% featuring companies with healthy yields above 3%.

- Accelerate your portfolio’s tech exposure by targeting the next wave of transformation in artificial intelligence with these 25 AI penny stocks leading innovation in this evolving sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives