- United States

- /

- Electrical

- /

- NasdaqGS:ENVX

A Look at Enovix (ENVX) Valuation Following Q3 Growth and New Guidance

Reviewed by Simply Wall St

Enovix (ENVX) just released its highly anticipated third quarter earnings, revealing strong year-over-year revenue growth and a narrowed net loss for the nine-month period. The company also provided fresh guidance for the upcoming quarter, giving investors updated insight into its outlook.

See our latest analysis for Enovix.

Following the latest earnings, Enovix's recent price action has been turbulent, with the share price falling over 20% in the past week and posting a 27% decline for the month. Still, despite this volatility, total shareholder return for the past year remains slightly positive. This highlights a stock that swings with momentum but continues to attract attention on signs of long-term growth potential and insider buying.

If you're weighing what else could ride the next wave of growth and insider optimism, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Enovix's recent pullback means the stock is trading at a discount, or if the market is already factoring in all future growth expectations, leaving little room for upside from here.

Most Popular Narrative: 68.6% Undervalued

According to the most widely followed narrative, Enovix’s fair value is calculated at $28.80. That is a dramatic jump from the last close price of $9.03, suggesting analysts see room for sharp upside if key assumptions play out.

Expansion into the defense and smart eyewear markets offers promising revenue growth opportunities, driven by compliance and high-margin premium pricing strategies. Upcoming high-volume production and next-gen battery advancements signal potential revenue and earnings growth aligned with 2025 smartphone and AR/VR launches.

What is really fueling this gap between market price and narrative value? The story hinges on several ambitious projections, including steep revenue ramps, a future earnings surge, and profit multiples rarely seen in this sector. If you want to see the bold financial forecasts and the exact inflection points this narrative leans on, you need to read the full breakdown.

Result: Fair Value of $28.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing financial strain and the challenge of scaling high-volume smartphone production remain key risks that could quickly shift sentiment around Enovix's growth story.

Find out about the key risks to this Enovix narrative.

Another View: Market Multiples Raise Questions

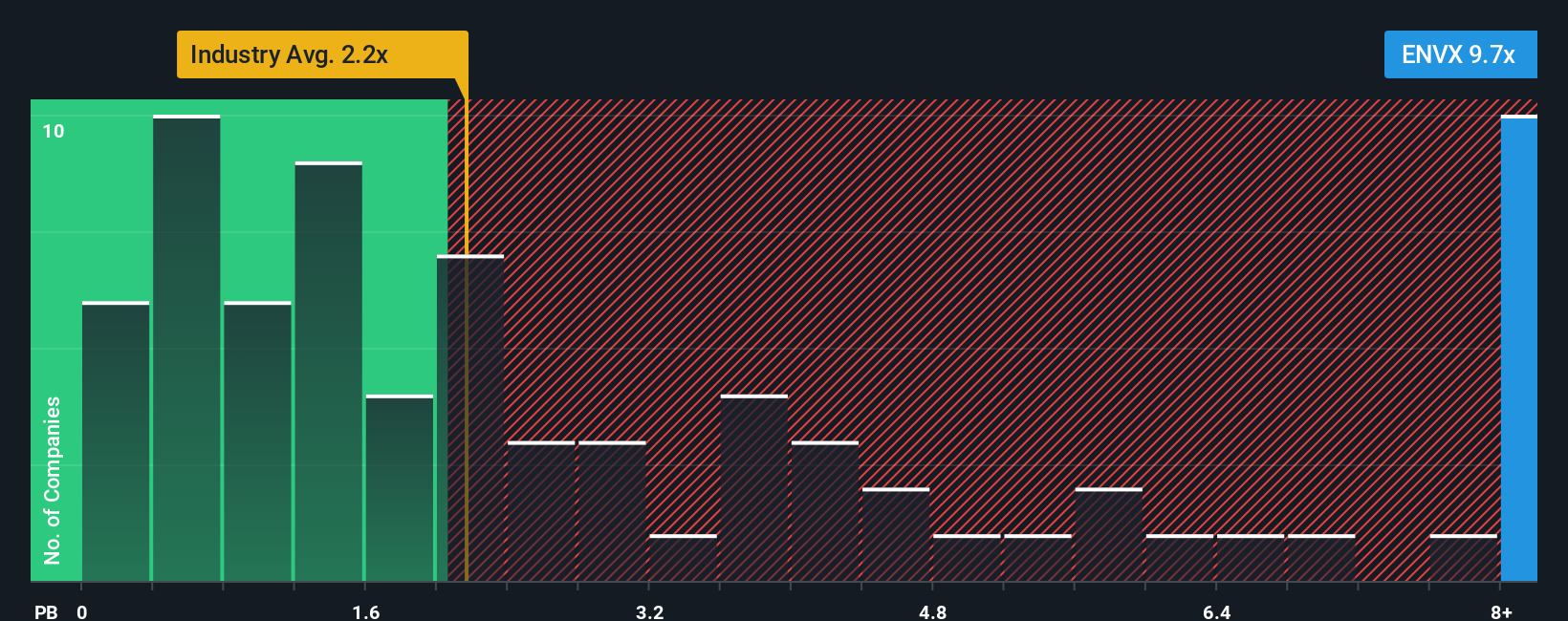

While narrative and analyst targets make Enovix look deeply undervalued, the company's actual price-to-book multiple stands at 6x. This is far above the US Electrical industry average of 2.6x. Even compared to peer companies, Enovix is not cheap. If the ratio moved closer to the fair ratio amidst changing sentiment, would valuation risk outweigh the opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enovix Narrative

If you want to go beyond the most popular views or challenge these assumptions with your own analysis, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your investment edge by tapping into powerful screening tools that uncover opportunities others might overlook. Don’t let the next breakthrough winner slip through your fingers.

- Capture the potential of AI-driven companies that are shaking up global markets by starting with these 25 AI penny stocks.

- Step up your income strategy and spot hidden gems with strong payouts using these 17 dividend stocks with yields > 3%.

- Position yourself ahead of market moves and find bargains by checking out these 861 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENVX

Enovix

Designs, develops, and manufactures lithium-ion battery cells in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives