- United States

- /

- Construction

- /

- NasdaqCM:ENGS

Energys Group (ENGS) Slides After Weaker Earnings and Delayed Filing Can Operational Stability Hold?

Reviewed by Sasha Jovanovic

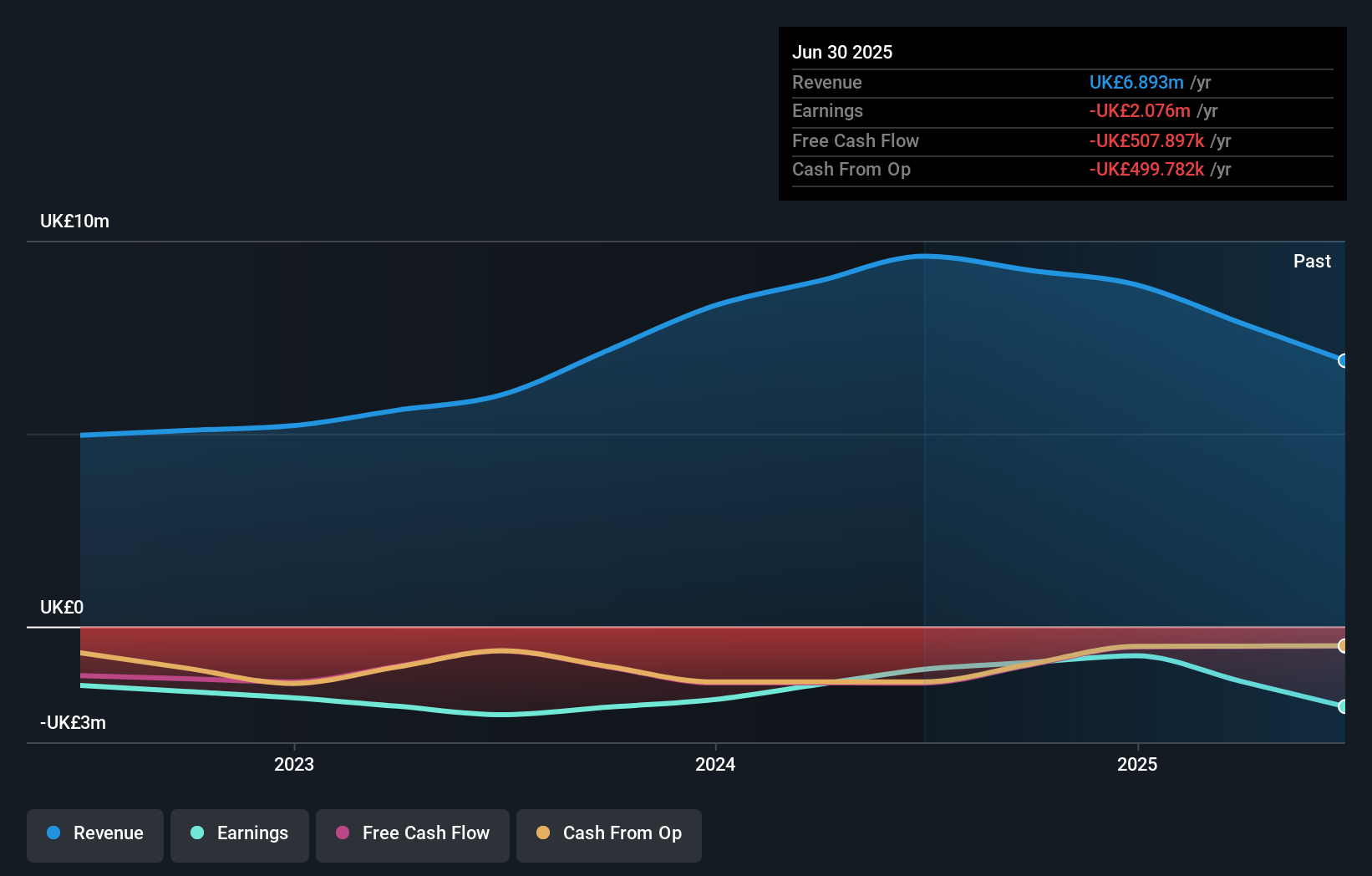

- Energys Group Limited recently reported full-year earnings for the period ending June 30, 2025, revealing sales of £6.89 million and a net loss of £2.08 million, both weaker than the previous year.

- The announcement also included a delayed SEC filing, which can heighten investor concerns regarding financial transparency and regulatory compliance.

- We’ll examine how the declining sales and rising losses affect Energys Group’s investment narrative and outlook for operational stability.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Energys Group's Investment Narrative?

Owning shares of Energys Group right now hinges on believing in its potential to turn around operational and financial challenges, despite the latest full-year results raising fresh doubts about near-term stability. The recent announcement of falling sales to £6.89 million and a wider net loss of £2.08 million intensifies pressure on the company’s existing plan to accelerate project wins or cost improvements. Arguably more significant in the short term is the delayed SEC filing, which compounds persistent risks around financial transparency and could impact access to capital markets, especially with the steep share price drop seen in the past week. Previous catalysts, such as new project contracts and strengthened board independence, now take a backseat as investor focus shifts sharply to regulatory compliance and liquidity fears given the company’s short cash runway and ongoing auditor concerns over going concern status.

But the potential regulatory risks from this delayed SEC filing are something investors cannot ignore.

Exploring Other Perspectives

Explore another fair value estimate on Energys Group - why the stock might be worth as much as $0.51!

Build Your Own Energys Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energys Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Energys Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energys Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energys Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ENGS

Energys Group

Provides end-to-end customized solutions and services involving the retrofitting of existing infrastructures to reduce CO2 emissions in the United Kingdom and Hong Kong.

Low risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives