- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Does Axon’s Recent Contract Wins Justify Its 67.8% Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Axon Enterprise is a hidden value or getting a bit ahead of itself? Let’s dig into what’s behind its market buzz together.

- Shares have surged 67.8% over the past year and 21.4% year-to-date. This impressive momentum has captured plenty of attention.

- Recent headlines about Axon’s latest contract wins and product launches have kept the company in the spotlight, fueling optimism about its long-term growth story. Investor sentiment seems buoyed by innovation updates and expanding adoption among public safety agencies.

- Despite all the excitement, Axon currently scores just 1 out of 6 on our valuation checks for being undervalued. Let’s break down what that really means using a few different approaches, and stick around for a smarter perspective on value at the end of this article.

Axon Enterprise scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Axon Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation tool that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This method is particularly valuable for companies with strong and predictable cash flows, as it helps investors understand the present worth of expected profits over time.

For Axon Enterprise, recent figures show a Last Twelve Months (LTM) Free Cash Flow (FCF) of $184 million. According to the latest analyst estimates, Axon's FCF is projected to climb significantly, with forecasts reaching over $820 million by 2027. Simply Wall St extrapolates these trends out to more than $1.6 billion by 2034. These projections reflect optimism around the company's capacity for future cash generation, helped by robust growth expectations.

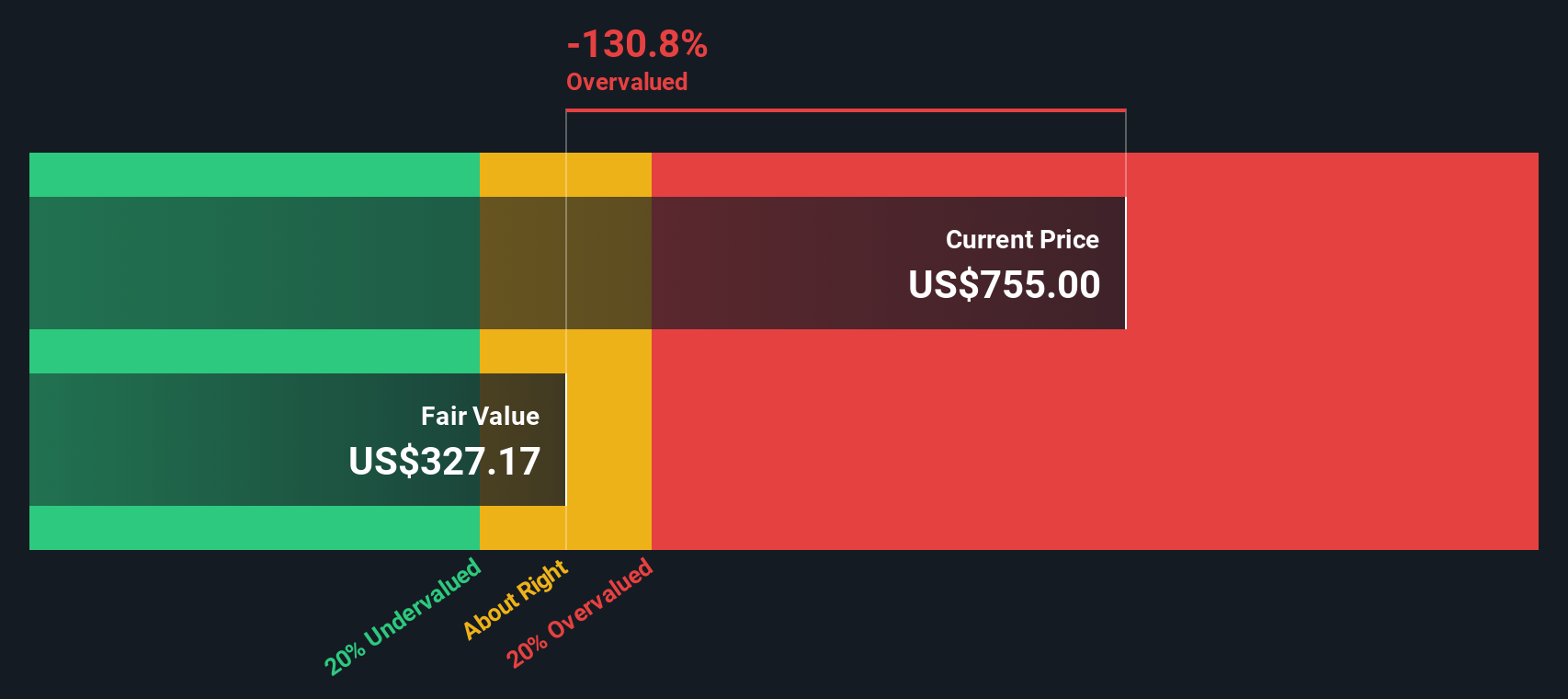

However, after discounting these future cash flows, the model arrives at an intrinsic value of $327.81 per share. Compared to the current market price, this suggests Axon Enterprise is trading at a 120.9% premium to its fair value, based on DCF analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axon Enterprise may be overvalued by 120.9%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Axon Enterprise Price vs Sales

When it comes to evaluating companies like Axon Enterprise, the Price-to-Sales (PS) ratio stands out as an especially relevant metric. This is because PS offers a clear, revenue-focused view that is well-suited to profitable companies, particularly when earnings may be volatile or reinvested heavily in growth. Growth expectations and the underlying risks of a company help to set what is considered a “normal” PS ratio, with higher growth or lower risk often justifying a higher multiple.

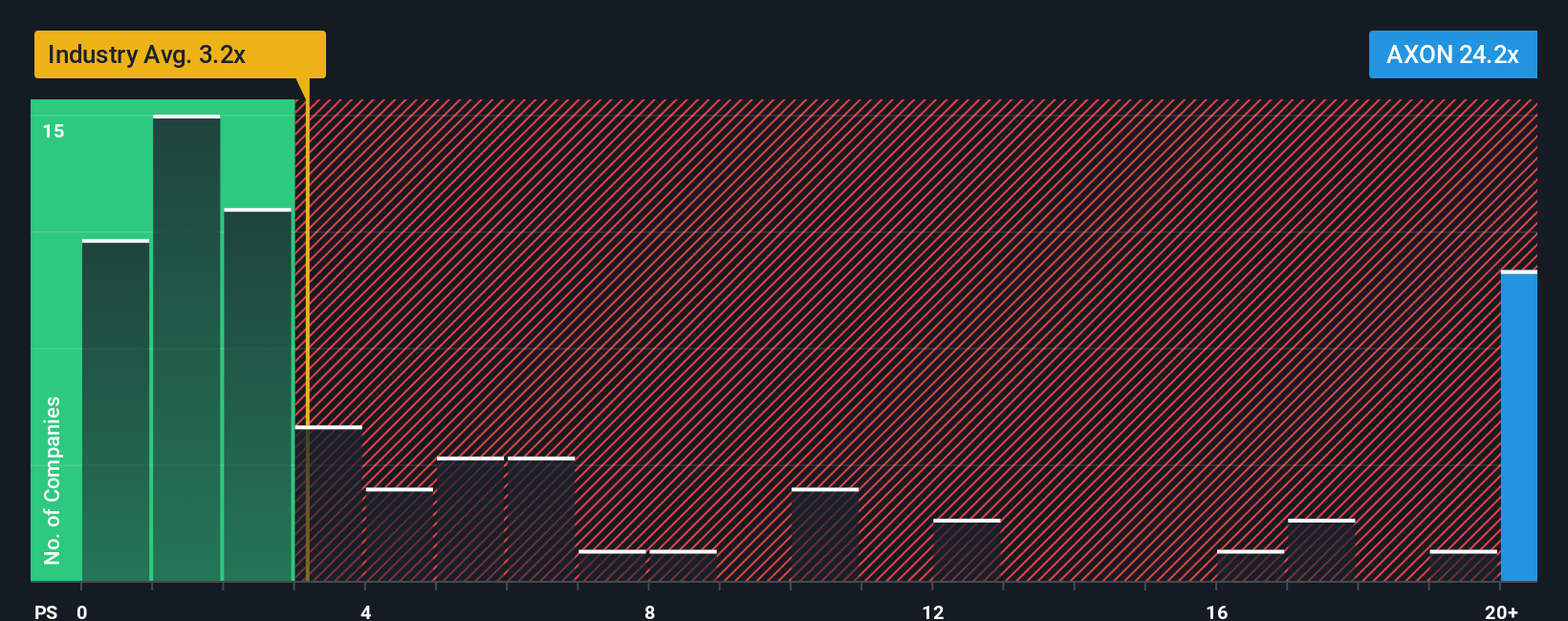

Currently, Axon trades at a PS ratio of 23.8x, which is significantly above its Aerospace & Defense industry average of 3.15x and the peer group average of 7.92x. This gap signals how much investors are willing to pay for each dollar of Axon’s revenue, likely driven by confidence in the company’s strong growth trajectory and expanding market position.

To provide further clarity, Simply Wall St introduces the Fair Ratio, a proprietary metric that incorporates Axon’s specific earnings growth outlook, industry dynamics, margins, market cap, and business risks. Unlike comparisons to simple industry or peer multiples, the Fair Ratio yields a more tailored benchmark that reflects the company’s actual opportunities and challenges.

Axon’s current PS ratio of 23.8x is well above its Fair Ratio of 17.18x. This suggests that, even after accounting for all the growth and quality factors, the stock is priced somewhat higher than what these fundamentals support today.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axon Enterprise Narrative

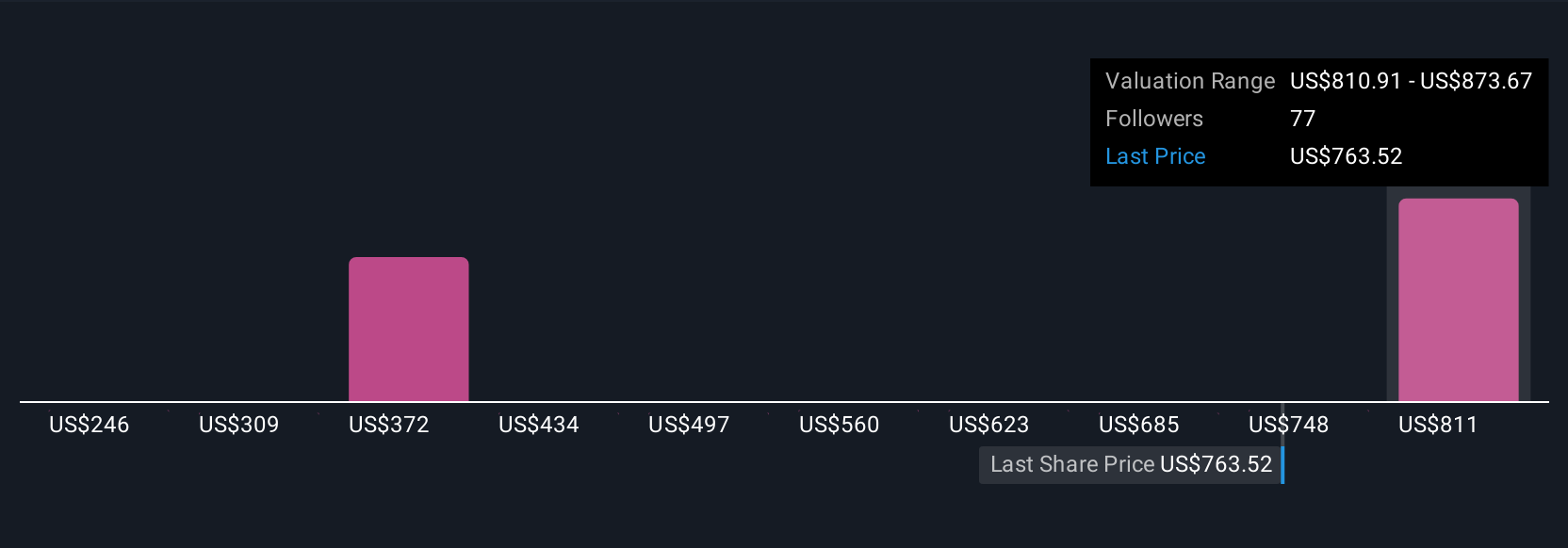

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, approachable way for you to express your story and your unique perspective about a company, linking what you believe about Axon Enterprise’s future revenue, earnings, and margins directly to a fair value estimate.

With Narratives, you can connect Axon’s business outlook to your personal forecasts, and see how those assumptions translate into what you think the shares should actually be worth. This tool is available within the Community section of Simply Wall St, used by millions of investors to make smarter, more informed investment calls.

What makes Narratives truly useful is that they help you decide when to buy or sell by directly comparing your Fair Value to the current market Price. They are always updated when new data, like earnings or big news, arrives.

For example, one investor might believe Axon’s adoption of AI, drones, and bundled SaaS means it will outpace analyst estimates and deserves a higher fair value, while a more cautious investor might focus on regulatory and competitive challenges, arriving at a significantly lower fair value. This demonstrates how Narratives let you weigh different scenarios and find your own edge in the market.

Do you think there's more to the story for Axon Enterprise? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives